FarmTogether

Premium fractional farmland platform offering accredited investors access to high-value permanent crops and row crop farms through multiple investment structures including crowdfunding ($15K minimum), sustainable fund ($50K minimum), and bespoke offerings ($3M+), with emphasis on California/Pacific Northwest specialty agriculture.

Platform Overview

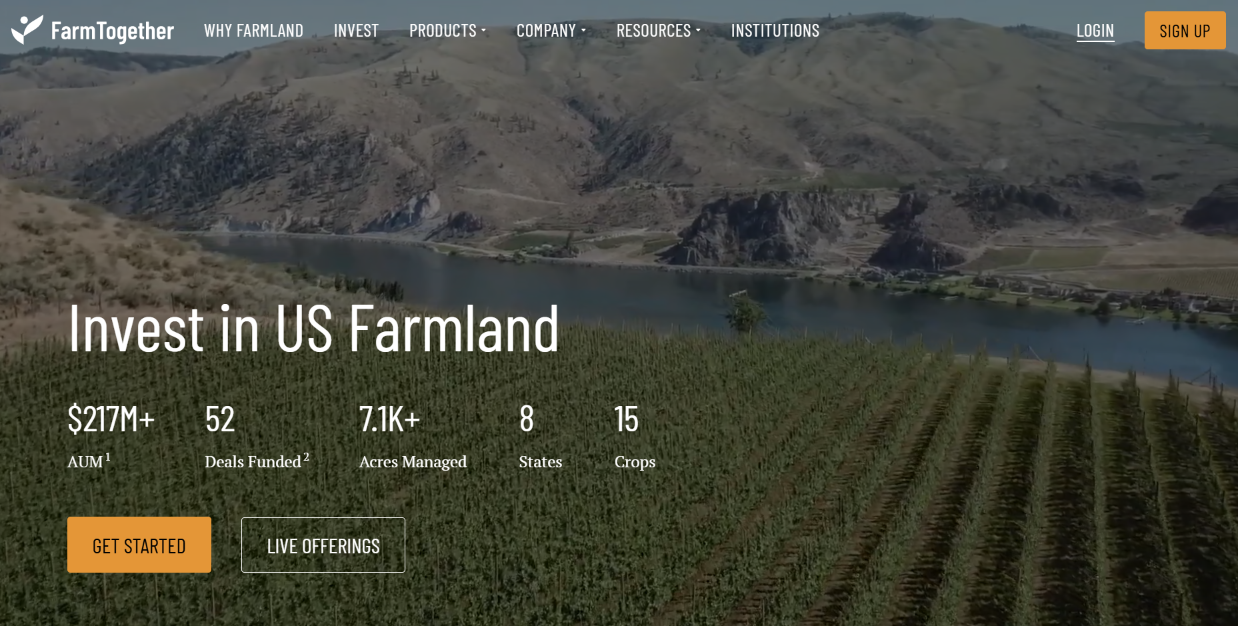

Multi-product fractional farmland platform: FarmTogether sources premium U.S. farmland (heavy California/Pacific Northwest permanent crop emphasis), conducts institutional due diligence via proprietary 105-point checklist, and offers accredited investors five distinct investment structures—(1) Crowdfunded single-farm offerings ($15K minimum, 8-12 year hold), (2) Sustainable Farmland Fund ($50K minimum, 2-year lockup then quarterly liquidity), (3) Tenancy-in-Common 1031-eligible offerings ($500K minimum), (4) Bespoke sole ownership ($3M minimum), (5) Separately Managed Accounts ($20M minimum). Platform manages $217M+ AUM across 52 funded deals spanning 7,100+ acres, 15 crop types, and 8 states, with investment team having deployed $2.1B collective capital historically.

farmland through five distinct product structures spanning $15K-$20M+ minimums. Platform manages $217M+ AUM across 52 funded deals covering 7,100+ acres in 8 states with emphasis on high-value permanent crops (almonds, pistachios, wine grapes, apples, hazelnuts) predominantly in California and Pacific Northwest. Investment team with $2.1B collective capital deployment experience conducts rigorous due diligence via proprietary 105-point checklist, accepting <1% of pipeline deals for platform inclusion. Core offering structure: (1) Crowdfunded single-farm fractional ownership ($15K minimum, 8-12 year hold, 6-13% target net IRR, passive LLC interests), (2) Sustainable Farmland Fund ($50K Class A/$5M Class I minimum, 2-year lockup then quarterly liquidity, 8-10% target net IRR, diversified evergreen fund), (3) Tenancy-in-Common 1031-eligible offerings ($500K minimum, 1031 exchange qualified), (4) Bespoke sole ownership ($3M minimum, fully customizable), (5) Separately Managed Accounts ($20M minimum, multi-asset portfolios). Platform provides professional farm management oversight, quarterly investor reporting, and comprehensive legal/tax documentation (K-1s for crowdfunding/TIC, 1099s for fund).

Product Range

5 structures: Crowdfunding ($15K), Fund ($50K), TIC ($500K), Bespoke ($3M), SMA ($20M)

Platform Scale

$217M+ AUM | 52 deals funded | 7,100+ acres managed | 15 crop types

Target Returns

Crowdfunding/TIC: 6-13% net IRR, 2-9% cash yield | Fund: 8-10% net IRR, 4-6% annual distribution

Holding Periods

Crowdfunding/TIC: 8-12 years | Fund: 2-year lockup + quarterly liquidity | Bespoke/SMA: Custom

Geographic Focus

8 states (heavy California/Pacific Northwest) | 15 crop types | Permanent crop emphasis

Crop Specialization

Almonds, pistachios, wine grapes, apples, pears, hazelnuts, walnuts + row crops

Investor Requirements

Accredited status required all products | U.S. person status required for Fund, optional for others

Liquidity Profile

Crowdfunding: Illiquid 8-12 years | Fund: 2-year lockup + quarterly windows (subject to approval)

Tax Treatment

Crowdfunding/TIC: K-1s, depreciation, 1031 eligible (TIC only) | Fund: 1099, REIT-like treatment

Due Diligence

105-point checklist | <1% of pipeline funded | $2.1B team capital deployment experience

🔄Strategic Positioning & Competitive Differentiation

- FarmTogether's multi-product structure ($15K → $20M) creates natural investor progression pathway—retail accredited start with crowdfunding, scale to fund for diversification, access TICs for 1031 exchanges, upgrade to bespoke for control, ultimately reach SMA tier for institutional mandates. Platform captures wallet share across investor lifecycle vs. single-product competitors.

- Premium permanent crop focus (California almonds, pistachios, wine grapes representing majority of portfolio) delivers 2-5x revenue per acre vs. Midwest row crops but introduces concentrated risk exposure—California water policy, regional climate patterns, and specialty crop markets drive correlated outcomes across multiple holdings. Strategy suits investors bullish on permanent crop premiums and California agriculture despite concentration risks.

- Sustainable Fund's 2-year lockup + quarterly liquidity structure occupies unique middle ground between illiquid farmland (8-12 year holds) and public REITs (daily liquidity but stock volatility). If fund successfully provides consistent quarterly redemptions, could attract significant capital from investors accepting modest illiquidity for stable returns and tax efficiency vs. REIT alternatives (FPI, LAND show 28-48% volatility vs. farmland's 3-7%).

- Investment team's collective $2.1B capital deployment and <1% deal acceptance rate positions platform as premium tier vs. competitors—implies rigorous underwriting and selective property acquisition. However, high rejection rate creates potential adverse selection if competing farmland platforms (AcreTrader, Farmland LP) source superior deals that FarmTogether passes on due to overly conservative criteria or capacity constraints.

Key Gaps & Non-Disclosures

- Fee opacity across product structures prevents efficient cost comparison—'dependent on product offering' disclosure requires investors to engage sales process and review multiple PPMs to understand total expense ratios. Standardized fee schedules (even as ranges) would enable informed product selection and competitor comparison without extensive due diligence burden.

- Sustainable Fund redemption mechanics lack operational transparency—quarterly liquidity windows subject to board approval and capacity constraints, but fund doesn't disclose historical redemption request volumes, fulfillment rates, queue management procedures, or stress-test scenarios. Critical information for assessing practical liquidity vs. theoretical rights.

- Exit track record comprehensiveness limited—while several successful exits disclosed, missing systematic reporting of: realized returns vs. initial projections across all exits, average holding periods vs. target ranges, exit execution timelines from decision to close, sales method effectiveness (auction vs. negotiated), and investor approval votes. Fuller disclosure would validate underwriting accuracy and exit execution capabilities.

- Platform co-investment and alignment disclosure insufficient—references to '$2.1B collective capital deployed' by team members unclear whether platform principals co-invest in offerings alongside investors, and if so, on identical terms or with preferential economics. Clear alignment disclosures and conflict management policies would strengthen investor confidence in recommendation objectivity.

Investment Structures

Crowdfunded Farmland Offerings (Single-Farm Fractional Ownership)

Fractional LLC membership interests in individual farms sourced and vetted by FarmTogether. Minimum $15,000 per farm with typical 8-12 year holding periods and 6-13% target net IRR plus 2-9% annual cash yields from crop income. Investors select specific farms across permanent crops (almonds, pistachios, wine grapes, apples) and row crops, receiving quarterly distributions from lease payments and participating in land appreciation upon eventual sale. K-1 tax reporting enables depreciation deductions and potential 1031 exchange eligibility (note: FarmTogether states crowdfunding offerings NOT 1031 eligible, only TIC structure qualifies). Suitable for accredited investors wanting direct farm selection and accepting full illiquidity for 8-12+ years. Build diversified portfolio requires $75K-$150K across 5-10 farms to mitigate single-asset concentration risk.

Sustainable Farmland Fund (Diversified Evergreen Fund)

Closed-end evergreen fund providing diversified exposure to portfolio of 10-20+ sustainably managed farms through single allocation. Class A shares $50,000 minimum for individual investors; Class I shares $5,000,000 minimum for institutional investors. Target 8-10% net IRR with 4-6% annual distributions. Unique 2-year initial lockup period followed by quarterly redemption windows subject to fund capacity and board approval—dramatically improved liquidity vs. traditional farmland but not guaranteed (redemptions may be delayed, partially fulfilled, or denied if fund lacks available cash). Fund structure eliminates farm selection burden and provides instant diversification, but investors sacrifice direct property control and depreciation benefits (1099 tax reporting vs. K-1). Requires U.S. person status. Best for passive investors prioritizing diversification and improved liquidity over specific farm selection and maximum tax benefits.

Tenancy-in-Common Offerings (1031 Exchange Eligible)

Fractional TIC interests in farmland properties structured specifically to qualify for Section 1031 like-kind exchanges, enabling tax-deferred transitions from appreciated real estate into farmland. Minimum $500,000 investment with 8-12 year typical holding periods and 6-13% target net IRR plus 2-9% cash yields. TIC structure provides each investor with direct undivided interest in underlying property (vs. LLC membership interest), satisfying 1031 replacement property requirements. Critical for investors selling commercial properties, residential rentals, or other real estate seeking to defer capital gains taxes while transitioning into farmland. Requires qualified intermediary coordination and strict 45-day identification / 180-day closing deadlines. K-1 tax reporting, depreciation benefits, and eventual 1031 out-exchange eligibility. Higher minimum ($500K vs. $15K crowdfunding) reflects administrative complexity and 1031 compliance requirements.

Bespoke Sole Ownership Offerings (Customized Acquisitions)

Fully customized farmland acquisitions where FarmTogether sources and underwrites properties meeting investor-specified criteria. Minimum $3,000,000 investment with complete flexibility on property type, geography, crop selection, operator arrangements, capital structure, leverage utilization, and exit strategy. Investor obtains 100% ownership (sole title) vs. fractional interests, maintaining full control over farm management decisions, capital improvements, and sale timing. FarmTogether provides sourcing, due diligence, acquisition coordination, and optional ongoing advisory services with custom fee arrangements aligned to deal structure. Suitable for high-net-worth individuals, family offices, or institutions seeking specific farmland exposure (particular crop types, sustainable certifications, water rights characteristics, geographic preferences) with resources for $3M+ single-farm commitments. Requires substantial agricultural sophistication or willingness to rely heavily on FarmTogether advisory guidance.

Separately Managed Accounts (Multi-Asset Portfolios)

Institutional-grade multi-farm portfolios with fully customizable investment mandates managed by FarmTogether on behalf of single client. Minimum $20,000,000 commitment with flexible structure accommodating client preferences on asset allocation (permanent crops vs. row crops vs. mixed), geographic distribution, sustainability criteria, leverage policy, risk-return profile, and liquidity management. FarmTogether handles all aspects of portfolio construction, farm acquisition, ongoing management, reporting, and eventual disposition under Investment Management Agreement defining scope, fees, and performance benchmarks. Custom fee arrangements typically combining asset-based management fees with performance-based incentives. Suitable for institutional investors (endowments, foundations, pension funds), ultra-high-net-worth families, and multi-family offices requiring dedicated farmland allocations with professional discretionary management. Provides portfolio-level diversification, professional oversight, and customization unavailable in crowdfunding or fund structures.

Risk Structure

Multi-Product Structure with Varying Risk/Liquidity Profiles

Five distinct product offerings create complexity in optimal structure selection—crowdfunding provides direct farm selection but full illiquidity; fund offers diversification and quarterly liquidity (subject to restrictions) but sacrifices farm choice; TIC enables 1031 exchanges but requires $500K minimum; bespoke provides complete control but demands $3M+ and operational sophistication; SMA offers institutional-grade management but requires $20M scale. Investors must understand trade-offs in fees, taxes, liquidity, control, and diversification across structures. Misalignment between investor objectives and selected product can produce disappointing outcomes despite underlying farmland performance.

Premium Permanent Crop Concentration & Weather Correlation

Platform's emphasis on high-value California/Pacific Northwest permanent crops (almonds, pistachios, wine grapes dominating portfolio) creates concentrated exposure to regional climate patterns, water policy, and specialty crop markets. Single drought, freeze event, or water allocation cut impacts multiple holdings simultaneously—2021-2023 California drought reduced water allocations 20-50% across Central Valley affecting numerous FarmTogether properties. Permanent crops require 5-10 years to establish full production (almonds 7-10 years, pistachios 8-12 years, wine grapes 4-6 years) and suffer multi-year recovery from severe weather damage (tree death requires replanting and re-establishment). While premium crops generate superior revenue per acre ($2,000-$8,000 vs. $200-$600 for row crops), concentration risk and extended establishment periods create meaningful downside scenarios insufficiently diversified across portfolio.

Sustainable Fund Liquidity Mechanics & Redemption Uncertainty

Fund's quarterly redemption windows post-lockup provide improved liquidity vs. traditional farmland, but practical redemption experience uncertain given limited track record and multiple restriction mechanisms. Redemptions subject to: (1) board approval (discretionary), (2) fund cash availability (may require asset sales to fulfill large redemption requests), (3) capacity limits (aggregate quarterly redemptions capped at percentage of NAV), (4) potential gates or suspensions during market stress (not clearly defined in public materials). Marketing emphasizes liquidity benefit vs. crowdfunding's 8-12 year illiquidity, but investors should not assume guaranteed quarterly redemptions—practical fulfillment rates, queue management during high-volume periods, and board approval consistency require validation through fund operational history not yet available.

Fee Opacity and Total Cost of Ownership Variability

Fee structures vary significantly across products but not comprehensively disclosed on public website—listed as 'dependent on product offering' without standardized ranges or examples. Crowdfunding offerings may include acquisition fees (1-3% of property value), annual management fees (1-2%), profit participation (5-15% above hurdle rates), and operating expense allocations (property taxes, insurance, maintenance). Fund includes management fees and potential performance incentives. TIC, bespoke, and SMA structures negotiate custom fee arrangements aligned with deal specifics. Without standardized disclosure, investors must review individual PPMs and engage sales conversations to understand total cost of ownership, preventing efficient comparison shopping or budget forecasting. Hidden expenses (crop insurance premiums 5-10% of crop value, water costs, equipment repairs) can materially reduce net returns below gross projections if not properly modeled.

Operator Dependency in Specialized Permanent Crop Management

Premium permanent crop operations (almonds, pistachios, wine grapes) require substantially greater operator expertise than Midwest row crops—irrigation timing and water budget optimization, integrated pest management for tree/vine crops, harvest logistics for delicate fruits requiring rapid processing, premium marketing through specialized channels (wine distribution, export markets for nuts). Operator mistakes devastate permanent crop operations more severely than row crop errors—missed irrigation timing stresses trees reducing yields for multiple years, pest/disease outbreaks spread through orchards destroying crops and requiring years of recovery, late harvest or poor handling destroys premium pricing opportunities. While FarmTogether vets operators through 105-point checklist, permanent crop specialization means operator failure modes more severe and recovery periods longer than diversified row crop portfolios. Investors depend entirely on operator quality with limited ability to assess management competence independently.

California Water Scarcity & Allocation Cuts

Risk Summary

FarmTogether's portfolio concentration in California permanent crops creates acute vulnerability to water allocation cuts—2021-2023 drought reduced Central Valley allocations 20-50%, 2024 WOTUS expansion increased regulatory constraints, and long-term groundwater sustainability regulations (SGMA) forcing permanent crop removal on marginal lands. California water policy single greatest risk to platform portfolio.

Why It Matters

Permanent crops (almonds, pistachios, wine grapes) require consistent irrigation throughout growing season—water stress during critical periods (bloom, nut fill, veraison) permanently reduces yields and quality. Unlike annual row crops that can fallow during drought years, tree/vine crops die without adequate water, requiring complete replanting ($20,000-$40,000 per acre) and 5-10 year re-establishment periods. California produces 80% of global almonds and 99% of U.S. pistachios—drought or regulatory restrictions create supply shocks driving commodity volatility. Water rights transferability critical due diligence item—senior water rights maintain allocations during scarcity while junior rights cut first. FarmTogether's California-heavy portfolio faces structural long-term water challenges as climate change reduces Sierra Nevada snowpack (primary water source) and competing urban/environmental demands constrain agricultural allocations.

Mitigation / Verification

Review water rights documentation in individual PPMs—prioritize farms with senior appropriative rights or confirmed groundwater access under sustainable management plans. Verify irrigation infrastructure (drip systems, soil moisture sensors, water storage) optimizing efficiency. Diversify geographically beyond California—allocate capital to Pacific Northwest (Washington/Oregon with Columbia River water), Midwest row crops (rain-fed), or Southern farms (different water basins). Monitor SGMA implementation and groundwater sustainability plans for specific farm locations—some basins facing mandatory permanent crop removal to achieve sustainability goals. Consider water-intensive permanent crops (almonds, pistachios) higher risk than lower-water options (wine grapes on dry farming, row crops).

Permanent Crop Establishment Periods & Cash Flow Delay

Risk Summary

New permanent crop plantings require 5-10 years to reach full commercial production—almonds 7-10 years, pistachios 8-12 years, wine grapes 4-6 years—creating extended cash flow deficits (negative operating cash during establishment) and delaying return realization. Development farmland purchases offer lower entry valuations but multi-year negative carry before positive returns.

Why It Matters

Development farmland investments (bare land or young plantings) trade at 30-50% discounts to mature producing orchards but require patient capital through long establishment periods. Annual costs during establishment (irrigation, pest control, fertilization, weed management, labor) total $3,000-$8,000 per acre annually while generating zero revenue—cumulative cash investment of $30,000-$80,000 per acre before first commercial harvest. Investors experience negative cash flow for 5-10 years, increasing capital at risk and extending breakeven horizons. Unexpected establishment delays (replanting after frost damage, slower-than-projected growth, pest/disease setbacks) stretch timelines further. Development deals suit experienced investors with substantial liquidity and conviction in permanent crop premiums; inappropriate for investors requiring near-term cash flow or shorter return horizons.

Mitigation / Verification

Understand establishment status and remaining years to full production in PPMs—prioritize mature producing orchards (established 8+ years) for investors needing near-term cash flow vs. development properties for patient capital. Model conservative establishment timelines adding 10-20% buffer to projected years-to-production. Verify establishment funding sources—confirm sufficient capital reserved for annual costs through full establishment period, avoiding need for capital calls or supplemental assessments. Diversify across maturity spectrum—combine mature cash-flowing farms with development opportunities rather than concentrating in single-stage assets.

Commodity Price Volatility in Specialty Crops

Risk Summary

Premium permanent crop prices fluctuate dramatically based on global supply/demand, export markets, and consumer trends—almond prices ranged $1.80-$3.80/pound (2014-2024), wine grape prices $500-$3,000/ton depending on variety and appellation, pistachio prices $2.00-$5.00/pound. Price volatility impacts revenue 40-60% while land values exhibit more stability creating return timing risk.

Why It Matters

Permanent crop income correlates with specialty commodity markets often driven by international trade—almonds export-dependent (70%+ of U.S. production shipped overseas, particularly to China, India, Middle East), wine grapes tied to premium wine market health and consumer preferences, pistachios competing with Iranian and Turkish production in global markets. Trade policy (tariffs, sanctions, trade tensions) create sudden demand shocks—2018-2019 U.S.-China trade war reduced almond exports 20-30%, 2020-2023 California drought reduced pistachio yields while simultaneously constraining water for processing. Unlike row crop futures markets providing hedging tools (corn, soybean futures widely liquid), specialty permanent crops lack efficient hedging mechanisms forcing growers to accept full price exposure. Buyers (processors, distributors, wineries) may refuse purchases or demand price concessions during oversupply periods—2015-2016 almond glut saw buyer negotiations slash prices 30-40% from prior years.

Mitigation / Verification

Prefer cash rent lease structures over crop share for permanent crop farms—fixed rent ($800-$2,000/acre typical for established orchards) insulates investors from commodity price volatility while operator bears crop marketing risk. Diversify across crop types (combine almonds, pistachios, wine grapes, apples) and end markets (domestic fresh, export processing, premium wine) to reduce single-commodity exposure. Review operator marketing strategies in PPMs—sophisticated operators forward-contract portions of harvest, maintain relationships with multiple buyers, and time sales to optimize prices vs. forced fire-sale at harvest. Monitor commodity supply fundamentals—track new permanent crop plantings (8-10 year supply lag before production impacts markets), trade policy developments, and consumer demand trends.

Sustainable Fund Redemption Restrictions & Illiquidity Risk

Risk Summary

Fund's quarterly redemption windows post-lockup subject to multiple restrictions—board approval (discretionary), capacity limits (capped redemptions per quarter), insufficient cash availability (requiring asset sales to fulfill requests). Marketing emphasizes liquidity improvement vs. traditional farmland, but practical redemption experience uncertain and subject to potential delays, partial fulfillment, or denial.

Why It Matters

Investors entering fund attracted by '2-year lockup + quarterly liquidity' marketing may discover redemption requests denied or delayed during critical personal liquidity needs. Board discretion over redemption approval creates information asymmetry—investors don't know approval criteria, historical approval rates, or board's economic incentives (board may prioritize fund stability over individual redemption requests). Capacity limits become binding during stress periods when multiple investors simultaneously request redemptions—queue management unclear (first-come-first-served? Pro-rata fulfillment? Board discretion?). Fund must maintain cash reserves or sell farms to fulfill redemptions—forced farm sales during unfavorable market conditions (low farmland prices, high interest rates, weak buyer demand) could produce realized losses and reduce remaining investors' NAV. Unlike liquid mutual funds with daily redemptions, closed-end farmland fund structure creates inherent redemption friction not fully transparent in marketing materials.

Mitigation / Verification

Request detailed redemption policy documentation—understand board approval criteria, capacity limits (percentage of NAV redeemable per quarter), notice requirements (30-90 days typical), and fulfillment timelines. Review fund cash management policies—what percentage of NAV maintained in cash reserves for redemptions vs. fully invested in farms? How does fund balance redemption capacity vs. return drag from uninvested cash? Understand stress-test scenarios—what happens if redemption requests exceed capacity? Can redemptions be suspended or gated? For how long? Treat fund as 3-5 year minimum investment despite 2-year lockup—quarterly redemption windows provide optionality for favorable exits but shouldn't be relied upon for guaranteed liquidity timing. Maintain separate emergency liquidity reserves rather than depending on fund redemption for urgent capital needs.

Fee Complexity and Total Cost Opacity

Risk Summary

Fee structures vary dramatically across five product offerings without comprehensive public disclosure—listed as 'dependent on product offering' requiring individual PPM review to understand total cost of ownership. Hidden expenses (crop insurance, water costs, equipment maintenance) and variable performance fees create difficulty modeling net returns accurately vs. gross projections.

Why It Matters

Platform economics drive recommendations—sales team incentivized to place investors in higher-fee products (fund, bespoke, SMA) vs. lower-cost crowdfunding even when simpler structure better aligns with investor needs. Without standardized fee schedules, investors cannot efficiently comparison shop across products or against competitors (AcreTrader, Farmland LP, direct ownership) without substantial due diligence burden. Operating expenses vary widely by crop and location—permanent crops carry higher costs ($3,000-$8,000/acre annually) than row crops ($200-$600/acre) but disclosures don't always break down expense components granularly. Water costs in California can swing $100-$500/acre annually based on drought conditions and water market prices—volatility difficult to predict. Total expense ratio (all fees + operating costs) may reach 3-5% annually for high-cost permanent crop operations, substantially reducing net returns below advertised gross IRR targets.

Mitigation / Verification

Request detailed fee breakdowns and total expense ratio projections in PPMs—demand line-item visibility into acquisition fees, annual management fees, profit participation structures, and forecasted operating expenses (property taxes, insurance, water, crop insurance, maintenance). Compare fee structures across multiple FarmTogether products qualifying for your capital level—$50K+ investors can choose crowdfunding or fund, $500K+ can access TIC, requiring explicit cost-benefit analysis. Benchmark against competitors—AcreTrader crowdfunding fees similar but fund structure unique to FarmTogether. Calculate net IRR (after all fees and expenses) vs. gross returns when evaluating opportunities—10% gross IRR becomes 6-7% net after 2-3% annual fee drag. Model sensitivity scenarios for variable costs (water, crop insurance) and performance fees to understand downside vs. base case vs. upside net return distributions.

Clarification & Verification Items

- Review complete product documentation (PPMs, operating agreements, fund documents) for intended investment structure—understand fee arrangements, tax treatment, liquidity provisions, and governance rights before committing capital. Crowdfunding, fund, TIC, bespoke, and SMA structures differ fundamentally in economics and legal rights.

- Verify water rights and irrigation infrastructure for California/Pacific Northwest properties—senior appropriative rights critical for drought resilience, confirmed groundwater access under SGMA sustainability plans essential for long-term viability. Request water rights documentation and allocation history (actual water received vs. paper rights) for recent drought years.

- Understand permanent crop establishment status and remaining years to full production—mature producing orchards (8+ years established) generate near-term cash flow; development plantings require 5-10 years negative carry before commercial production. Match investment timeframe and cash flow needs with property maturity.

- Request Sustainable Fund redemption policy details—board approval criteria, capacity limits, notice periods, historical redemption request fulfillment rates, and stress-test scenarios (what happens if requests exceed capacity?). Don't assume guaranteed quarterly liquidity without understanding practical restrictions.

- Calculate total expense ratios and net returns after all fees and costs—acquisition fees, annual management, profit participation, property taxes, insurance, water, crop insurance, and maintenance collectively reduce net returns 2-4% annually vs. gross IRR projections. Model conservative operating expense scenarios for permanent crops.

- Evaluate product structure trade-offs against personal objectives—crowdfunding provides farm selection control but full illiquidity; fund offers diversification and improved liquidity (subject to restrictions) but sacrifices farm choice and depreciation benefits; TIC enables 1031 exchanges but requires $500K minimum; bespoke/SMA offer customization but demand substantial capital and sophistication. Misalignment between product structure and investor needs produces suboptimal outcomes.

Regulatory & Legal Posture

Security Status

Multiple Securities Structures - Regulation D (Rule 506c) for Crowdfunding/TIC, Investment Company Act Registration for Fund

FarmTogether operates multiple regulatory frameworks across product structures: (1) Crowdfunding and TIC offerings utilize Regulation D (Rule 506c) requiring accredited investor verification and permitting general solicitation—each farm offering constitutes separate securities sale requiring PPM with standard disclosures; (2) Sustainable Farmland Fund operates as registered investment company under Investment Company Act of 1940 providing enhanced investor protections including independent board oversight, audited financials, and regulatory reporting requirements; (3) Bespoke and SMA relationships structured as advisory/consulting arrangements rather than securities offerings—direct property ownership by investor with FarmTogether providing sourcing and management services. Platform complies with state Blue Sky regulations across 8 operating states and FINRA advertising rules. No SEC enforcement actions or regulatory sanctions since founding. Multiple regulatory frameworks across products create complexity requiring investors to understand applicable rules, protections, and requirements for chosen structure.

Disclosure Quality

Good for crowdfunding/TIC offerings with comprehensive PPMs covering soil quality, water rights, operator details, lease terms, and risk factors. Moderate for fund—marketing materials emphasize liquidity benefits but redemption policy details (board approval criteria, capacity limits, historical fulfillment rates) not transparently disclosed. Operating expense projections sometimes show aggregated 'operating costs' without granular line-item breakdown (water, insurance, crop insurance, maintenance separated). Operator financial details occasionally limited due to confidentiality. Overall transparency exceeds most fractional farmland competitors but fee standardization and redemption fulfillment disclosure would improve clarity.

Custody Model

Multi-Structure Custody - Investor-Owned LLCs (Crowdfunding/TIC), Fund Custodian (Sustainable Fund), Direct Title (Bespoke/SMA)

Crowdfunding and TIC offerings held in single-purpose investor-owned LLCs with farmland titles vesting in LLC (not platform entity), reducing platform bankruptcy risk—if FarmTogether fails, farms remain owned by investor LLCs with independent legal existence. Platform serves as LLC manager or general partner handling operations but not controlling underlying asset ownership. Sustainable Fund assets held through fund vehicle with independent fund administrator and custodian—Investment Company Act structure requires asset segregation, independent audit, and custody arrangements protecting investor interests. Bespoke and SMA investors hold direct legal title to farmland (sole ownership) or title through client-owned entities, eliminating platform custody risk entirely. Title insurance (typically $1,000-$5,000 per farm) protects against ownership defects. However, structures lack registered investment company safeguards for crowdfunding/TIC (no SIPC insurance, limited redemption rights, LLC operating agreement governance vs. federal securities protections). Fund structure provides enhanced protections (Investment Company Act registration, independent board, custody rules) not available in crowdfunding model.

Tax Treatment

Reporting

Structure-Dependent: K-1 (Crowdfunding/TIC), 1099 (Fund), Custom (Bespoke/SMA)

Crowdfunding and TIC offerings issue annual Schedule K-1s (Form 1065) from farm LLCs typically by March 15 (extensions to September common) detailing proportionate share of rental income, deductions, credits, and basis adjustments. Fund issues 1099 forms reporting annual distributions and potentially REIT-like income characterization. Bespoke and SMA structures vary based on client ownership entity (sole proprietorship, partnership, corporation, trust) generating corresponding tax forms. Investors report income on personal returns via Schedule E (K-1 rental income), Schedule D (capital gains), Form 4562 (depreciation), and applicable state returns.

Income Character

Structure-Dependent: Passive Rental Income + Capital Gains with Depreciation (Crowdfunding/TIC) vs. Fund Distributions (Potentially REIT-Like) vs. Custom (Bespoke/SMA)

Crowdfunding and TIC structures generate passive rental income from crop leases (ordinary income up to 37% federal) with depreciation deductions on buildings/improvements (depreciable over 7-20 years) sheltering 10-20% of income annually. Land appreciation taxed as long-term capital gains (15-20% + 3.8% NIIT) upon sale, with depreciation recapture (Section 1250) taxed as ordinary income up to 25% on depreciated portion. TIC structure enables Section 1031 like-kind exchanges for tax-deferred farmland transitions. Fund structure may characterize distributions as return of capital, ordinary income, or capital gain distributions depending on fund operations and potentially qualify for REIT-like treatment—tax efficiency varies and requires fund documentation review. Bespoke/SMA tax treatment depends on client entity structure. Overall, crowdfunding/TIC provide superior tax benefits (depreciation, 1031 eligibility, estate planning advantages) vs. fund structure (1099 reporting, limited depreciation pass-through, no 1031 eligibility).

Passive activity loss limitations (IRC Section 469) restrict crowdfunding/TIC farmland loss deductions for investors not materially participating—losses can only offset passive income, not W-2 wages or business income (suspended losses carried forward and released at sale or upon material participation qualification). Real estate professionals (750+ hours annually in real estate, >50% of working time) can deduct losses against ordinary income. High-income investors (doctors, lawyers, tech workers) often cannot use depreciation deductions currently, accumulating suspended losses for decades. Net Investment Income Tax (3.8% NIIT) applies to crop income and capital gains for AGI >$200K (single) / >$250K (married) unless material participation achieved. Fund structure may avoid some passive activity loss limitations depending on characterization but sacrifices direct depreciation benefits vs. crowdfunding/TIC.

Special Considerations

- 1031 Exchange Eligibility—TIC structure specifically enables Section 1031 like-kind exchanges for tax-deferred transitions from appreciated real estate into farmland or farmland-to-farmland exchanges. Crowdfunding LLC interests generally do NOT qualify for 1031 treatment (FarmTogether states crowdfunding offerings not 1031 eligible). Fund units definitely not 1031 eligible (securities vs. direct real property interest). Investors planning 1031 exchanges must use TIC structure ($500K minimum) and coordinate with qualified intermediary within strict 45-day identification / 180-day closing deadlines.

- Depreciation reduces cost basis—when selling farmland in crowdfunding/TIC structures, depreciation claimed increases capital gains by lowering basis. Depreciation recapture (Section 1250) taxes depreciated portion as ordinary income up to 25% vs. 15-20% long-term capital gains rates on appreciation. 1031 exchanges defer recapture by rolling basis into replacement property, but eventual taxable disposition triggers full recapture.

- Multi-state tax filing requirements—owning farms in multiple states creates nexus requiring state income tax returns in each jurisdiction for crowdfunding/TIC investors. Must allocate income/deductions across states using apportionment formulas. State property taxes vary dramatically (California $50-$200/acre, Washington $20-$80/acre, Oregon $15-$60/acre). Agricultural use exemptions (Williamson Act in California, Open Space programs elsewhere) reduce property taxes 40-60% but require 10+ year agricultural use commitments. Fund structure may simplify multi-state complexity with single 1099 vs. multiple state K-1s.

- Estate planning benefits—crowdfunding/TIC farmland qualifies for special estate tax valuation (IRC Section 2032A) using agricultural use vs. development value, potentially reducing estate values 20-40%. Step-up in basis at death eliminates built-in capital gains allowing heirs to sell tax-free or depreciate from stepped-up basis. However, Section 2032A requires qualified use continuation by heirs (10 years) and material participation by decedent. Fund structure doesn't offer same estate planning flexibility as direct farm ownership.

- Sustainable Fund REIT-like treatment possibilities—if fund qualifies as Real Estate Investment Trust (REIT) or uses REIT-like structure, distributions may include return of capital (tax-deferred), ordinary income (dividends), and capital gain distributions with special characterization. Fund documentation should clarify tax treatment expectations and potential REIT qualification—impacts investor net returns significantly vs. assuming all distributions taxed as ordinary income.

Account Suitability

Taxable

Optimal account context for crowdfunding/TIC structures. Farmland tax benefits (depreciation, 1031 exchanges, estate planning advantages, step-up in basis) fully realizable in taxable accounts. Depreciation deductions reduce current income, 1031 exchanges defer capital gains indefinitely, estate planning strategies maximize wealth transfer efficiency. High-net-worth investors prioritize taxable farmland holdings for tax optimization. Fund structure also suitable for taxable accounts but provides less tax benefit than direct ownership.

Roth IRA

Generally impractical and suboptimal for crowdfunding/TIC structures. Most IRA custodians don't support alternative asset holdings. Self-directed IRA structures technically permit farmland but create compliance complexity (prohibited transaction rules, UBTI reporting if farm uses leverage, annual fair market valuations). Critically, Roth's tax-free growth advantage wasted on farmland—depreciation benefits and 1031 exchanges unavailable inside retirement accounts, and farmland's stable moderate returns (6-10% total) less valuable than tax-free compounding of high-growth assets (stocks, crypto 10-20%+ potential). Better to use Roth for high-volatility/high-growth assets where tax-free appreciation most valuable. Fund structure slightly more practical in IRA (1099 reporting simpler than K-1) but still suboptimal vs. stocks/bonds.

Traditional IRA

Generally impractical for similar reasons. Self-directed IRA creates compliance burden, farmland's tax advantages (depreciation, 1031 exchanges) unavailable inside retirement accounts. Traditional IRA distributions taxed as ordinary income (up to 37%) vs. more favorable capital gains treatment (15-20%) in taxable accounts—eliminates farmland's capital gains advantage. Consider taxable farmland holdings with other retirement assets in IRAs/401(k)s for portfolio diversification. Fund structure slightly easier to hold in IRA (1099 vs. K-1) but still suboptimal allocation.

HSA

Unsuitable. Health Savings Accounts face strict eligibility requirements (high-deductible health plans), contribution limits ($4,150 individual / $8,300 family), and qualified medical expense withdrawal restrictions. Alternative asset custody extremely rare among HSA providers. Farmland's illiquidity incompatible with HSA's medical expense purpose. Use HSAs for liquid investments (stocks, bonds, money market) accessible for medical costs—never farmland.

Investor Fit

High-Net-Worth Portfolio Diversifiers Seeking Premium Crop Exposure

Ideal for accredited investors with $500K+ portfolios seeking 5-15% farmland allocation emphasizing permanent crops (almonds, pistachios, wine grapes) for higher returns vs. Midwest row crops. FarmTogether's California/Pacific Northwest specialty agriculture focus provides access to premium crops generating $2,000-$8,000/acre revenue vs. $200-$600/acre for corn/soybeans. Suitable for investors with 8-12 year liquidity tolerance (crowdfunding) or accepting 2-year lockup + quarterly redemption restrictions (fund), maintaining 12-24 months cash reserves, and comfortable with permanent crop risks (weather, water, establishment periods). Investment team's $2.1B capital deployment experience and <1% deal acceptance rate provides institutional-quality underwriting. Best for investors bullish on permanent crop premiums despite California water constraints and willing to accept regional concentration vs. geographic diversification.

1031 Exchange Investors Transitioning from Appreciated Real Estate

Particularly well-suited for investors selling appreciated commercial properties, residential rentals, or other qualified real estate seeking Section 1031 like-kind exchanges into farmland for tax-deferred transitions. FarmTogether's TIC structure ($500K minimum) specifically designed for 1031 compliance providing each investor direct undivided interest in underlying property (vs. LLC membership interest disqualified from 1031 treatment). Platform handles 1031 coordination including qualified intermediary arrangements, property identification (45-day deadline), and closing execution (180-day deadline). Farmland provides attractive 1031 replacement property—stable income from crop leases, long-term appreciation, diversification from traditional commercial real estate, potential estate planning benefits. Suitable for investors with $500K+ exchange proceeds seeking to defer capital gains taxes while transitioning into inflation-hedging hard assets with 8-12 year holding horizons.

Passive Investors Prioritizing Diversification Over Farm Selection

Sustainable Fund structure ($50K Class A minimum) ideal for passive investors wanting instant portfolio diversification across 10-20 farms without farm-by-farm selection burden. Fund provides professional management, quarterly distributions (4-6% target annual), improved liquidity vs. traditional farmland (2-year lockup + quarterly redemption windows subject to restrictions), and elimination of individual farm due diligence requirements. Suitable for investors lacking agricultural expertise or time for property evaluation, prioritizing diversification over specific farm control, accepting fund fees and REIT-like tax treatment (1099 vs. K-1 depreciation benefits), and understanding redemption windows subject to board approval and capacity limits (not guaranteed quarterly liquidity). Fund structure bridges gap between illiquid farmland (8-12 year holds) and public REITs (daily liquidity but stock volatility)—appropriate for investors accepting modest illiquidity for stable returns.

Institutional Investors & Family Offices Requiring Customization

Bespoke ($3M minimum) and SMA ($20M minimum) structures provide institutional-grade customization suitable for family offices, endowments, foundations, and ultra-high-net-worth individuals. Bespoke enables sole ownership of farms sourced to investor specifications (crop type, geography, sustainability certifications, water rights characteristics, operator preferences) with complete operational control and custom fee arrangements. SMA provides multi-farm portfolios with flexible investment mandates (asset allocation, risk-return profile, leverage policy, liquidity management) under Investment Management Agreement. Suitable for institutions requiring dedicated farmland allocations ($20M-$100M+), fiduciary-grade documentation and reporting, benchmark tracking (NCREIF Farmland Index), and ability to customize investment criteria aligned with investment policy statements or ESG requirements. Requires substantial agricultural sophistication or willingness to rely on FarmTogether advisory discretion.

Smaller Portfolio Retail Investors (<$100K Farmland Allocation)

Neutral fit for accredited investors with <$100K farmland allocation budgets. $15K crowdfunding minimum provides accessible entry point, but meaningful diversification (5-10 farms spanning crop types and geographies) requires $75K-$150K—consuming substantial portfolio percentage for investors with <$500K total assets. Single-farm exposure ($15K-$25K) creates binary concentration risk—localized weather event, operator underperformance, or crop disease devastates returns without portfolio-level mitigation. Sustainable Fund ($50K minimum) provides instant diversification but may still represent disproportionate allocation for smaller portfolios. Alternative consideration: Farmland Partners REIT (FPI) offers $10-15 per-share access with instant diversification (180+ farms) and daily liquidity, though sacrificing direct ownership tax advantages and exposing investors to stock volatility (28% standard deviation) vs. stable farmland NAV. Investors with $15K-$50K budgets should carefully weigh single-farm concentration risks vs. waiting to accumulate larger capital for diversified positions.

Liquidity-Focused Investors & Short-Term Traders

Poor fit for investors requiring near-term liquidity or frequent portfolio turnover. Crowdfunding and TIC offerings require 8-12 year holding periods with no secondary market—early exits force disadvantageous sales or prevent participation. Sustainable Fund improves liquidity profile (2-year lockup + quarterly windows) but redemptions subject to board approval, capacity limits, and potential delays/denials if fund lacks cash. Marketing emphasizes fund liquidity benefit vs. crowdfunding, but investors shouldn't assume guaranteed quarterly redemptions—practical fulfillment experience uncertain. Emergency capital needs (medical expenses, job loss, investment opportunities) occurring during holding periods create forced exit challenges or lock investors into unwanted positions. Those prioritizing liquidity should consider Farmland Partners (FPI) or Gladstone Land (LAND) REITs offering daily trading at 3-5% dividend yields, accepting stock market volatility (28-48% annual swings) for immediate liquidity access.

Row Crop Investors Seeking Midwest Stability

Poor fit for investors specifically seeking Midwest row crop exposure (corn, soybeans, wheat) for operational stability and weather diversification. FarmTogether's portfolio emphasizes California/Pacific Northwest permanent crops (almonds, pistachios, wine grapes, apples, hazelnuts) with limited Midwest row crop offerings. Permanent crops provide higher revenue per acre ($2,000-$8,000 vs. $200-$600 for row crops) but introduce elevated risks—longer establishment periods (5-10 years), weather vulnerability (frost, heat stress), water dependency (California allocations), and specialized operator requirements. Investors wanting row crop stability, shorter crop cycles (annual planting/harvest vs. multi-year establishment), lower water dependency (rain-fed agriculture), and geographic focus on Iowa/Illinois/Nebraska corn belt should consider AcreTrader (heavy Midwest concentration), Farmland LP (diversified across row and permanent crops), or Farmland Partners REIT (FPI) with row crop emphasis vs. FarmTogether's permanent crop specialization.

Risk-Averse Conservative Income Seekers

Poor fit for investors seeking fixed-income characteristics (guaranteed income, stable principal, minimal volatility, high liquidity). While farmland offers stability vs. equities (6% volatility vs. 18% for stocks per NCREIF data), permanent crop investments carry meaningful risks absent from Treasury bonds or FDIC-insured deposits—commodity price volatility (almond prices fluctuate 40-60%), weather events (droughts, freezes, hail), water allocation cuts (California reductions 20-50%), operator performance dependency, and 8-12 year illiquidity (crowdfunding) or 2+ year restricted liquidity (fund with redemption uncertainties). Capital preservation not guaranteed—2014-2016 commodity decline saw some permanent crop land values decline 10-20%, development plantings experience 5-10 years negative cash flow. Those seeking conservative income and principal protection better served by Treasury bonds, municipal bonds, CDs, or high-grade corporate debt providing guaranteed coupon payments and maturity principal return. Farmland suits moderate-risk portfolios comfortable with agricultural market exposure, not conservative fixed-income allocations.

Key Tradeoffs

Permanent Crops (High Revenue) vs. Row Crops (Lower Risk)

FarmTogether's California/Pacific Northwest permanent crop focus (almonds, pistachios, wine grapes) generates 3-10x revenue per acre ($2,000-$8,000) vs. Midwest row crops ($200-$600), providing superior income potential and land value appreciation. However, permanent crops require 5-10 year establishment periods (negative cash flow), face elevated weather vulnerability (frost, heat stress, water dependency), and depend critically on specialized operator expertise. Row crops (corn, soybeans) offer shorter crop cycles (annual planting/harvest), rain-fed agriculture reducing water risk, established commodity hedging tools, and simpler operations—but lower revenue per acre and more modest appreciation potential. Investors seeking maximum returns accept permanent crop complexity and risk; those prioritizing stability should emphasize row crops via AcreTrader or Farmland LP.

Sustainable Fund Liquidity vs. Crowdfunding Control & Tax Benefits

Sustainable Fund ($50K minimum, 2-year lockup + quarterly redemptions subject to restrictions) provides instant diversification (10-20 farms), improved liquidity vs. traditional farmland, and eliminates farm selection burden—suitable for passive investors. However, fund structure sacrifices farm selection control, depreciation deduction pass-through (1099 vs. K-1 reporting), 1031 exchange eligibility, and estate planning flexibility vs. direct ownership. Crowdfunding ($15K minimum per farm, 8-12 year hold) maintains direct farm selection, K-1 tax benefits, potential 1031 exchange eligibility (note: FarmTogether states crowdfunding NOT 1031 eligible, only TIC structure), and estate planning advantages—but requires building diversification farm-by-farm ($75K-$150K for 5-10 properties) and accepting full illiquidity. Investors prioritizing liquidity and instant diversification choose fund; those seeking tax optimization and direct control prefer crowdfunding.

Premium Platform Underwriting vs. Fee Complexity

FarmTogether's rigorous 105-point due diligence checklist and investment team's $2.1B capital deployment experience provide institutional-quality underwriting—accepting <1% of reviewed deals ensures selective property acquisition and operator vetting. Premium underwriting justifies platform fees for investors lacking farmland expertise or resources for independent due diligence. However, fee structures vary by product ('dependent on product offering') without comprehensive public disclosure, creating comparison shopping challenges and potential fee opacity. Total costs (acquisition fees, management fees, profit participation, operating expenses) may reach 3-5% annually for premium permanent crop operations—materially reducing net returns vs. gross projections. Investors value professional underwriting but must carefully assess fee impact on net performance vs. direct ownership alternatives.

Multi-Product Flexibility vs. Selection Complexity

Five distinct product structures ($15K crowdfunding → $50K fund → $500K TIC → $3M bespoke → $20M SMA) enable investors to scale farmland allocations across lifecycle—retail start with crowdfunding, upgrade to fund for diversification, access TIC for 1031 exchanges, reach bespoke for customization, ultimately achieve SMA for institutional mandates. Product range accommodates varying capital levels, sophistication, and objectives within single platform relationship. However, structure multiplicity creates decision complexity—investors qualifying for multiple products (e.g., $100K capital can access crowdfunding or fund) must evaluate trade-offs in fees, taxes, liquidity, control, and diversification without standardized comparison tools. Product selection errors produce suboptimal outcomes despite underlying farm quality—requires substantial sophistication or professional advisory guidance.

California Permanent Crop Premiums vs. Water/Climate Concentration Risk

California produces 80% of global almonds, 99% of U.S. pistachios, and premium wine grapes commanding $3,000-$8,000/ton (Napa, Sonoma appellations)—providing unique access to high-value specialty agriculture with strong export demand and premiumization trends. FarmTogether's portfolio concentration in California/Pacific Northwest permanent crops capitalizes on these market dynamics for superior returns. However, regional concentration creates correlated risk exposure—California drought simultaneously impacts almonds, pistachios, grapes across multiple holdings; SGMA groundwater regulations force permanent crop removal on marginal lands; water allocation cuts devastate yields. Investors bullish on California agriculture accept concentration for return potential; those prioritizing geographic diversification should blend with Midwest row crop platforms (AcreTrader) or diversified funds (Farmland LP).

Who This Is Not For

Non-Accredited Investors

All FarmTogether products require accredited investor status—$200K annual income ($300K married) or $1M net worth excluding primary residence. Platform legally prohibited from accepting non-accredited investors under Regulation D (506c) offerings and Investment Company Act registration. Those below accreditation thresholds should consider public farmland REITs (FPI, LAND) accessible to all investors with lower minimums ($10-15 per share) providing instant diversification and daily liquidity, though sacrificing direct ownership advantages (depreciation, 1031 exchanges, stable NAV vs. stock volatility).

Investors Requiring Guaranteed Near-Term Liquidity

Crowdfunding and TIC offerings require 8-12 year holding periods with no secondary market—early exits extremely difficult and disadvantageous. Sustainable Fund's 2-year lockup + quarterly redemption windows improve liquidity vs. traditional farmland, but redemptions subject to board approval, capacity limits, and potential delays/denials if fund lacks cash—not guaranteed quarterly liquidity. Marketing emphasizes fund liquidity benefit, but investors shouldn't assume reliable redemption fulfillment without operational track record validation. Emergency capital needs (medical expenses, job loss, family obligations) force disadvantageous exits or lock investors into unwanted positions. Maintain 12-24 months cash reserves before investing and limit farmland to <10-15% portfolio allocation.

Midwest Row Crop Investors Seeking Corn/Soybean Exposure

FarmTogether's portfolio emphasizes California/Pacific Northwest permanent crops (almonds, pistachios, wine grapes, apples, hazelnuts) with limited Midwest row crop availability. Permanent crops offer higher revenue ($2,000-$8,000/acre vs. $200-$600 for row crops) but introduce elevated risks—longer establishment periods (5-10 years negative carry), weather vulnerability (frost, heat stress), water dependency (California allocation cuts), and specialized operator requirements. Investors specifically seeking Midwest row crop stability (annual crop cycles, rain-fed agriculture, established markets, simpler operations) should consider AcreTrader (heavy Iowa/Illinois/Nebraska focus), Farmland LP (more balanced row/permanent mix), or Farmland Partners REIT (FPI) rather than FarmTogether's permanent crop specialization.

Investors Unable to Build Diversified Portfolios

Crowdfunding structure requires $75K-$150K to build meaningful diversification (5-10 farms across crop types and geographies) mitigating single-farm concentration risk. Investors with <$75K farmland allocation budgets face choice between: (1) concentrated single-farm exposure ($15K-$25K positions) accepting binary outcomes from localized weather, operator issues, or crop disease without portfolio-level diversification, or (2) Sustainable Fund ($50K minimum) providing instant multi-farm diversification but consuming substantial portfolio percentage for investors with <$500K total assets. Those unable to commit $75K+ for diversified crowdfunding positions or $50K for fund should consider public REITs (FPI, LAND) offering diversification with $10-15 per-share minimums, accepting stock volatility for accessibility.

Fee-Sensitive Investors Requiring Transparent Cost Structures

Fee structures vary by product ('dependent on product offering') without comprehensive public disclosure—requires reviewing individual PPMs to understand acquisition fees, annual management, profit participation, and operating expense allocations. Total cost of ownership may reach 3-5% annually for premium permanent crops (acquisition fees 1-3%, management fees 1-2%, profit participation 5-15% above hurdles, operating expenses $3,000-$8,000/acre including water, crop insurance, maintenance)—materially reducing net returns below gross IRR projections. Investors requiring standardized fee schedules for efficient comparison shopping or budgeting face challenges without engaging sales process. Fee transparency-focused investors may prefer platforms with published rate cards or direct ownership alternatives despite sacrificing professional underwriting benefits.

Risk-Averse Fixed Income Investors

Farmland carries meaningful risks absent from Treasury bonds or FDIC-insured deposits—commodity price volatility (almond prices swing 40-60%), weather events (droughts, freezes, heat stress), water allocation uncertainties (California cuts 20-50%), operator performance dependency, permanent crop establishment periods (5-10 years negative cash flow), and illiquidity (8-12 years crowdfunding or 2+ years fund with redemption restrictions). Capital preservation not guaranteed—commodity downturns, climate events, or water restrictions can produce returns below projections or principal losses. While farmland offers stability vs. equities (6% volatility vs. 18% for stocks), permanent crop concentration introduces risks inappropriate for conservative fixed-income allocations. Those seeking predictable income and principal protection better served by Treasury bonds, municipal bonds, or high-grade corporate debt providing guaranteed coupon payments and maturity principal return.

AltStreet Perspective

Verdict

FarmTogether provides premium fractional farmland access through sophisticated multi-product platform emphasizing high-value permanent crops (California/Pacific Northwest almonds, pistachios, wine grapes) with institutional-quality underwriting ($2.1B team experience, <1% deal acceptance rate, 105-point due diligence). Platform's five-tier structure ($15K crowdfunding → $50K fund → $500K TIC → $3M bespoke → $20M SMA) accommodates diverse investor needs across capital levels and sophistication, with Sustainable Fund's 2-year lockup + quarterly redemption windows offering unprecedented liquidity for farmland sector (subject to board approval and capacity restrictions).

Positioning

Most compelling for accredited investors ($500K+ portfolios) seeking 5-15% farmland allocation emphasizing permanent crop premiums over Midwest row crop stability, with capital and conviction to build diversified positions ($75K-$150K crowdfunding across 5-10 farms, or $50K+ fund allocation). Investment team's selective underwriting and permanent crop expertise justify platform fees (total costs 2-4% annually including management and operating expenses) for investors lacking agricultural sophistication. However, California/Pacific Northwest concentration creates regional climate correlation (drought, water policy, freeze events), fee opacity across products challenges efficient comparison shopping, and Sustainable Fund's practical redemption experience remains uncertain given limited track record. Platform excels in permanent crop access and product optionality but requires investors comfortable with specialty agriculture risks, regional concentration, and fee complexity. Those prioritizing Midwest row crop stability, fee transparency, or proven secondary market liquidity may find better fit with AcreTrader (row crop focus, simpler fee structure) or public REITs (FPI, LAND for daily liquidity despite stock volatility).

"Premium permanent crop platform for sophisticated farmland investors—verify water rights, understand permanent crop risks, and build diversified portfolio accepting California concentration for specialty agriculture upside."

Next Steps

Evaluate product structure alignment with investment objectives—crowdfunding ($15K) for direct farm selection and K-1 tax benefits, fund ($50K) for instant diversification and improved liquidity (subject to restrictions), TIC ($500K) for 1031 exchanges, bespoke ($3M) for customization, or SMA ($20M) for institutional mandates. Understand trade-offs in fees, taxes, liquidity, control, and diversification across structures before selecting entry point.

Review current portfolio allocation and farmland budget—determine total capital for farmland exposure ($75K-$150K recommended for diversified crowdfunding across 5-10 farms, or $50K+ for fund instant diversification). Confirm adequate cash reserves (12-24 months) and farmland represents <10-15% of total portfolio. Verify genuine 8-12 year capital commitment tolerance (crowdfunding) or acceptance of 2-year lockup + redemption uncertainties (fund).

Assess permanent crop risk tolerance and water exposure—FarmTogether's California/Pacific Northwest emphasis provides access to high-value specialty agriculture ($2,000-$8,000/acre revenue) but creates regional concentration vulnerable to drought, water policy, and climate events. Investors bullish on permanent crop premiums and comfortable with California water constraints proceed; those prioritizing geographic diversification and row crop stability should blend with Midwest platforms (AcreTrader) or diversified alternatives (Farmland LP).

Request comprehensive fee disclosures across qualifying products—demand detailed breakdowns of acquisition fees, annual management fees, profit participation structures, and forecasted operating expenses (property taxes, water costs, crop insurance, maintenance). Calculate total expense ratios and net IRR projections (after all fees and costs) vs. gross returns. Compare fee structures across FarmTogether products you qualify for ($50K+ can choose crowdfunding or fund, $500K+ can access TIC) and benchmark against competitors (AcreTrader crowdfunding similar fees but no fund option).

Review available farm offerings and sustainable fund details—evaluate crowdfunding properties for permanent crop establishment status (mature producing vs. development plantings), water rights documentation (senior appropriative rights critical for California), operator track records, and crop type diversification opportunities. Request Sustainable Fund redemption policy documentation (board approval criteria, capacity limits, historical fulfillment rates, stress-test scenarios) to assess practical liquidity vs. marketing claims.

Understand tax implications for chosen structure—crowdfunding/TIC generate K-1s with depreciation deductions and potential 1031 exchange eligibility (TIC only, crowdfunding NOT 1031 eligible per FarmTogether), while fund provides 1099 reporting with limited depreciation pass-through. Consult CPA familiar with farmland taxation to optimize structure selection (crowdfunding/TIC for maximum tax benefits vs. fund for simplification and improved liquidity). Assess passive activity loss limitation impact particularly for high-income W-2 employees unable to use deductions currently.

Verify water rights and climate resilience for California properties—request water rights documentation, historical allocation data during drought years, SGMA groundwater sustainability compliance status, and irrigation infrastructure descriptions (drip systems, soil moisture monitoring, water storage). Prioritize farms with senior appropriative rights, confirmed sustainable groundwater access, and drought-resilient infrastructure over properties with junior rights or regulatory uncertainties.

Make initial investment to test platform experience—start with single crowdfunding farm ($15K-$25K) or minimum fund allocation ($50K) to understand platform processes (onboarding, PPM review, capital deployment, quarterly reporting, annual K-1/1099 issuance, investor communications). Gain experience with FarmTogether operations, reporting quality, and management responsiveness before committing full farmland allocation ($75K-$150K crowdfunding diversification or larger fund position).

Build diversified portfolio strategically over 12-24 months—for crowdfunding, add 1-2 farms quarterly spanning permanent crop types (combine almonds, pistachios, wine grapes, apples to diversify commodity exposure), geographies (balance California with Pacific Northwest), and establishment stages (mix mature producing orchards with development plantings matching cash flow needs). Stagger entry across growing seasons and commodity price cycles reducing timing risk. For fund, consider graduated entry with partial allocation initially followed by additions post-lockup period.

Monitor portfolio performance and fund redemption experience—track quarterly reports comparing actual yields vs. projections, operator performance vs. county averages, commodity price movements, and water allocation status. For fund investors, observe redemption request handling (approval rates, fulfillment timing, capacity constraint impact) as other investors exit to assess practical liquidity vs. contractual rights. Rebalance allocation if farmland becomes overweight relative to target (5-15%) as land values appreciate, potentially harvesting gains during favorable exit opportunities.

Related Resources

Explore Asset Class

Farmland Real AssetsSimilar Platform Reviews

- AcreTrader

Direct competitor with similar fractional farmland model but heavier Midwest row crop concentration vs. FarmTogether's California/Pacific Northwest permanent crop focus. AcreTrader lacks fund structure offering improved liquidity and provides simpler single-product approach vs. FarmTogether's five-tier complexity.

- Farmland LP

Permanent capital fund structure similar to FarmTogether's Sustainable Fund but with longer track record (founded 2015) and more balanced row crop/permanent crop mix. Quarterly liquidity windows comparable but different minimum ($15K vs. FarmTogether $50K) and potentially different fee structures requiring individual comparison.

- Farmland Partners (FPI)

Publicly traded farmland REIT offering daily liquidity, lower minimums ($10-15 per share), and instant diversification (180+ farms). Different structure from FarmTogether—stock ownership vs. direct/fund farmland exposure, 28% volatility vs. stable NAV, REIT tax treatment vs. K-1 benefits, leverage exposure (30-40% debt) vs. unleveraged farm ownership. FPI suits liquidity-focused investors accepting stock volatility; FarmTogether for direct ownership tax benefits and stable returns.

🔍Review Evidence

Scrape Date

2026-01-08

Methodology

Platform analysis combining FarmTogether scraped materials (59 pages) + product documentation review + USDA/NCREIF farmland performance data + California water policy research + permanent crop market analysis + competitor comparison (AcreTrader, Farmland LP, public REITs)

Scope

Public website materials (home, products, why farmland, innovations, learning center) + product comparison matrix + performance data + regulatory disclosures + permanent crop economics research + water rights analysis + California agricultural policy context

Key Findings

- •Platform manages $217M+ AUM across 52 funded deals spanning 7,100+ acres, 15 crop types, and 8 states—demonstrating substantial operational scale though smaller than some competitors (AcreTrader $300M+ transaction volume).

- •Investment team with collective $2.1B capital deployment experience and proprietary 105-point due diligence checklist accepting <1% of pipeline deals—provides institutional-quality underwriting and selective property acquisition differentiating from less rigorous competitors.

- •Five distinct product structures spanning $15K-$20M+ minimums enable investor progression across lifecycle—crowdfunding ($15K), fund ($50K), TIC ($500K), bespoke ($3M), SMA ($20M). Multi-product approach unique among fractional farmland platforms creating competitive differentiation but also fee comparison complexity.

- •Sustainable Fund's 2-year lockup + quarterly redemption windows represent unprecedented liquidity innovation for farmland sector—potentially game-changing if redemptions consistently fulfilled, but practical fulfillment experience uncertain given limited track record. Redemptions subject to board approval, capacity limits, and fund cash availability creating redemption uncertainty despite marketing emphasis.

- •Portfolio concentration in California/Pacific Northwest permanent crops (almonds, pistachios, wine grapes, apples, hazelnuts) provides access to high-value specialty agriculture but creates regional climate correlation and water policy exposure—California drought 2021-2023 reduced water allocations 20-50% across Central Valley impacting multiple FarmTogether properties simultaneously.

- •NCREIF Farmland Index shows 10.15% annual returns (1992-2024) with 6.82% volatility vs. publicly traded farmland REITs—FPI (1.72% returns, 28.33% volatility) and LAND (1.67% returns, 48.33% volatility) from 2014-2024. Data validates direct farmland investment thesis vs. REIT alternatives suffering stock market volatility despite underlying farmland stability.

- •Platform operates under multiple regulatory frameworks—Regulation D (506c) for crowdfunding/TIC, Investment Company Act registration for fund, advisory arrangements for bespoke/SMA. Regulatory complexity across products requires investor understanding of applicable rules, protections, and requirements for chosen structure.

Primary Source Pages

- farmtogether.com

- farmtogether.com/why-farmland

- farmtogether.com/products/overview

- farmtogether.com/products/crowdfunding

- farmtogether.com/products/fund

- farmtogether.com/products/tic

- farmtogether.com/products/bespoke

- farmtogether.com/products/sma

- farmtogether.com/products/1031-exchange

- farmtogether.com/learn

- USDA NASS Farmland Values

- NCREIF Farmland Index

- California Department of Water Resources

Comparable Platforms

- AcreTrader

Directly comparable fractional farmland platform with similar crowdfunding structure and minimums ($15K-$25K). Primary differences: AcreTrader emphasizes Midwest row crops (Iowa, Illinois, Nebraska corn/soybeans) vs. FarmTogether's California/Pacific Northwest permanent crops; AcreTrader offers single product (crowdfunding only) vs. FarmTogether's five-tier structure; simpler fee approach vs. FarmTogether's product-dependent complexity.

- Farmland LP

Permanent capital fund similar to FarmTogether's Sustainable Fund providing instant diversification and quarterly liquidity windows. Key differences: Farmland LP $15K minimum vs. FarmTogether $50K; longer operational track record (founded 2015 vs. FarmTogether fund more recent); more balanced row crop/permanent crop allocation vs. FarmTogether permanent crop emphasis; single-product focus vs. FarmTogether multi-product range.

- Farmland Partners (FPI)

Public REIT structure fundamentally different from FarmTogether—stock ownership providing daily liquidity and $10-15 per-share minimums vs. direct/fund farmland ownership with extended illiquidity. FPI shows 28% volatility (stock market correlation) vs. FarmTogether targeting stable NAV; REIT tax treatment (all dividends ordinary income) vs. FarmTogether K-1 benefits (crowdfunding/TIC) or fund 1099; leverage exposure (FPI 30-40% debt) vs. unleveraged farm ownership.

Frequently Asked Questions

What is FarmTogether and how does it differ from AcreTrader?

FarmTogether is a fractional farmland platform offering five distinct investment structures spanning $15K-$20M minimums—crowdfunding single-farm offerings ($15K), Sustainable Farmland Fund ($50K with 2-year lockup + quarterly liquidity), Tenancy-in-Common 1031-eligible offerings ($500K), bespoke sole ownership ($3M), and separately managed accounts ($20M). Primary differentiation from AcreTrader: (1) Multi-product structure vs. AcreTrader's single crowdfunding approach, (2) California/Pacific Northwest permanent crop emphasis (almonds, pistachios, wine grapes) vs. AcreTrader's Midwest row crop focus, (3) Sustainable Fund offering improved liquidity (quarterly redemptions subject to restrictions) vs. AcreTrader's hold-to-maturity only, (4) Higher minimum for diversified fund access ($50K vs. AcreTrader requiring $75K-$150K to build comparable farm-by-farm diversification).

What are the key risks of FarmTogether's permanent crop investments?

Primary risks include: (1) California water scarcity—2021-2023 drought reduced allocations 20-50%, SGMA regulations forcing permanent crop removal on marginal lands, long-term climate change reducing snowpack—critically impacts almonds, pistachios requiring consistent irrigation, (2) Extended establishment periods—almonds 7-10 years, pistachios 8-12 years, wine grapes 4-6 years to full production creating negative cash flow during development requiring patient capital, (3) Weather vulnerability—late frosts devastate bloom, heat stress damages developing nuts/grapes, requiring multi-year recovery vs. annual row crop replanting flexibility, (4) Commodity price volatility—almond prices fluctuate $1.80-$3.80/pound, wine grape prices $500-$3,000/ton based on global supply/export markets/consumer preferences creating 40-60% revenue swings, (5) Operator dependency—permanent crop management requires specialized expertise (irrigation timing, integrated pest management, premium marketing) with operator mistakes producing multi-year yield impacts vs. row crop annual reset opportunities.

How does the Sustainable Farmland Fund's liquidity actually work?

Sustainable Fund requires initial 2-year lockup period followed by quarterly redemption windows—investors can request redemptions each quarter subject to: (1) Board approval (discretionary based on undisclosed criteria), (2) Fund capacity limits (aggregate quarterly redemptions capped at percentage of NAV), (3) Cash availability (fund must have sufficient liquidity or sell farms to fulfill requests). Marketing emphasizes improved liquidity vs. 8-12 year crowdfunding holds, but redemptions NOT guaranteed—board can delay, partially fulfill, or deny requests if fund lacks capacity or cash. Historical redemption fulfillment rates not publicly disclosed given fund's limited track record. Investors should treat fund as 3-5 year minimum investment despite quarterly redemption optionality—practical liquidity uncertain until operational history validates consistent fulfillment. Maintain separate emergency reserves rather than depending on fund redemption for urgent capital needs.

What are FarmTogether's fees across different products?