The convergence of traditional finance and blockchain technology is unlocking unprecedented access to institutional-grade assets. For decades, the highest-quality yield instruments—U.S. Treasuries, money market funds, private credit, and investment-grade real estate—remained confined to institutional investors with millions in capital and complex operational infrastructure. This exclusivity created inefficiencies: illiquid markets, opaque pricing, settlement delays measured in days, and barriers preventing global capital from flowing to its highest productive use.

Tokenization is dismantling these barriers. By representing ownership rights to real-world assets as blockchain-based digital tokens, innovators are creating a new financial infrastructure that operates 24/7, settles instantly, and provides transparent, auditable records of ownership. This isn't speculative cryptocurrency or experimental DeFi— this is BlackRock, JPMorgan, and Franklin Templeton bringing institutional-grade assets on-chain with regulatory compliance and traditional custody standards.

TL;DR: Tokenized RWAs in 2025

- •What RWAs Are: Blockchain tokens representing ownership of traditional assets (Treasuries, real estate, private credit) with legal claims to underlying value through regulated custodians.

- •What's Investable Today: Tokenized Treasuries (led by BlackRock BUIDL at $2.5B+ AUM as of late 2024), private credit pools (Maple, Centrifuge), tokenized fund shares (Securitize platform), and yield-bearing stablecoins earning Treasury-linked rates.

- •Where Yield Comes From: Risk-free rate from Treasuries, credit spreads on private loans, rental income from tokenized real estate, and protocol incentives through DeFi composability.

- •What Can Break: Smart contract exploits, issuer insolvency, custody failures, regulatory crackdowns, thin liquidity during stress, and untested legal structures in bankruptcy scenarios.

- •How to Access: Through SEC-registered funds (typically requiring accredited or qualified purchaser status), decentralized protocols (varying compliance requirements by jurisdiction), tokenization platforms (Securitize, Ondo), or DeFi lending markets. Minimums range from $100 (retail stablecoin products) to $5M+ (institutional funds).

Best For: Sophisticated investors seeking Treasury-level safety with blockchain liquidity, institutions wanting 24/7 settlement, and allocators building alternative fixed-income exposure.

Not For: Retail investors expecting crypto-level volatility, those uncomfortable with regulatory uncertainty, or anyone seeking get-rich-quick speculation.

The tokenized real-world asset market grew 85% year-over-year to reach $15.2 billion by December 2024, spanning diverse asset classes from private credit to commodities. This is merely the beginning of a transformation that Boston Consulting Group projects will reach $16 trillion by 2030—nearly 10% of global GDP.

This comprehensive analysis explores how tokenized real-world assets are rebuilding the global yield market. We examine the mechanics of tokenization, profile the platforms and protocols leading this shift, analyze regulatory frameworks providing legal certainty, and assess the risks and opportunities as traditional finance migrates on-chain. This is the definitive guide for sophisticated investors seeking to understand how blockchain technology is creating more efficient, accessible, and transparent capital markets.

RWA Market Snapshot: Today vs 2030

| Metric | Current Status | Why It Matters | Source |

|---|---|---|---|

| Total Market Size | $15.2B (Dec 2024) | 85% YoY growth signals institutional acceleration | Investax |

| Tokenized Treasuries | ~$2.5B (late 2024) | Fastest-growing segment; BUIDL dominates with institutional backing | arXiv |

| 2030 Projection (BCG) | $16 trillion | 10% of global GDP; validates infrastructure thesis | BCG via Webisoft |

| Primary Blockchain Rails | Ethereum, Stellar, Solana, Polygon | Multi-chain deployments maximize accessibility | Stellar |

| Major Institutional Issuers | BlackRock, Franklin Templeton, JPMorgan, WisdomTree | TradFi giants validate tokenization as infrastructure | BusinessWire |

| Regulatory Milestones | EU MiCA (effective Dec 30, 2024) | Comprehensive framework across 27 member states | ComplyCube |

Note: Market size and AUM figures as of late 2024. Tokenized Treasury yields fluctuate with Federal Reserve policy; verify current rates before investing.

Understanding Real-World Assets: The Bridge Between Blockchain and Traditional Finance

Real-world assets (RWAs) represent any tangible or traditional financial asset that exists outside the purely digital crypto ecosystem. This broad category encompasses U.S. Treasury bills, corporate bonds, real estate properties, commodities like gold and oil, private credit instruments, equity shares, invoices and receivables, infrastructure projects, intellectual property rights, and even collectibles with verifiable value.

The tokenization process converts these assets into digital tokens on a blockchain network, creating a programmable representation of ownership or investment rights. This digital wrapper doesn't change the underlying asset—a tokenized Treasury bill is still backed by the full faith and credit of the U.S. government—but it transforms how that asset can be accessed, traded, and integrated into modern financial infrastructure.

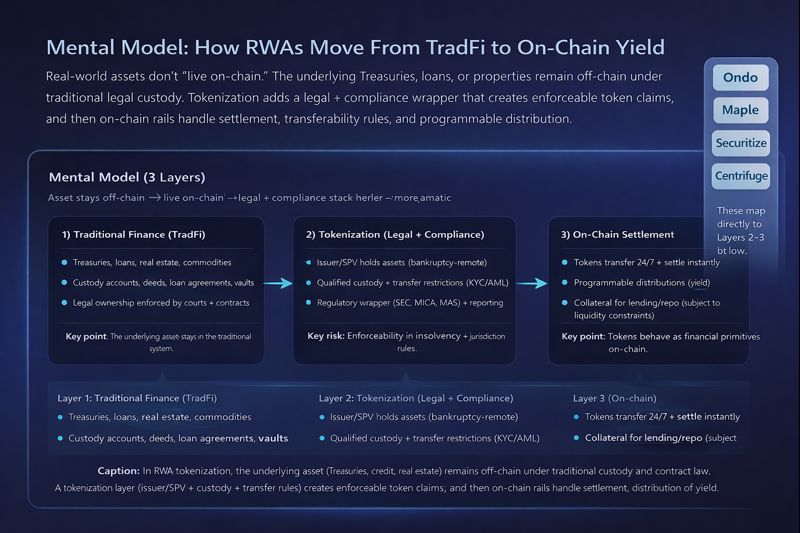

Mental Model: How RWAs Move From TradFi to On-Chain Yield

Real-world assets don’t “live on-chain.” Treasuries, loans, and real estate remain off-chain under traditional custody and contract law. Tokenization adds a legal + compliance wrapper that creates enforceable token claims, then on-chain rails handle settlement, transfer rules, and programmable distribution.

Layer 1 (TradFi): The underlying asset stays in the traditional system—custody accounts, deeds, loan agreements, or vaults.

Layer 2 (Tokenization): The legal wrapper and compliance stack turns “ownership rights” into an enforceable token claim (this is where most risks live).

Layer 3 (On-chain): Tokens can settle instantly, pay yield programmatically, and become usable collateral—subject to liquidity and regulatory constraints.

Major financial institutions including BlackRock, Fidelity, BNY Mellon, JPMorgan, Goldman Sachs, UBS, and HSBC are already using blockchain to tokenize assets. This institutional participation validates tokenization as infrastructure evolution rather than speculative innovation.

RWA Asset Map: Yield Sources, Risks & Access Points

| Asset Category | Typical Yield Driver | Primary Risks | Research on AltStreet | Example Platforms |

|---|---|---|---|---|

| Tokenized Treasuries | Risk-free rate (varies with Fed policy) | Smart contract, custody, regulatory shifts | Tokenized Treasuries Guide | BlackRock BUIDL, Ondo USDY, Franklin BENJI |

| Private Credit | Credit spread over risk-free rate | Default, liquidity, platform insolvency | RWA Category Hub | Maple Finance, Centrifuge, Goldfinch |

| Real Estate | Rental income + appreciation | Property market cycles, tenant defaults, illiquidity | Due Diligence Framework | RealT, Lofty, Securitize Markets |

| Commodities | Price appreciation + carry yield | Volatility, custody verification, contango costs | Browse All Categories | Paxos Gold (PAXG), Tether Gold (XAUT) |

| Yield-Bearing Stablecoins | Treasury yields distributed to holders | Regulatory (MiCA limits), bank failures, de-pegging | Stablecoins & Yield | Mountain USDM, Ondo USDY, Backed bIB01 |

| Tokenized Funds | Portfolio returns (varies by strategy) | Manager performance, high minimums, redemption gates | Private Equity Structures | Securitize, Hamilton Lane, Apollo |

Note: Yield ranges vary significantly by platform, asset quality, and market conditions. All investments subject to platform fees, regulatory restrictions, and accreditation requirements. Verify current terms before investing.

Why Tokenization Matters: The Core Value Proposition

Tokenized assets deliver three fundamental improvements over traditional financial infrastructure:

Enhanced Liquidity Through Fractional Ownership

Traditional real estate, private credit, and alternative investments require massive minimum commitments—often millions of dollars—creating inherent illiquidity. Tokenization enables fractional ownership, dividing a $10 million property or credit portfolio into 10,000 tokens at $1,000 each. This dramatically expands the potential investor base, creating liquidity where none previously existed.

As Nasdaq reports on the transformation of traditionally illiquid markets, tokenization facilitates transactions that would otherwise require significant capital and involve lengthy, complex processes. Assets like real estate, fine art, and private credit—once locked in long-term investments and accessible only to select investors—can now be traded more easily on digital platforms.

Transparency and 24/7 Accessibility

Blockchain provides immutable, auditable records of ownership and transaction history. Every transfer, dividend distribution, and ownership change is recorded on-chain, creating unprecedented transparency compared to opaque private markets where pricing and ownership information remain closely guarded.

Unlike traditional markets constrained by business hours and time zones, tokenized assets trade continuously. An investor in Singapore can purchase tokenized U.S. Treasuries from a seller in Europe at 3am on Sunday—impossible in legacy infrastructure where settlement occurs only during banking hours.

Programmable Settlement and Reduced Friction

Smart contracts automate complex financial operations: dividend distributions occur automatically when interest accrues, compliance checks execute programmatically to ensure only qualified investors can transfer tokens, and settlement completes instantly versus T+2 or longer in traditional markets.

This automation eliminates intermediaries who extract fees at each step—transfer agents, custodians, clearinghouses—reducing transaction costs by 40-60% according to industry estimates. Securitize CEO Carlos Domingo notes that in capital markets, "every transaction involves updating a ledger. Right now, the ledgers are built on software from the 1970s, and the process is siloed." Blockchains provide direct, real-time records that update instantly.

Categories of Tokenized Real-World Assets

Tokenized Treasuries and Government Securities

U.S. Treasury bills represent the largest and fastest-growing segment of tokenized RWAs. The tokenized Treasury market soared from $100 million at the start of 2023 to nearly $2.5 billion by late 2024, reflecting explosive institutional demand for on-chain, government-backed yield. For a deeper breakdown of BUIDL, USDY, and BENJI—including yield mechanics, liquidity structures, and investor requirements—see our comprehensive guide to tokenized Treasuries and the on-chain risk-free rate.

These instruments appeal to both crypto-native investors seeking stable yield and traditional institutions wanting blockchain efficiency. Tokenized Treasuries maintain the safety profile of U.S. sovereign debt while enabling liquidity and composability impossible in traditional markets. Investors can earn Treasury-linked yields, use tokens as collateral in DeFi lending protocols, transfer ownership instantly, and access Treasury markets 24/7 regardless of jurisdiction.

Private Credit and Tokenized Lending

Private credit—loans to companies outside public bond markets—typically requires $10+ million minimum commitments and multi-year lockups. Tokenization transforms this illiquid asset class by enabling fractional participation and creating secondary markets for loan positions.

Platforms like Maple Finance facilitate institutional lending on-chain, connecting borrowers needing capital with lenders seeking yield through smart contract automation. Centrifuge tokenizes real-world invoices and receivables, allowing businesses to access working capital by selling future cash flows as on-chain assets. This brings traditional trade finance—a $10 trillion global market—onto blockchain rails with improved transparency and efficiency.

Tokenized Real Estate and Infrastructure

Real estate tokenization divides property ownership into digital shares tradable on blockchain networks. Rather than purchasing an entire $5 million commercial building, investors can buy $50,000 or $500,000 fractional interests, receiving proportional rental income and appreciation exposure.

Infrastructure projects—toll roads, energy grids, water systems— traditionally financed through municipal bonds or pension fund commitments, can now be fractionally owned by global investors. This democratizes access to stable, government-contracted cash flows previously available only to institutional players.

Commodities and Physical Assets

Gold, oil, agricultural products, and other commodities increasingly exist as blockchain tokens backed by physical reserves. Each token represents ownership of specific quantities stored in audited vaults or warehouses, with oracle networks providing proof of reserves.

This eliminates storage costs and security concerns for individual investors while maintaining exposure to commodity price movements. Trading tokenized gold requires no physical transportation, instantaneous settlement replaces multi-day transfers, and fractional ownership allows participation with hundreds rather than thousands of dollars.

Leading Platforms and Protocols: The Infrastructure Builders

BlackRock BUIDL: Institutional Validation

BlackRock's launch of its USD Institutional Digital Liquidity Fund (BUIDL) in March 2024 represents the most significant institutional endorsement of tokenized assets to date. As the world's largest asset manager with $10 trillion under management, BlackRock's entry validates tokenization as core financial infrastructure rather than experimental technology.

BUIDL invests in short-term U.S. Treasury bills, cash, and repurchase agreements, with assets surpassing $2.5 billion as of late 2024. The fund provides qualified investors with U.S. dollar yields on-chain through daily dividend distributions, near-instant settlement, and institutional-grade custody through Bank of New York Mellon.

BUIDL's expansion across multiple blockchains—Ethereum, Solana, Polygon, Arbitrum, Avalanche, Optimism, and Aptos—demonstrates multi-chain strategy for maximum accessibility. Each blockchain enables native interaction with that ecosystem's applications, creating network effects as DeFi protocols integrate Treasury-backed collateral.

Critically, Binance's recent decision to accept BUIDL as trading collateral represents a watershed moment—the world's largest cryptocurrency exchange now treats tokenized Treasuries as legitimate collateral alongside Bitcoin and Ethereum, bridging TradFi and crypto infrastructure.

Ondo Finance: Decentralized Treasury Access

Ondo Finance has emerged as a leading gateway to tokenized Treasury exposure for crypto-native investors, with substantial assets under management in tokenized U.S. Treasuries through flagship products like OUSG and USDY (figures vary over time; verify current AUM directly with Ondo or on-chain dashboards).

USDY (USD Yield Token) is a tokenized note backed by short-term Treasuries and bank deposits, designed to offer eligible non-U.S. investors access to dollar-denominated yields. USDY has expanded across multiple blockchains including Ethereum, Solana, Aptos, Stellar, and Sei Network, enabling 24/7 transferability and DeFi integrations depending on the chain and venue.

Unlike traditional Treasury investments limited to market hours and brokerage rails, tokenized Treasury products can trade continuously on exchanges and in on-chain venues (liquidity still depends on market depth and redemption terms). This structure can be especially relevant for international investors seeking USD yield exposure alongside portability.

OUSG (Ondo Short-Term U.S. Government Treasuries) provides exposure to short-duration government securities via a regulated wrapper (e.g., ETF/fund rails), then tokenized for on-chain use—an approach that aims to balance composability with securities-law constraints.

Want the full due diligence? Read our platform breakdown:

AltStreet Review: Ondo Finance →Coverage includes product structure, eligibility, custody/legal wrapper, on-chain liquidity considerations, and key risks.

Maple Finance: Institutional DeFi Lending

Maple Finance pioneered institutional-style lending on-chain by combining credit underwriting with smart contract execution. The platform structures credit pools where sophisticated borrowers access capital and lenders earn yield from loan coupons—bringing private credit mechanics (pricing, covenants, risk tiers) into a more transparent settlement environment.

Maple’s model illustrates how blockchain rails can reduce friction in lending: originations and servicing can be streamlined, reporting is more transparent, and lender positions can sometimes be transferred more flexibly than in off-chain private credit—though liquidity remains highly pool-dependent.

See how Maple actually works in practice:

AltStreet Review: Maple Finance →We cover underwriting, pool structure, yield drivers, default handling, liquidity constraints, and what to verify before allocating.

Securitize: The Tokenization Infrastructure Layer

Securitize is a core infrastructure provider for compliant tokenization, offering end-to-end rails for issuing and managing tokenized securities. Importantly, it has been involved in major institutional initiatives (including tokenized fund structures), operating across functions typically handled by broker-dealers, transfer agents, and regulated trading venues.

At a high level, Securitize focuses on the hardest part of RWAs: the legal and operational bridge. That includes investor onboarding (KYC/AML), permissioned transfer controls, cap table and record-keeping, compliance workflows, and regulated secondary trading pathways where applicable.

For the compliance + custody details:

AltStreet Review: Securitize →Includes regulatory posture, issuance stack, secondary markets/ATS context, and the key diligence questions for investors and issuers.

Centrifuge: Asset-Backed Securities On-Chain

Centrifuge specializes in bringing real-world credit on-chain—often by financing assets like invoices, receivables, and other collateralized cash flows through structured pools. The goal is to make credit performance more transparent and to automate distribution logic using smart contracts.

The key innovation is programmability applied to structured credit mechanics: pools can define seniority and payment waterfalls, route repayments based on tranche priority, and integrate with on-chain liquidity and collateral systems (with all the usual caveats around liquidity, underwriting quality, and platform risk).

Go deeper on Centrifuge’s credit structure:

AltStreet Review: Centrifuge →We break down pool architecture, underwriting signals, tranche mechanics, historical performance considerations, and what “real yield” depends on.

The Regulatory Landscape: Legal Clarity Driving Adoption

Europe's MiCA Framework: Comprehensive Harmonization

The European Union's Markets in Crypto-Assets (MiCA) regulation, fully effective December 30, 2024, establishes the world's most comprehensive framework for digital asset regulation. MiCA provides legal certainty across all 27 EU member states, eliminating the patchwork of conflicting national regulations that previously hindered cross-border tokenization.

The regulation categorizes crypto assets into distinct types with tailored requirements: Asset-Referenced Tokens (ARTs) like commodity- backed stablecoins must publish detailed whitepapers, maintain sufficient reserves, and establish robust governance structures. E-Money Tokens (EMTs) representing fiat currencies face strict backing requirements and cannot pay interest to holders under MiCA rules—a provision driving institutional demand toward tokenized money market funds rather than traditional stablecoins.

Importantly, tokenized securities remain outside MiCA's scope, continuing to fall under existing capital markets regulations like MiFID II and the Prospectus Regulation. This provides clear guidance to securities issuers using established frameworks.

MiCA's "passporting" system allows entities authorized in one EU member state to offer services across the entire union without obtaining separate licenses in each jurisdiction. This dramatically reduces compliance costs and legal complexity, encouraging tokenization platforms to establish European operations.

United States: Fragmented but Evolving Framework

The U.S. regulatory approach remains fragmented across federal and state levels, creating complexity for issuers and intermediaries. The SEC applies the Howey Test to determine if tokens qualify as securities, requiring registration or exemption through Regulation D (limiting sales to accredited investors) or Regulation A+ (allowing broader access with extensive disclosure requirements).

The Commodity Futures Trading Commission (CFTC) regulates tokens classified as commodities, while the Financial Crimes Enforcement Network (FinCEN) enforces AML/KYC requirements for crypto exchanges and service providers. This multi-agency oversight creates jurisdictional uncertainty—the same token might be deemed a security by SEC, a commodity by CFTC, or neither depending on specific characteristics.

At the state level, Uniform Commercial Code (UCC) revisions are addressing how security interests in tokenized assets can be perfected and enforced. Several states including Wyoming and Delaware have enacted blockchain-friendly legislation establishing clear legal recognition for digital assets and DAOs.

Despite fragmentation, progress occurs: proposed federal legislation like the GENIUS Act would create explicit safe harbors for certain stablecoins, distinguishing them from securities and providing clearer regulatory pathways. The SEC has approved several tokenized fund structures, establishing precedents for compliant offerings.

Singapore, UAE, and Asia-Pacific Innovation Hubs

Singapore's Monetary Authority has established clear frameworks for digital payment tokens under the Payment Services Act, balancing innovation with investor protection. The MAS Project Guardian initiative supports commercialization of asset tokenization through forming commercial networks to deepen liquidity, developing ecosystem infrastructure, and enabling access to common settlement facilities.

The UAE, particularly Dubai and Abu Dhabi, has moved aggressively with regulatory sandboxes and clear crypto frameworks. The Dubai Virtual Assets Regulatory Authority (VARA) provides specific licensing for tokenization platforms, while Abu Dhabi Global Market (ADGM) offers comprehensive digital asset regulations aligned with international standards.

Japan's Financial Services Agency provides subsidies for security token issuances, offering support as the Tokyo Metropolitan Government acknowledged benefits of lower denomination requirements and streamlined intermediation for tokenized securities.

Yield Mechanics and Investment Structures

How Tokenized Bonds Generate Returns

Tokenized Treasury and bond products generate yields through straightforward mechanics mirroring traditional fixed income: the underlying assets (Treasury bills, corporate bonds, money market instruments) pay regular interest. This interest accrues to the fund or SPV holding the assets, which then distributes proportional payments to token holders.

BUIDL and similar products automate this process through smart contracts that mint new tokens representing accrued interest each month, directly depositing them in investors' wallets. No manual claims or broker involvement required—the blockchain handles distribution automatically based on token holdings at preset intervals.

For daily interest accrual products like USDY, token balances rebase automatically. Interest compounds continuously with the proportional increase appearing in your wallet without any action required.

How Tokenized Yield Actually Pays You: Distribution Models

| Distribution Model | How It Works | What You See in Wallet | Tax Considerations | Example Platforms |

|---|---|---|---|---|

| Rebasing Balance | Token quantity increases continuously as interest accrues | Balance grows automatically without separate transactions | Each rebase may trigger taxable event; jurisdiction-dependent | Ondo USDY, Mountain USDM |

| Dividend/Token Mint | New tokens deposited periodically representing accrued yield | Additional tokens appear as separate transaction | Typically dividend income taxed when received | BlackRock BUIDL, Franklin BENJI |

| Pool Waterfall | Senior tranches paid first, then junior; automated via smart contract | Periodic distributions to wallet based on tranche seniority | Interest income; may require K-1s for partnership structures | Maple Finance, Centrifuge, TrueFi |

| DeFi Collateral Yield | Deposit RWA tokens in lending protocol; earn additional yield | Protocol-specific rewards tokens plus base RWA yield | Complex; multiple income streams may require specialized reporting | Aave (accepting BUIDL), Compound, MakerDAO |

Tax Disclaimer: Tax treatment varies significantly by jurisdiction and individual circumstances. RWA yield may be classified as interest, dividends, or capital gains depending on structure. Consult a qualified tax professional familiar with digital assets before investing.

Private Credit Yield Structures

Tokenized private credit pools typically establish senior-subordinated structures: senior tranches receive first claim on interest payments and principal repayments, offering lower yields with reduced risk. Junior tranches absorb first losses but receive higher yields as compensation for increased risk.

Platforms like Maple and TrueFi implement these waterfalls through smart contracts that automatically route loan repayments to senior token holders first, distributing remaining funds to junior positions only after senior obligations are satisfied. This programmable enforcement provides greater certainty than trust-based traditional structures.

Institutional Adoption: The Network Effect Accelerates

Traditional Asset Managers Embrace Tokenization

BlackRock CEO Larry Fink's statement that "the next generation for markets, the next generation for securities, will be tokenization of securities" reflects growing institutional consensus. Beyond BlackRock, Franklin Templeton launched tokenized money market funds on Stellar and Polygon networks, managing substantial on-chain assets.

JPMorgan operates JPM Coin for institutional settlements and partnered with Chainlink on Project Guardian to demonstrate cross-chain atomic settlements for tokenized assets. Goldman Sachs has announced tokenization initiatives focusing on digital asset platforms and tokenized financial instruments.

This institutional migration creates network effects: as major banks adopt tokenization for internal operations (collateral management, settlement, treasury functions), they build infrastructure that can extend to client-facing products. Once J.P. Morgan processes billions in tokenized repo transactions internally, offering similar products to hedge funds and asset managers becomes straightforward.

Sovereign and Government Adoption

Slovenia issued $32.5 million in digital bonds through distributed ledger technology in July 2024, becoming the first EU nation to issue sovereign digital bonds. This validates tokenization at the highest level of creditworthiness—if governments issue debt on blockchain, private issuers face fewer adoption barriers.

The Bank for International Settlements Project Agorá, collaborating with central banks from France, Japan, South Korea, Mexico, Switzerland, the UK, and U.S. Federal Reserve, explores asset tokenization within monetary systems. These initiatives investigate how central bank digital currencies (CBDCs) can interact with tokenized private assets for instant, atomic settlement of complex transactions.

Risks and Challenges: Navigating the Transition

RWA Risk Matrix: Understanding What Can Go Wrong

| Risk Category | What It Looks Like | Who Bears It | Mitigation Strategies | Due Diligence Resources |

|---|---|---|---|---|

| Smart Contract Vulnerability | Code exploits, bugs causing fund loss or locked assets | Token holders (investors) | Multiple audits, formal verification, bug bounties, gradual rollout with caps | Smart Contract Audit Checklist |

| Custody & Legal Structure | Unclear token-to-asset claims in bankruptcy; custodian insolvency | Token holders (investors) | Qualified custodians (BNY Mellon), bankruptcy-remote SPVs, legal opinions | Custody Evaluation Framework |

| Regulatory Uncertainty | SEC enforcement, changing rules, cross-border restrictions | Platforms & investors | Operate only in clear jurisdictions (MiCA, Singapore MAS), maintain SEC registration | Regulatory Status by Platform |

| Liquidity Risk | Thin markets, wide spreads, inability to exit during stress | Token holders (investors) | Understand redemption windows, size positions appropriately, avoid leverage | Liquidity Planning Guide |

| Platform/Issuer Risk | Platform shutdown, issuer bankruptcy, operational failures | Token holders (investors) | Diversify across platforms, favor established institutions, review legal structure | Platform Comparison Matrix |

| Credit/Default Risk | Borrower defaults in private credit; underlying asset impairment | Lenders/investors (especially junior tranches) | Understand underwriting standards, favor senior tranches, diversify loans | Private Credit Analysis |

| Tax Complexity | Unclear treatment of rebasing, multi-jurisdictional filing requirements | Token holders (investors) | Work with crypto-savvy CPAs, maintain detailed transaction records | RWA Tax Planning Guide |

| Bridge Risk (Chain↔TradFi) | Delays in redemptions, fiat on/off-ramp failures, settlement breaks | All participants | Use platforms with banking relationships, plan for settlement delays | Operational Risk Assessment |

Risk Note: This matrix covers primary risk categories but is not exhaustive. Token holders should conduct comprehensive due diligence and consult qualified advisors before investing. For detailed platform-specific risk assessments, see our Alternative Assets Due Diligence Framework.

Smart Contract and Technology Risks

Smart contracts, while offering automation and efficiency, introduce code-based vulnerabilities. Bugs or exploits can lead to fund loss, unauthorized transfers, or locked assets. Even audited contracts face risks—the history of DeFi includes numerous high-profile hacks of supposedly secure protocols.

Mitigation strategies include multiple independent audits by firms like Trail of Bits, OpenZeppelin, or Consensys Diligence; formal verification mathematically proving contract correctness; bug bounty programs incentivizing white-hat hackers to find vulnerabilities; gradual rollouts with initial cap limits; and insurance coverage through protocols like Nexus Mutual.

Liquidity and Market Depth Constraints

While tokenization promises enhanced liquidity, current reality shows significant gaps. Many tokenized assets trade on thin markets with wide bid-ask spreads and limited depth. During stress periods, liquidity evaporates as it does in traditional markets—tokenization doesn't magically create buyers when everyone wants to sell.

Most platforms acknowledge this by offering structured redemption windows (quarterly or monthly) rather than continuous liquidity. Institutional tokenized funds often require substantial minimum investments and restrict participation to qualified purchasers, limiting the pool of potential counterparties. Secondary markets exist but lack institutional depth—selling large positions in tokenized credit typically requires off-chain negotiations rather than simple market orders.

Counterparty and Custody Risks

Tokenized RWAs create dependence on multiple counterparties: the issuer maintaining underlying asset backing, custodians holding physical assets or securities, platforms managing smart contracts and compliance, and service providers handling KYC, reporting, and redemptions. Failure at any point in this chain creates risk for token holders.

Unlike pure crypto assets where "not your keys, not your coins" applies absolutely, tokenized RWAs require trust in off-chain legal structures and institutions. If a tokenization platform faces bankruptcy or regulatory action, what happens to token holders' claims on underlying assets? Legal documentation addresses these scenarios but remains untested in many jurisdictions.

Regulatory Evolution and Jurisdictional Complexity

Regulatory frameworks continue evolving rapidly. Tokens compliant today may face new restrictions tomorrow as authorities refine approaches. The U.S. SEC has shown willingness to challenge tokenized offerings years after issuance, creating uncertainty for platforms and investors.

Cross-border complexity multiplies risks: a token issued in the Cayman Islands, backed by U.S. Treasuries, trading on Ethereum, and marketed to EU and Asian investors faces overlapping and potentially conflicting regulations from multiple jurisdictions. Legal structures attempt to navigate this complexity but add operational costs and uncertainty.

The Path to 2030: Infrastructure Transformation

Scaling Infrastructure and Interoperability

Layer 2 solutions on Ethereum—Arbitrum, Optimism, Polygon—already provide substantial cost reductions and throughput increases versus Ethereum mainnet. As these networks mature and adoption grows, transaction costs will become negligible while throughput supports millions of daily transactions.

Cross-chain interoperability protocols like Chainlink's CCIP, Wormhole, and LayerZero enable seamless asset movement between blockchains. This allows issuers to deploy on optimal networks for their use cases while maintaining global accessibility—BUIDL's multi-chain strategy exemplifies this approach.

Integration with Central Bank Digital Currencies

As major economies launch CBDCs, the payment leg of tokenized asset transactions will settle instantly on-chain. Currently, purchasing tokenized Treasuries requires off-chain bank transfers taking 1-3 days; with CBDCs, payment and asset transfer occur atomically in seconds.

This eliminates settlement risk, reduces capital tied up in clearing operations, and enables sophisticated atomic swaps where complex multi-asset transactions either complete entirely or revert automatically if any component fails.

Regulatory Maturation and Harmonization

As frameworks like MiCA demonstrate success, expect global convergence toward similar principles: clear asset categorization, investor protections through disclosure and reserve requirements, licensing for service providers, and mechanisms enabling innovation through regulatory sandboxes.

The G20 and Financial Stability Board increasingly coordinate on digital asset regulation, potentially leading to international standards reducing current jurisdictional fragmentation. This regulatory clarity will unlock institutional capital currently sidelined by legal uncertainty.

Key Terms: RWA Infrastructure Glossary

SPV (Special Purpose Vehicle)

Legal entity created to isolate financial risk by holding specific assets. In RWA tokenization, SPVs hold underlying assets (Treasuries, real estate) separate from issuer's balance sheet, protecting token holders if issuer faces bankruptcy.

Qualified Purchaser vs Accredited Investor

Accredited Investor: Individual with $200K+ annual income or $1M+ net worth (excluding primary residence). Qualified Purchaser: Higher threshold requiring $5M+ in investments. Many institutional tokenized funds require qualified purchaser status.

ATS (Alternative Trading System)

SEC-regulated trading venue operating outside traditional stock exchanges. Platforms like Securitize Markets operate as ATSs, enabling compliant secondary trading of tokenized securities among qualified investors.

Transfer Agent

Entity maintaining official records of security ownership and handling transfers. Digital transfer agents like Securitize perform this function for tokenized securities, ensuring compliance with transfer restrictions and investor qualifications.

Rebase vs Dividend Distribution

Rebase: Token quantity in wallet automatically increases as yield accrues (e.g., USDY). Dividend: New tokens minted and deposited separately (e.g., BUIDL). Both deliver yield but with different tax and user experience implications.

Proof of Reserves

Cryptographic verification that tokens are backed 1:1 by claimed assets. Protocols use attestations from auditors, blockchain-based tracking of custody accounts, or oracle networks to provide ongoing verification that backing exists.

Qualified Custody

Custody meeting regulatory standards for safeguarding client assets, typically requiring segregation, insurance, and regular audits. Qualified custodians for RWAs include Bank of New York Mellon, Fireblocks, and Anchorage Digital.

Waterfall Structure

Prioritized distribution system where senior tranches receive payments before junior tranches. In tokenized private credit, loan repayments flow first to senior token holders, then to mezzanine, then equity—protecting senior positions while compensating junior for higher risk.

Conclusion: The Institutional Finance Layer of the Future

Tokenized real-world assets represent not revolution but infrastructure evolution—the steady, unglamorous work of rebuilding financial plumbing with superior technology. This isn't about speculative gains or decentralization ideology; it's about institutional capital demanding more efficient, transparent, and accessible markets.

When BlackRock tokenizes billions in Treasuries, when JPMorgan settles substantial volumes in repo transactions on blockchain, when European governments issue sovereign bonds digitally—these actions signal that tokenization has crossed the chasm from experiment to infrastructure.

The $16 trillion projection for 2030 appears achievable not through wholesale disruption but through gradual adoption: meaningful percentages of debt issuances, growing shares of private market transactions, tokenization embedded in most major asset managers' platforms. Not overnight transformation but steady institutionalization creating vastly superior efficiency, transparency, and accessibility.

For sophisticated investors, the opportunity lies not in speculation on which tokens will "moon" but in understanding how tokenization improves capital markets structurally. Fractional Treasury access for global investors, instant settlement eliminating counterparty risk, programmable compliance reducing operational costs—these benefits compound over decades to create fundamental competitive advantages for platforms embracing tokenization.

The global yield market is being rebuilt on-chain, brick by blockchain brick. Those who understand this infrastructure transition early will capture disproportionate benefits as substantial portions of traditional assets gradually migrate to superior technology rails.

Navigate the Tokenized Asset Landscape with Expert Analysis

Explore comprehensive guides on tokenized Treasuries, private credit platforms, regulatory frameworks, and institutional-grade portfolio construction for the on-chain finance era.

Tokenized Treasuries Guide

BUIDL, USDY, BENJI: compare yields, liquidity, minimums, and regulatory structures

Private Credit Platforms

Maple, Centrifuge, Goldfinch: underwriting standards, waterfall structures, and credit risk

Platform Deep Dives

Securitize, Ondo, Backed: infrastructure analysis and compliance frameworks

RWA Due Diligence

Smart contract audits, custody verification, legal structure evaluation