Energea

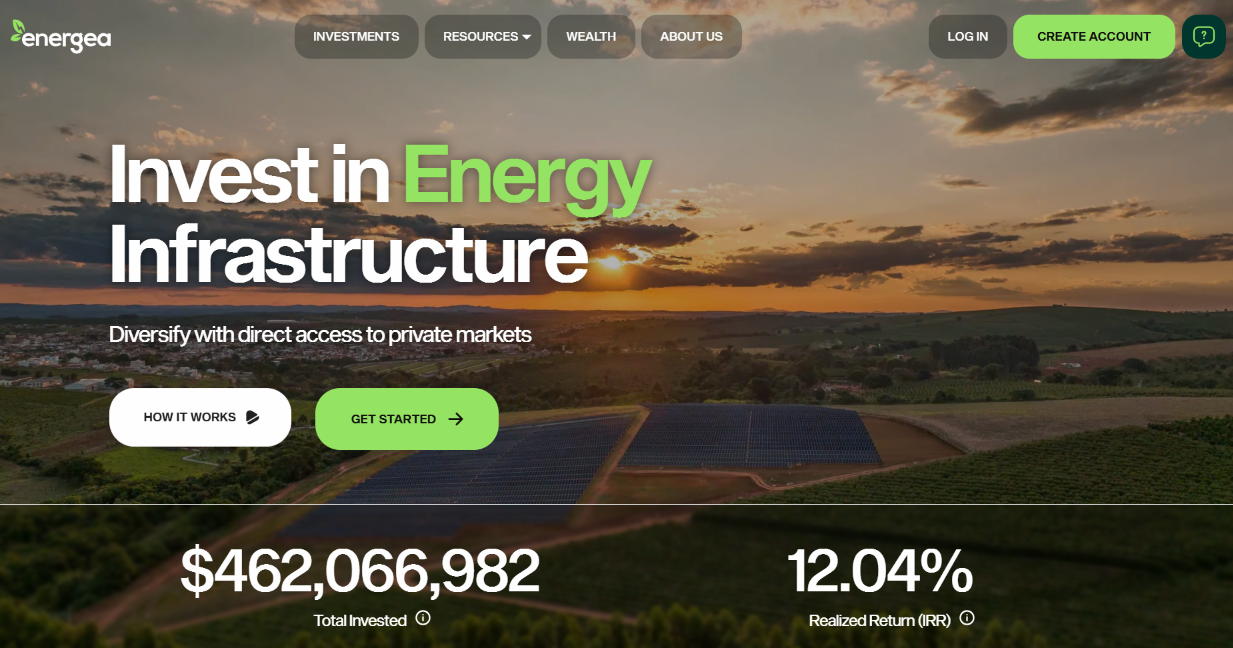

Solar energy crowdfunding platform offering equity stakes in global solar project portfolios—$100 minimum, ~11-14% target IRR, monthly distributions, 3-year minimum hold with no guaranteed redemption. Non-accredited investors welcome via Reg CF/Reg A+ structures.

Platform Overview

Crowdfunding platform offering equity ownership in portfolios of operating solar energy projects across USA, Brazil, and Africa. Investors purchase LLC membership interests in geographic portfolio companies (SPVs) that own and operate solar installations selling power under long-term contracts (PPAs). Minimum investment $100, accessible to non-accredited investors through Regulation CF and Regulation A+ offerings. Platform manages entire project lifecycle: development, construction, operation, monitoring. Investors receive monthly distributions from project cash flows (electricity sales revenue minus expenses) and potential equity appreciation upon project sale/refinancing. Target returns 11-14% IRR (internal rate of return combining distributions plus equity appreciation, not distribution yield alone) depending on geography, with Brazil/Africa higher risk/return than USA projects. Fee structure: 1-2% annual management fee on distributions plus 20-30% carried interest (performance fee) above return hurdles.

Platform operates through SEC-registered offerings (Regulation CF and Regulation A+) allowing both accredited and non-accredited investors to participate with $100 minimums. Investment structure: LLC membership interests in geographic portfolio companies owning operating solar installations selling electricity under long-term power purchase agreements (PPAs) with utilities and commercial customers. Per platform materials: Over $100M AUM, 11%+ historical IRR, team participated in 500+ directly developed projects plus 14,000+ across prior roles and partnerships totaling 365MW. Target returns by geography: USA ~11-12% IRR, Brazil ~14-16% IRR, Africa similar to Brazil. CRITICAL: For Brazil and Africa portfolios, currency movement may matter as much as solar performance—local revenue in BRL and African currencies exposes USD investors to FX depreciation potentially offsetting operational returns. Fee structure: 1-2% annual management fee on monthly distributions plus 20-30% carried interest on returns above 8-10% hurdles. Monthly distributions paid from project cash flows; investors also receive equity appreciation upon project sales/refinancing. Minimum 3-year holding period with redemption requests considered after 3 years but not guaranteed—no formal secondary market. Platform provides monthly updates, quarterly webinars, project monitoring apps (iOS/Android), and educational content. Regulatory: Offerings registered under Regulation CF (crowdfunding exemption with lower raise limits) or Regulation A+ (mini-IPO structure with higher limits and ongoing reporting). Non-accredited investors subject to annual investment limits based on income/net worth. Suitable for: Impact-focused investors, those comfortable with 3+ year illiquid holds, diversification seekers adding uncorrelated real assets, and income-oriented investors who accept variable distributions. Not suitable for: Investors requiring liquidity or short hold periods, conservative investors uncomfortable with emerging market risks, those expecting bond-like stability, and investors unable to evaluate complex international project structures.

Platform Structure & Access

SEC-registered crowdfunding platform (Reg CF and Reg A+) open to accredited and non-accredited investors. $100 minimum per portfolio, $10 increments thereafter. Non-accredited subject to annual investment limits based on income/net worth. Web dashboard plus iOS/Android apps for portfolio management.

Investment Products

Geographic portfolio LLCs: Solar in USA (domestic projects), Solar in Brazil (BRL exposure), Solar in Africa (multi-country), Energea Core (automated allocation across portfolios). Each LLC owns specific project assets with distinct risk/return profiles based on geography and PPA counterparty quality.

Fee Structure

Two-tier fees: (1) Management Fee: 1-2% of monthly distributions paid (percentage varies by portfolio; no fee charged if no distribution paid that month); (2) Carried Interest (Promoted Interest): 20-30% of returns exceeding hurdle rate benchmarks (typically 8-10% IRR hurdles). All performance figures shown on platform are net of fees. Fee structure modeled after private equity/hedge funds; reduces investor returns significantly if projects outperform hurdles.

Geographic Diversification

USA (regulatory stability, 11-12% target IRR), Brazil (higher yields, BRL exposure, 14-16% IRR, EM risks), Africa (multiple countries/currencies, similar returns to Brazil with additional political uncertainties). Geographic spread provides currency diversification and exposure to different solar resources and electricity pricing.

Liquidity & Hold Period

3-year minimum hold required. After 3 years, may request redemption but platform not obligated to approve—granted at Energea's discretion based on capital availability. No secondary market, no guaranteed pricing. Actual hold periods likely 5-10+ years.

Revenue Model & Distributions

Solar projects generate revenue from selling electricity under long-term PPAs (typically 15-25 year contracts with utilities, corporations, governments); contracts often include inflation escalators providing inflation protection. Monthly distributions paid to investors from project cash flows after operating expenses and reserve accounts. Distribution amounts variable depending on solar production (weather-dependent), electricity prices, O&M costs, and debt service; not guaranteed and may be reduced/suspended.

Team & Track Record

Founded by Mike Silvestrini (500+ solar projects developed) and Chris Sattler (energy and private markets background); team includes Gray Reinhard (CTO) and Isabella Mendonça (General Counsel). Team participated in 500+ directly developed projects plus 14,000+ across prior roles and partnerships (23 states, 3 continents, 365MW installed). Platform positioned itself as an early mover in renewable energy crowdfunding in the United States.

Performance Data

Platform reports 11%+ historical IRR (net of fees). IRR represents total return including monthly distributions AND equity appreciation—not distribution yield alone. Limited granularity on individual projects or vintage performance. Performance may reflect survivorship bias if failed projects excluded.

Project Types & Contracts

Operating solar projects: utility-scale ground arrays, commercial rooftop, community solar. All backed by long-term PPAs (15-25 years) with counterparties ranging from utilities to corporate/government offtakers. Contract structures may include fixed-price or escalation clauses, and may involve REC sales. Most projects operational before investor inclusion (some development-stage possible).

Regulatory Compliance

Offerings registered under SEC Reg CF or Reg A+ Tier 2; both allow non-accredited participation with investment limits. Platform files Form C (Reg CF) or Offering Circular (Reg A+) with business and project details, financials, risk factors, and use of proceeds. Ongoing annual reports required. Investors receive K-1 tax forms for LLC pass-through taxation.

Investor Communication

Monthly email updates with production data and operational status. Quarterly investor webinars with management Q&A. Online dashboard showing portfolio value, distributions earned, and project details. Educational content library including glossary resources.

Currency Exposure & FX Risk

USA portfolio: USD-denominated (no FX risk for US investors). Brazil: Revenue in Brazilian Real (BRL)—depreciation versus USD reduces returns. Africa: Multiple currencies (ZAR, others) create additional FX complexity. Platform does not disclose hedging strategies; investors bear currency risk.

Investment Structures

Geographic Portfolio LLCs (Reg CF / Reg A+)

Individual portfolios organized by geography: USA Solar, Brazil Solar, Africa Solar. Each portfolio is a separate LLC registered under SEC Regulation CF (smaller raises) or Regulation A+ (larger raises) allowing non-accredited investor participation. Investors purchase membership interests representing fractional ownership in an LLC that owns operating solar projects in that region. $100 minimum per portfolio; subsequent $10 increments. LLC pays monthly distributions from project cash flows pro-rata to members. 3-year minimum hold with potential redemptions at platform discretion thereafter. Structure provides direct exposure to specific geography and associated risks/returns (USA lower risk ~11-12% target, Brazil/Africa higher risk ~14-16% targets). K-1 tax reporting for pass-through income. Suitable for investors wanting targeted geographic exposure or willing to manually diversify across regions.

Energea Core (Automated Diversification)

Automated investment product allowing investors to customize allocation percentages across all open portfolios (USA, Brazil, Africa) in a single workflow. Investors set desired portfolio weights (e.g., 50% USA, 30% Brazil, 20% Africa) and the platform allocates capital across regions accordingly. Enables diversification with one decision versus purchasing each portfolio individually. Minimum $100 total investment with customizable splits. Same fee structure and holding period as individual portfolios (1-2% management + 20-30% carry, 3-year minimum). Suitable for investors seeking simplified geographic diversification; requires understanding each underlying portfolio's risks to make informed allocation decisions.

Self-Directed IRA Investments

Platform is compatible with some self-directed IRA custodians, allowing investors to hold solar project equity in tax-advantaged retirement accounts. Investors work with an IRA custodian to direct funds into Energea portfolio offerings; distributions flow back to the IRA maintaining tax-deferred or tax-free status (traditional or Roth). However, pass-through LLC interests can generate UBTI (Unrelated Business Taxable Income), which may require the IRA to file Form 990-T and pay tax on UBTI above $1,000. Renewable energy tax credits (ITC) typically provide limited benefit inside tax-exempt accounts. Some self-directed IRA custodians charge additional fees for alternative assets. Illiquidity can also create a mismatch with RMD needs for older investors. Consult a tax advisor experienced with UBTI before using retirement funds.

Risk Structure

Illiquidity and 3-year minimum hold

No formal secondary market; redemptions after 3 years at platform discretion, not guaranteed—investors should assume 5-10 year actual hold periods treating redemption option as uncertain exit feature rather than reliable liquidity. Monthly distributions provide some cash return but underlying equity positions are long-term illiquid investments.

Currency exposure in Brazil/Africa portfolios

Projects in Brazil generate revenue in Brazilian Real (BRL), Africa projects in local currencies (ZAR, others)—currency depreciation versus USD reduces investor returns when converted. No disclosed currency hedging means investors bear FX risk. Diversification across currencies provides some natural hedge, but emerging market exposure during sustained USD strength cycles can materially impact realized returns.

Crowdfunding structure and regulatory exemptions

Regulation CF and Reg A+ offerings involve different disclosure and reporting regimes than fully registered securities (mutual funds, ETFs)—investor protections and transparency may be more limited, and redemption/liquidity is not standardized. Non-accredited access expands availability, but investors should expect less uniform disclosure than public-market funds and conduct independent due diligence.

Platform operational dependency

Energea serves as managing member of portfolio LLCs with control over project operations, vendor selection, capital decisions, and redemption approvals—investors are passive members with limited recourse. Platform failure, mismanagement, or key-person departures can affect all holdings. Independent oversight is limited in many portfolio structures.

Fee structure impact on net returns

Combined 1-2% management fee plus 20-30% carried interest above 8-10% hurdles can create meaningful fee drag if projects outperform—15% gross project return may translate to ~12-13% net, depending on waterfall mechanics. Management fees tied to distributions can persist even if equity appreciation is limited. Carried interest details may vary by offering and can be difficult to model without full waterfall disclosures.

Illiquidity and uncertain redemption timing

Risk Summary

3-year minimum holding period with no formal secondary market—after 3 years, investors may request redemptions but the platform is not obligated to approve. Redemption timing, pricing methodology, and approval criteria are not consistently disclosed, creating a realistic possibility of 5-10+ year holds or extended lock-up periods.

Why It Matters

Monthly distributions can create an expectation of liquidity similar to publicly traded income vehicles, but these positions are private LLC interests. Investors needing principal access within 3-5 years face exit risk. Redemption pricing (if granted) could reflect a discount to internal valuations depending on platform-set terms.

Mitigation / Verification

Only invest capital that can remain committed for 5-10 years; treat redemption as an optional feature, not a plan. Diversify across platforms and structures to reduce single-platform exposure. Request disclosure on historical redemption approvals, timing, and pricing methodology. Consider public-market alternatives if liquidity is required.

Currency risk and emerging market exposure

Risk Summary

Brazil and Africa portfolios generate revenues in local currencies (BRL, ZAR, others), exposing USD investors to FX swings. Currency depreciation can offset operational performance: a strong local project may still deliver weaker USD returns if FX moves against investors. The platform does not disclose systematic FX hedging, so investors generally bear currency risk.

Why It Matters

Emerging market currencies can depreciate sharply during risk-off cycles, potentially reducing or negating the return premium versus USA-only portfolios. FX risk compounds operational risk—both can move against investors at once.

Mitigation / Verification

Limit Brazil/Africa exposure within the Energea allocation if FX volatility is a concern; overweight USD-denominated portfolios for simplicity. Ask for disclosure on any hedging policies and how FX impacts reported performance. Diversify the broader portfolio with USD assets to offset EM currency exposure.

Project operational and performance risk

Risk Summary

Solar project returns depend on production (weather and irradiance), uptime, O&M costs, equipment degradation, interconnection/grid constraints, and PPA terms. Projects can underperform projections due to lower-than-modeled production, outages, maintenance surprises, or counterparty payment issues.

Why It Matters

Target IRRs assume baseline operating performance. Persistent production shortfalls, higher costs, or PPA disputes can reduce cash available for distributions and lower realized total returns. Aggregate portfolio reporting may obscure dispersion across projects.

Mitigation / Verification

Review offering documents for project assumptions, PPA counterparties, and stress cases. Diversify across geographies and vintages. Track monthly updates for production vs projections and ask for historical forecast accuracy if available.

Platform dependency and key-person risk

Risk Summary

Energea controls portfolio LLCs as managing member, including operations, vendor relationships, reserves, and redemption approvals. Investors are passive with limited governance rights. Operational missteps, personnel changes, or platform distress could affect all holdings.

Why It Matters

This is a single-operator risk concentration. Unlike public funds with standardized governance and external oversight, many crowdfunding structures depend heavily on the sponsor’s competence and integrity.

Mitigation / Verification

Avoid concentration in a single platform. Review disclosures on related-party transactions, governance, and asset segregation. Monitor communication cadence, operational consistency, and any delays in distributions or reporting quality.

Fee drag and carried interest impact

Risk Summary

Management fees (1-2% on distributions) plus carried interest (20-30% above hurdles) can materially reduce net returns. Even moderate outperformance can trigger carry, shifting upside to the sponsor.

Why It Matters

Fees reduce compounding over multi-year holds and may leave investors with a smaller share of upside than headline project economics imply. Comparing net-of-fee outcomes to public alternatives (ETFs/yieldcos) is essential.

Mitigation / Verification

Model net returns under multiple scenarios. Compare to liquid renewables exposure (yieldcos/ETFs/green bonds). Confirm whether performance figures shown are net of fees and how carry is calculated for each offering.

Regulatory & Legal Posture

Security Status

Securities offered under SEC Regulation Crowdfunding (Reg CF, Section 4(a)(6) exemption) and/or Regulation A+ (Tier 2 qualified offering); LLC membership interests representing equity ownership in portfolio companies; offerings open to accredited and non-accredited investors, with annual investment limits for non-accredited investors based on income/net worth

Crowdfunding exemptions allow companies to raise capital from the general public without full SEC registration. Reg CF permits smaller raises with simplified disclosure requirements and Form C filings; Reg A+ Tier 2 permits larger raises with offering circulars and ongoing reporting, but still differs from fully registered offerings. Both frameworks require disclosures covering business description, financial statements (requirements vary by exemption and raise size), risk factors, and use of proceeds. However, disclosure and investor protections are generally less comprehensive than registered securities (mutual funds, REITs, ETFs). Non-accredited investors are subject to annual investment limits across crowdfunding offerings; specific thresholds can change over time and should be confirmed in current SEC guidance and in the active offering documents (limits referenced by platforms are often updated periodically). Platform materials indicate ongoing filings and periodic reporting; investors should review current offering documents on the platform and/or SEC EDGAR before investing.

Disclosure Quality

Moderate transparency through offering documents, monthly updates, and quarterly webinars—often better than some crowdfunding platforms, but less standardized than public companies or registered funds. Offering documents may include project locations, capacity, PPA descriptions, projections, and risk factors. However, project-level attribution is limited, redemption policy details are often vague, FX impact is not always quantified, and fee waterfalls can be hard to model without full disclosures. Investors should expect crowdfunding-level disclosure, not public-fund-level transparency.

Custody Model

Investor funds held via platform payment rails (e.g., ACH transfer partners) before deployment into specific portfolio LLCs; after investment, ownership interests are private LLC membership records maintained via cap tables rather than brokerage custody. These are private company interests, not exchange-traded shares; SIPC-style brokerage protections generally do not apply to investment performance.

Reg CF and Reg A+ provide a securities-law framework for offering and disclosure, but they do not provide FDIC insurance (bank deposits) or SIPC protection (broker insolvency) for investment outcomes. Investor rights are primarily contractual (Operating Agreements) and statutory (anti-fraud securities laws). LLC structures can provide some asset segregation, but operational control typically rests with the managing member; investors should evaluate governance, related-party disclosures, and sponsor reliability.

Tax Treatment

Reporting

Schedule K-1 (Form 1065)

Portfolio LLCs are pass-through entities issuing Schedule K-1 forms annually to members. Multiple K-1s may be issued if investors participate in multiple portfolios (separate K-1 per LLC). K-1 timing can be later than 1099s and may require filing extensions in some cases. Cash distributions are not the same as taxable income—tax outcomes depend on annual allocations reported on the K-1.

Income Character

Ordinary income from solar project operations; potential capital gains on project sales/refinancings

Pass-through LLC structure means investors report a proportionate share of portfolio income, deductions, and gains/losses. Operating income is generally ordinary, but depreciation deductions can materially reduce taxable income in early years, potentially making cash distributions partially tax-deferred. Project exits may generate capital gains, but depreciation recapture can convert portions to ordinary income. Some projects may generate tax credits (e.g., ITC) depending on structure and eligibility; foreign projects may involve foreign taxes and potential foreign tax credits. This is complex partnership taxation; many investors will require a qualified tax professional.

K-1 complexity, possible multi-state filings, passive activity rules, and potential depreciation recapture on exit can complicate after-tax outcomes. IRA accounts may face UBTI risk depending on activity characterization and structure. Consult a tax advisor familiar with partnership taxation and renewable energy investments.

Account Suitability

Taxable

Suitable with caveats—depreciation shields and potential credits may improve after-tax outcomes, but K-1 complexity and possible multi-state/foreign reporting add burden. Best for investors comfortable with partnership taxation or willing to work with a tax professional.

Roth IRA

Use caution—pass-through LLC interests may generate UBTI, potentially requiring Form 990-T and taxes within the IRA above $1,000 UBTI. Tax credits are typically less useful in tax-exempt accounts. Consider only with professional guidance on structure-specific UBTI risk.

Traditional IRA

Use caution—UBTI may create tax liability within the IRA, and capital gains benefits are generally not preserved inside an IRA (withdrawals are ordinary). K-1 administration through custodians can be burdensome. Consult a UBTI-experienced tax advisor before investing retirement assets.

HSA

Not recommended—most HSA custodians restrict alternative assets; even if permitted, illiquidity and potential UBTI-like complications make this a poor fit for funds intended for near-term medical liquidity.

Investor Fit

Impact-focused investors seeking direct renewable energy exposure

Provides direct equity ownership in operating solar projects generating clean energy and displacing fossil fuels—appeals to impact investors who want measurable outcomes beyond public ESG funds. Monthly distributions align returns with project cash flows. Suitable for investors comfortable with illiquidity and long holds.

Diversification seekers adding uncorrelated real assets to portfolios

Solar project cash flows can be less correlated with public equities, and long-term PPAs may provide revenue visibility. Best used as a satellite allocation within a diversified portfolio, acknowledging illiquidity and sponsor risk.

Income-oriented investors seeking monthly cash flow

Monthly distributions can be attractive, but they are variable and not guaranteed. Illiquidity and K-1 reporting reduce suitability for investors who want simple, liquid income. Consider public alternatives if liquidity and tax simplicity are priorities.

Non-accredited investors seeking alternative asset access

Reg CF/Reg A+ enables non-accredited access at low minimums, providing a pathway to infrastructure-style exposure that would otherwise be inaccessible. Best as a small satellite position given liquidity and sponsor risks.

Conservative investors requiring capital preservation

Equity risk, illiquidity, emerging market exposure, and sponsor dependence conflict with capital preservation objectives. Better suited to investment-grade bonds, cash equivalents, and conservative funds.

Investors requiring liquidity or short holding periods (<3 years)

A 3-year minimum hold plus discretionary redemptions makes this unsuitable for short horizons or investors with foreseeable liquidity needs. Public yieldcos/ETFs offer daily liquidity for renewable exposure.

Tax-averse investors or those uncomfortable with K-1 complexity

K-1 reporting and potential multi-state/foreign complexity can be a meaningful administrative burden. Investors preferring 1099 simplicity should avoid.

Growth investors seeking capital appreciation over income

Operating solar projects tend to emphasize cash flow over high growth. Fees can also reduce compounding. Growth-oriented investors may prefer renewable equities, growth funds, or venture-stage cleantech exposure.

Key Tradeoffs

Direct renewable energy exposure vs complexity

Direct project ownership can provide tangible real asset exposure and impact alignment, but the structure introduces complexity (LLCs, K-1s, multi-country operations, PPAs, FX) versus simpler public-market options like renewable ETFs or green bonds.

Target returns (11-14% IRR) vs illiquidity

Higher stated IRR targets can be attractive, but the 3+ year minimum hold and lack of guaranteed redemption materially reduce liquidity compared with public alternatives.

Non-accredited access vs regulatory protections

Crowdfunding exemptions allow broad participation at low minimums, but disclosure and investor protections differ from fully registered securities. Investors should expect crowdfunding-level transparency and do deeper diligence.

Geographic diversification vs currency/political risks

International portfolios diversify geography and solar resources but introduce FX volatility and political/regulatory uncertainty that can outweigh operational performance in USD terms.

Monthly distributions vs tax complexity

Monthly distributions can be useful for compounding and budgeting, but K-1 reporting, potential state filings, and IRA-specific complications (UBTI risk) increase administrative burden versus 1099-based income investments.

Who This Is Not For

Conservative investors requiring capital preservation or stable NAV

Equity risk, illiquidity, and (for international portfolios) FX and political risks conflict with capital preservation. Monthly distributions do not guarantee principal safety.

Investors requiring liquidity or holding periods under 5 years

A 3-year minimum hold plus discretionary redemptions means there is no reliable exit timeline. This is unsuitable for investors with medium-term liquidity needs.

Tax-averse investors or those uncomfortable with K-1 reporting complexity

K-1 tax reporting, potential multi-state/foreign complexity, and possible amended forms can create a meaningful administrative burden compared to 1099 investments.

Growth-focused investors prioritizing capital appreciation over income

Operating solar portfolios are typically cash-flow oriented rather than high-growth. Fees and illiquidity can further reduce attractiveness for growth-first investors.

Investors unable to conduct independent due diligence on international solar projects

International operations add FX, regulatory, and enforcement complexity. Limited project-level attribution can make it hard to assess dispersion and risk drivers without deep diligence.

Investors seeking ESG purity or excluding all fossil fuel industry connections

Projects often sell power to utilities or grids with mixed generation sources; investors seeking strict exclusion may prefer other approaches aligned to their screening constraints.

AltStreet Perspective

Verdict

Legitimate crowdfunding platform providing non-accredited investor access to renewable energy infrastructure with reasonable target returns, but illiquidity, fee drag, and emerging market risks demand careful consideration

Positioning

Energea is an early mover in renewable energy crowdfunding in the United States, expanding retail access to solar project equity traditionally reserved for institutional investors or accredited individuals with $25K-$250K minimums. Platform's Regulation CF/Reg A+ structure allows $100 entry points and non-accredited investor participation—meaningful advancement in alternative asset accessibility. Founded by experienced solar professionals (Mike Silvestrini 500+ projects developed, Chris Sattler private markets background) with team collectively participating in 14,000+ projects across prior roles and partnerships across 23 states and 3 continents. Target returns of 11-14% IRR are competitive with infrastructure investing and materially above many fixed income alternatives, achieved through equity ownership in operating solar projects generating monthly cash flows from long-term PPAs. Geographic diversification across USA (regulatory stability), Brazil (higher yields, currency risk), and Africa (emerging market opportunities) provides exposure to different solar resources and electricity markets. Monthly distributions appeal to income-focused investors while real asset backing and inflation-indexed contracts can provide inflation sensitivity. Platform serves a dual role as crowdfunding intermediary AND project developer/operator, creating potential conflicts but also operational alignment if Energea owns equity alongside investors. However, critical considerations demand attention: (1) Illiquidity is substantial—3-year minimum hold with redemptions only at platform discretion thereafter; no formal secondary market means actual hold periods likely 5-10+ years with potential for extended lock-up if redemptions are denied; monthly distributions do not provide principal liquidity; (2) Fee structure mirrors private equity (1-2% management + 20-30% carried interest) creating meaningful drag on net returns—headline project economics can look stronger than investor net outcomes; (3) Emerging market exposure (Brazil/Africa) introduces currency depreciation and political/regulatory risks that may not be fully compensated by stated return premiums; (4) Transparency limitations with aggregate portfolio reporting—limited project-level attribution, redemption approval data, and realized-vs-target performance makes manager evaluation harder; (5) Platform operational dependency creates key-person and sponsor risk—Energea controls LLC operations with limited investor recourse; (6) K-1 tax complexity (partnership reporting, potential multi-state/foreign issues, IRA UBTI risk) can require professional support; (7) Crowdfunding exemptions provide different disclosure and protection standards than registered funds. Suitable for: Impact-focused investors seeking direct renewable energy exposure; diversification seekers adding uncorrelated real assets as satellite positions (5-15% allocation); income-oriented investors comfortable with variable distributions, illiquidity, and tax complexity; non-accredited investors wanting alternative asset access; patient capital committed to 5-10+ year holds. Not suitable for: Conservative investors requiring capital preservation; investors needing liquidity within 5 years; tax-averse investors; growth-focused investors prioritizing appreciation over cash flow; those unable to diligence international project risks. Best analyzed as a satellite alternative allocation for impact-driven patient capital—not a core holding given liquidity constraints, fee drag, and sponsor dependence.

"Renewable energy crowdfunding democratizing solar project access with $100 minimums and 11-14% target returns, but 3+ year illiquidity, private-equity-style fees, and EM currency risks require careful evaluation—best as a small satellite position for impact-focused patient capital."

Next Steps

Review current offering documents and portfolio options—read the full Form C / offering circular materials (not just summaries) for risk factors, fees, financial statements, and PPA details; compare USA vs Brazil/Africa portfolios.

Assess liquidity needs and timeline—assume 5-10 year holding periods; treat redemption as uncertain. Only invest capital you do not need in the foreseeable future.

Model fee impact on net returns—run scenarios for gross project returns vs net investor outcomes after management fees and carry; compare to liquid alternatives (yieldcos, ETFs, green bonds).

Evaluate FX risk tolerance—consider limiting Brazil/Africa exposure within the Energea allocation; ask about hedging practices and how FX impacts performance reporting.

Review tax implications with a qualified professional—understand K-1 reporting, potential state/foreign issues, depreciation effects, and IRA UBTI considerations before allocating meaningful capital.

Start small to learn the mechanics—make a modest initial allocation (e.g., USA portfolio) and monitor reporting quality, distributions, and communications for 6-12 months before scaling.

Diversify across platforms and structures—avoid over-concentrating in a single sponsor; use Energea as a satellite allocation rather than a core portfolio holding.

Ask for redemption transparency—request historical redemption approval rates, pricing approach, and typical timelines; incorporate the uncertainty into allocation sizing.

Benchmark against public alternatives—compare to yieldcos and renewable ETFs for liquidity and fee simplicity; decide if Energea’s direct project exposure justifies the added complexity and lock-up.

Related Resources

Explore Asset Class

Solar Project EquitySimilar Platform Reviews

- WattFunders

USA-focused solar crowdfunding with different fee structure

- Brookfield Renewable Partners (BEP)

Publicly-traded yieldco offering daily liquidity, 6-9% yields

🔍Review Evidence

Scrape Date

2026-01-16

Methodology

Review synthesized from Energea platform materials, SEC filings (Reg CF Form C and Reg A+ offering circulars), and third-party reviews. Analysis focuses on platform structure, fee mechanics, regulatory framework, liquidity profile, tax treatment, key risks, and investor suitability.

Scope

Platform history, offering structure (Reg CF/Reg A+), investment products (geographic portfolios and Core), fees (management + carry), target returns (IRR), minimums, holding periods, distribution mechanics, geographic/FX exposure, project contract types (PPAs), tax treatment (K-1), and operational/sponsor risks.

Key Findings

- •PLATFORM-CONFIRMED: Founded by Mike Silvestrini and Chris Sattler; team participation claims include 500+ directly developed projects plus 14,000+ across prior roles and partnerships (23 states, 3 continents, 365MW).

- •PLATFORM-CONFIRMED: Over $100 million in assets under management and 11%+ historical IRR (net of fees) per platform materials.

- •PLATFORM-CONFIRMED: $100 minimum per portfolio with incremental investments thereafter; open to accredited and non-accredited investors via Reg CF/Reg A+ offerings.

- •PLATFORM-CONFIRMED: Fee structure includes management fees on distributions plus carried interest above hurdle rates; performance figures shown are reported as net of fees.

- •PLATFORM-CONFIRMED: 3-year minimum hold; redemption requests may be considered after 3 years but are not guaranteed.

- •THIRD-PARTY REPORTED: No formal secondary market and limited transparency on redemption approval rates, pricing, and timing.

- •THIRD-PARTY REPORTED: Currency risk is material for Brazil/Africa portfolios and hedging practices are not clearly disclosed.

- •THIRD-PARTY REPORTED: K-1 tax complexity and IRA-specific complications (e.g., UBTI risk) are common investor friction points.

Primary Source Pages

- energea.com homepage (investment overview, target returns, platform scale)

- energea.com/about-us (management team, mission, track record)

- energea.com/investments (portfolio offerings, project details)

- energea.com/performance (historical IRR data, comparative returns)

- SEC filings (Reg CF Form C and Reg A+ offering circulars for specific portfolios)

- VirtueScout Energea review (third-party analysis, fee disclosure, investor experience)

- Asset Scholar Energea overview (portfolio structure, redemption policy, fees)

- 100kImpact Energea analysis (impact assessment, risk factors, fee structure)

Frequently Asked Questions

What is Energea and how does it work?

Energea is a renewable energy crowdfunding platform allowing investors to purchase equity stakes in portfolios of operating solar projects across the USA, Brazil, and Africa. Investors buy LLC membership interests through SEC Reg CF or Reg A+ offerings ($100 minimums, open to non-accredited investors). Projects generate revenue from selling electricity under long-term contracts (PPAs); investors receive monthly distributions from cash flows plus potential equity appreciation upon project sales or refinancings. Target returns are typically described as 11-14% IRR depending on geography. There is a 3-year minimum holding period, and redemptions are considered at the platform’s discretion thereafter—no guaranteed liquidity or secondary market.

What are Energea's fees and how do they impact returns?

Energea offerings typically include (1) a 1-2% management fee on monthly distributions (varies by portfolio; generally no fee if no distribution is paid) and (2) 20-30% carried interest on returns above hurdle rates (often described around 8-10% IRR). All performance figures shown on the platform are generally presented net of fees. Fees can materially reduce net outcomes versus gross project economics, especially over long holding periods.

How liquid are Energea investments and when can I get my money back?

Investments are illiquid with a 3-year minimum holding period. After 3 years, investors may request redemptions, but the platform is not obligated to repurchase interests and there is no formal secondary market. Exit timing and pricing are therefore uncertain. Investors should assume 5-10+ year holds and only invest capital that can remain committed long-term.

What are the currency risks in Energea's Brazil and Africa portfolios?

Brazil portfolios generate revenues in BRL and Africa portfolios in various local currencies (e.g., ZAR and others). Currency depreciation versus USD can reduce investor returns when converted. The platform does not clearly disclose systematic FX hedging, so FX risk is generally borne by investors. The higher stated IRR targets for emerging market portfolios are intended to compensate for this risk, but FX headwinds can still overwhelm operational performance in USD terms.

Is Energea suitable for IRA or retirement accounts?

Energea may be accessible through some self-directed IRA custodians, but it can create complications. Pass-through LLC interests may generate UBTI, which can require Form 990-T and taxes within the IRA above $1,000 of UBTI. Tax credits are typically less useful inside tax-exempt accounts, and K-1 administration through custodians can be burdensome. Consult a UBTI-experienced tax advisor before using retirement funds.

How does Energea compare to publicly-traded renewable energy investments?

Energea offers direct project equity exposure and potential net IRR targets around 11-14%, but with illiquidity, higher fee drag, and K-1 tax complexity. Public alternatives (yieldcos and renewable ETFs) offer daily liquidity, lower fees, and simpler tax reporting, but may provide lower income or different risk exposures. Energea is best evaluated as a satellite alternative allocation rather than a replacement for liquid public renewables exposure.

What risks should I be most concerned about with Energea?

Primary risks include illiquidity and uncertain redemption timing, currency risk in Brazil/Africa portfolios, project operational underperformance, platform dependency and sponsor risk, fee drag from management and carried interest, and limited project-level transparency relative to public markets. Only suitable for investors comfortable with long holds and sponsor-driven structures.

How are Energea investments taxed?

Investments are typically structured as LLC interests that issue Schedule K-1 forms. Tax outcomes depend on annual allocations of income, deductions (including depreciation), and potential credits, as well as any gains on project exits. This can be materially more complex than 1099-based public investments, especially with multi-portfolio participation, multi-state/foreign considerations, and IRA-specific issues like UBTI. Many investors will want a qualified tax professional.

What is Energea Core and how does it work?

Energea Core is an allocation tool that lets investors set desired weights across open portfolios (e.g., USA, Brazil, Africa) with a single workflow. It simplifies diversification, but the underlying holdings remain separate portfolio LLC interests, with the same fee structure and illiquidity profile as the individual portfolios.

Should I invest in Energea's USA portfolio or emerging market portfolios?

USA portfolios are generally simpler for USD-based investors because they avoid FX risk and tend to target lower but potentially steadier IRRs. Brazil/Africa portfolios may target higher IRRs but introduce FX and political/regulatory risks that can materially affect USD outcomes. Many investors start with the USA portfolio and add emerging market exposure only if they understand and accept currency risk and longer-horizon uncertainty.