Charm Industrial

Durable carbon removal supplier using biomass-to-bio-oil conversion and long-term storage—built for enterprise offtake, not a marketplace, with contract/MRV specifics driving real buyer risk.

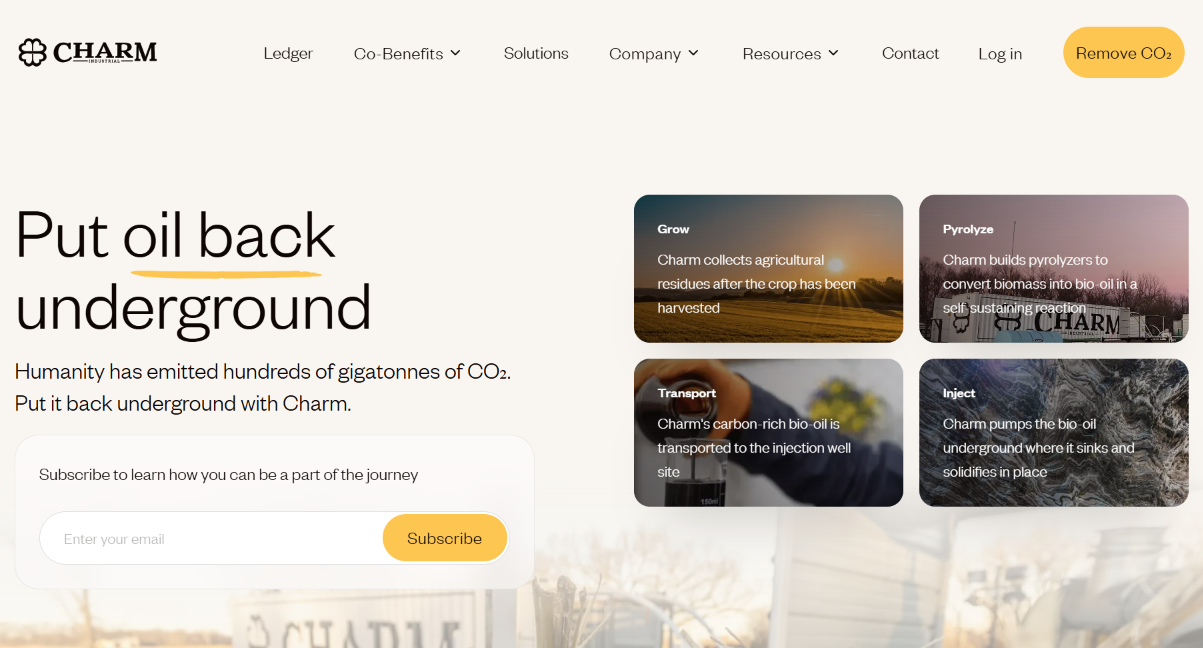

Platform Overview

Charm Industrial delivers durable carbon removal by converting biomass residues into a stable bio-oil and storing it in long-lived containment (i.e., designed to prevent near-term re-release), selling removal via enterprise offtake/forward contracts with MRV and registry/verification as the binding layer.

It converts biomass residues into bio-oil and stores it in long-lived containment, then sells the associated carbon removal to enterprises seeking high-integrity climate claims. Unlike marketplaces, the core diligence burden sits in (1) MRV definitions and auditing, (2) storage durability assumptions and monitoring obligations, and (3) the contract remedies if something goes wrong. Public website Terms of Use reflect a service-layer posture (AS IS, arbitration, class waiver, and a low liability cap). For enterprise buyers, this reinforces the core takeaway: the ‘product’ is the executed offtake/MSA + MRV boundary + evidence deliverables—not the marketing page or the web portal. For allocators and procurement teams, the practical question is not whether the story is compelling—it’s whether the contract contains enforceable, scenario-based protections (delivery failure, verification failure, methodology change, reputational controversy) and whether the buyer has the operational maturity to monitor and document claims over time.

Platform Model

Supplier / Project Developer (CDR)

Primary Function

Durable Carbon Removal Delivery

Target Users

Enterprise Buyers & Aggregators

Workflow Lens

Offtake + MRV + Retirement/Transfer

🔄How It Works (Economic & Claim Mechanics)

- Contracting: Often structured as multi-year offtake/forward agreements; delivery timing and acceptance criteria matter as much as headline ‘tons.’

- MRV: The credibility of the claim depends on measurement boundaries (feedstock sourcing, conversion factors, storage monitoring) and third-party verification scope.

- Claim Integrity: Buyers need an auditable chain of evidence (registry entries/attestations, retirement proofs, and documentation controls) for reporting and marketing claims.

- Remedies: The buyer’s true protection is the remedies schedule—make-good tons, refunds, termination rights, and dispute resolution mechanics.

- Service-Layer Terms: Public Terms of Use apply binding arbitration (AAA) and a class-action waiver, and cap liability at the greater of $100 or fees paid in the prior 6 months—so enterprise protections must be explicitly defined in the executed purchase documents.

Key Gaps & Non-Disclosures

- Dossiers do not clearly provide a universal post-issuance dispute/remediation policy that applies platform-wide.

- Public materials rarely specify ‘who decides’ replacement vs. invalidation vs. refund—this must be defined contractually.

- If a registry/verifier changes standards, the buyer needs clarity on responsibility for compliance upgrades and cost allocation.

- Public Terms reserve the right to modify/discontinue online services and disclaim reliability; enterprises relying on portals/APIs should contract for evidence deliverables and service expectations (or offline alternatives).

Investment Structures

Charm does not offer a securities-style investment product. Buyers are purchasing durable carbon removal for retirement/claims and reporting—typically treated as a procurement/operating expense rather than an investable, tradable asset.

- No secondary market structure is implied; the objective is retirement/claiming, not resale.

- Economic exposure is driven by contract performance + MRV validity, not capital appreciation.

- Any transferability/ownership mechanics (if present) are contract-defined, not exchange-defined.

Risk Structure

AIAltStreet Risk Inferences

- Treat the ‘product’ as the contract + MRV boundary, not the ton number alone.

- If dispute/invalidity procedures are not explicit, assume the buyer will carry reputational and compliance risk by default.

- Forward purchases magnify counterparty and methodology-change risk; require escalation paths and make-good language.

- Public website Terms include arbitration/class waiver and low liability caps; do not assume consumer-style web terms provide ton-level remedies—anchor remedies in executed purchase documents.

Counterparty & Performance Risk

As a supplier, Charm’s buyer risk is dominated by operational execution: feedstock sourcing, process uptime, storage operations, and delivery schedules defined in the offtake.

MRV Boundary Risk

If MRV definitions (system boundaries, sampling/monitoring, storage durability assumptions) are weak or change over time, the buyer’s claim integrity can degrade even if delivery occurs.

Dispute & Remedy Ambiguity

The dossier does not surface a universal, public remediation protocol for post-issuance disputes. Buyers should assume remedies are bespoke and must be negotiated into the agreement.

Public Terms: Arbitration + Low Liability Cap

Charm’s public website Terms of Use include binding arbitration (AAA) with a class-action waiver and limit liability to the greater of $100 or fees paid in the prior six months. For high-value programs, buyers should rely on negotiated MSAs/offtakes that supersede these service-layer constraints and define ton-level remedies.

Public Terms: ‘AS IS’ + Service Discontinuation Rights

Public Terms disclaim warranties (AS IS/AS AVAILABLE) and allow Charm to modify or discontinue online services without liability. If evidence portals/APIs are part of buyer workflow, enterprises should contract for deliverables, retention, and fallback evidence paths.

Public Terms: Broad Indemnity + Short Claim Window

Public Terms include broad user indemnity obligations and a one-year limitations period for claims. Enterprises should ensure executed purchase documents include appropriate survival periods, mutual indemnities, and a claims window aligned to verification and disclosure timelines.

Delivery Shortfall / Timing Risk

Risk Summary

Forward or multi-year agreements can miss volume or schedule targets due to operational constraints.

Why It Matters

Climate programs and public claims are calendar-driven; missed delivery can create reporting gaps or force buyers into last-minute replacement purchasing.

Mitigation / Verification

Insist on milestone-based delivery schedules, liquidated damages or refund triggers, and explicit substitution rights (pre-approved alternative tons).

MRV / Methodology Change Risk

Risk Summary

Verification standards can tighten, registries can revise methodologies, and auditors can change interpretation of boundaries and uncertainty.

Why It Matters

A buyer can end up with ‘delivered’ tons that are later contested or excluded from certain reporting regimes.

Mitigation / Verification

Require change-control clauses: who pays for upgrades, who owns re-verification cost, and what happens to previously delivered tons if standards change.

Reversal / Durability Controversy Risk

Risk Summary

Even durable pathways face uncertainty (storage integrity assumptions, monitoring horizon, governance of ‘reversal’ determinations).

Why It Matters

If a reversal or controversy occurs, buyers may face reputational risk, and the climate value of prior claims can be challenged.

Mitigation / Verification

Obtain a scenario-based remedy schedule: definitions, investigation procedures, independent arbiter, and make-good/refund mechanics.

Claims & Marketing Compliance Risk

Risk Summary

Buyers can overstate what a ‘ton’ means (durability horizon, additionality framing, or scope of retirement evidence).

Why It Matters

Greenwashing scrutiny can turn an otherwise legitimate procurement into a legal/reputational problem.

Mitigation / Verification

Align claim language to registry/attestation proofs; keep an internal claims register and require Charm-provided claim-use guidance in writing.

Dispute Resolution & Remedies Mismatch Risk

Risk Summary

Public service-layer Terms may not align with enterprise expectations for remedies, discovery, or dispute venue.

Why It Matters

If the executed purchase documents do not clearly supersede web Terms, buyers may face arbitration/class waiver constraints and low caps when seeking relief.

Mitigation / Verification

In the executed agreement, explicitly define: governing law/venue, whether arbitration applies (and on what rules), class waiver applicability, liability caps, survival periods, and ton-level remedies with a scenario-based schedule.

⚠️Walk-Away Signals

- Refusal to provide a written, scenario-based remediation protocol for disputes, invalidation, or alleged reversals.

- Inability to explain MRV boundaries in plain language (what is measured, what is modeled, what is assumed).

- No clarity on whether the buyer receives make-good tons, refunds, or nothing in key failure modes.

- Unwillingness to provide audit/verification artifacts or permit reasonable buyer audit rights for enterprise programs.

- High-value procurement governed only by public website Terms (or unclear hierarchy-of-terms), leaving buyers exposed to low liability caps and arbitration/class waiver constraints without ton-level remedies.

- No clear commitment on evidence deliverables/retention if services/portals change or are discontinued.

Clarification & Verification Items

- Define dispute triggers: who can challenge a ton, within what window, and what evidence standard applies?

- Who decides replacement vs. invalidation vs. refund, and is there an independent arbiter?

- What monitoring obligations exist post-delivery, for how long, and who bears ongoing monitoring cost?

- If a registry/verifier de-lists a methodology, how are previously delivered tons treated and what remedies apply?

- Confirm hierarchy-of-terms: do executed offtake/MSA terms supersede website Terms of Use for purchasers and for disputes relating to delivered tons?

- Confirm dispute forum: arbitration vs court, AAA rules applicability, venue, and whether class waiver applies to enterprise buyers.

- Confirm limitations period for claims in the executed agreement (do not rely on the 1-year web Terms default for long-lived programs).

Regulatory & Legal Posture

Security Status

Not a Security

Charm’s core activity is supplying a climate commodity/service (durable carbon removal) for retirement and claims workflows, not pooling capital for profit distribution. Economic value is tied to delivery + verification, not investment returns.

Disclosure Quality

Moderate: technical pathway is discussed publicly, but buyer protections and remedies typically live in negotiated contracts rather than standardized public terms.

Custody Model

No Custody (Supplier delivery / registry retirement mechanics are contract-defined)

Public website Terms of Use reflect a service-layer legal posture (AS IS/no warranties, binding arbitration under AAA rules with class-action waiver, liability cap of greater of $100 or fees paid in prior 6 months, and a one-year limitations period). For enterprise procurement, the controlling legal instrument should be the executed MSA/offtake/purchase agreement—buyers should confirm the agreement’s governing law, dispute resolution venue/arbitration, limitations of liability, indemnities, survival periods, and ton-level remedies supersede the web Terms where applicable.

Tax Treatment

Reporting

Not Applicable

Typically no investment tax forms (e.g., 1099/K-1) because the transaction is a procurement/expense workflow rather than an investment product.

Income Character

Procurement / Operating Expense

Enterprises generally treat carbon removal purchases used for retirement/claims as an operating or procurement expense aligned to sustainability commitments rather than investment income.

Tax treatment varies by jurisdiction, entity structure, accounting policy, and how credits are used (internal retirement vs. pass-through). Consult qualified tax counsel/advisors.

Investor Fit

Institutional / Enterprise Buyers

Best for enterprise climate procurement teams that can manage contract negotiation, evidence retention, and claims governance over multi-year programs—and that can ensure ton-level remedies are defined in executed agreements.

ESG / Climate SaaS Providers

Potential fit if an intermediary/aggregator wraps Charm supply into an embedded workflow—but most SaaS use cases require standardized pricing, terms, and claims kits that may not be ‘off-the-shelf.’

Investors Seeking Financial Returns

Not designed for speculative holding or tradable exposure. This is procurement of climate outcomes with contract/MRV risk, not a return-bearing financial instrument.

Key Tradeoffs

Durability vs. Complexity

Higher-integrity, durable pathways can strengthen climate claims, but require deeper MRV diligence and tighter contract remedies than simpler offset purchases.

Forward Cost vs. Execution Risk

Forward purchases may reduce cost and secure supply, but create delivery, counterparty, and methodology-change risk over time.

Supplier Specialization vs. Concentration

Single-pathway specialization can improve auditability, but increases concentration risk relative to diversified procurement portfolios.

Who This Is Not For

investors-seeking-returns

Charm is a carbon removal supplier. There is no intended secondary market or capital appreciation mechanism; economic exposure is contract/MRV performance, not return generation.

retail-offset-buyers

Best fit is enterprise procurement with contract negotiation and documentation controls. Retail users seeking one-click offsets may find the workflow and evidence standards misaligned with consumer checkout expectations.

buyers-without-dd-capacity

Durable CDR requires real diligence: MRV boundary review, claims governance, and explicit remedy negotiation. Teams without these capabilities risk buying ‘tons’ that create compliance and reputational exposure.

AltStreet Perspective

Verdict

Charm is a durable CDR supplier—your risk is the contract, not the story.

Positioning

Strong fit for sophisticated enterprise buyers who can (1) negotiate scenario-based remedies, (2) audit MRV boundaries, and (3) maintain claims documentation discipline. Weak fit for buyers who want standardized, platform-style protections without bespoke contracting—especially where public service-layer terms (arbitration, class waiver, low caps) would govern by default.

"If you can’t get a written remediation protocol and MRV boundary clarity, you don’t have a product—you have reputational risk."

Next Steps

Request a written, scenario-based remediation protocol: delivery failure, verification failure, dispute/invalidity, and alleged reversal events.

Ask for MRV boundary documentation (what is measured vs modeled), uncertainty ranges, and audit artifacts available to buyers.

Confirm registry/verification pathway and change-control: what happens if standards tighten or methodologies are revised.

Negotiate evidence deliverables: retirement/attestation proofs, claim-use guidance, and buyer audit rights suitable for public reporting.

In the executed agreement, confirm dispute resolution (arbitration vs court), venue, class-waiver applicability, limitations period for claims, and liability caps—do not rely on the public website Terms for high-value programs.

If relying on portals/APIs, contract for evidence retention, exportability, and a fallback evidence delivery path if online services change or are discontinued.

Related Resources

Explore Asset Class

Carbon & ClimateFrameworks

🔍Review Evidence

Scrape Date

2025-12-24

Methodology

Limited Dossier Scrape + Public Source Triangulation + Website Terms Review

Scope

Dossier (limited fields) + external validation sources + public Terms of Use

Key Findings

- •Operates as a durable carbon removal supplier (not a trading venue).

- •Buyer risk concentrates in MRV boundaries, delivery milestones, and contractual remedies.

- •Public website Terms of Use include binding arbitration (AAA) and a class-action waiver.

- •Public Terms disclaim warranties (AS IS/AS AVAILABLE) and reserve the right to modify/discontinue services.

- •Public Terms cap liability at the greater of $100 or fees paid in the prior 6 months and include a one-year limitations period for claims—reinforcing the need for negotiated enterprise offtake/MSA protections.

Primary Source Pages

- https://charmindustrial.com/

- https://charmindustrial.com/terms-of-use

- https://charmindustrial.com/privacy-policy

Comparable Platforms

- Patch

Patch optimizes procurement/retirement workflows; Charm is a supply-side removal producer with pathway-specific MRV.

Frequently Asked Questions

Is Charm Industrial an investment platform or a procurement supplier?

Charm is best understood as a carbon removal supplier selling durable removal under enterprise procurement contracts (often multi-year). Buyers are purchasing climate outcomes and evidence for claims/retirement, not a return-bearing investment product.

What should buyers demand before making public claims?

A claims kit: retirement/attestation proofs, MRV boundary summary (measured vs modeled), audit/verification artifacts available to buyers, and written claim-use guidance aligned to the executed contract and any registry/verifier requirements.

What happens if a delivered ton is disputed post-issuance?

Do not assume a standard platform-wide policy. Buyers should require a scenario-based remediation protocol in writing that defines dispute triggers, decision authority (including any independent arbiter), and remedies (make-good tons, refunds, or other corrective actions).

Do Charm’s public Terms of Use affect enterprise buyers?

They can. Public Terms for the online service layer include binding arbitration (AAA) with a class-action waiver, broad ‘AS IS’ warranty disclaimers, and a low liability cap (greater of $100 or fees paid in the prior 6 months), plus a one-year limitations period. Enterprise buyers should ensure the executed offtake/MSA explicitly supersedes these service-layer terms where appropriate and defines ton-level remedies and dispute mechanics.

What is the single biggest diligence risk with durable CDR?

Ambiguity: unclear MRV boundaries and unclear remedies. If you can’t clearly explain what was measured, what was assumed, and what happens in failure modes, the procurement can create reputational and compliance risk even if delivery occurs.