Percent

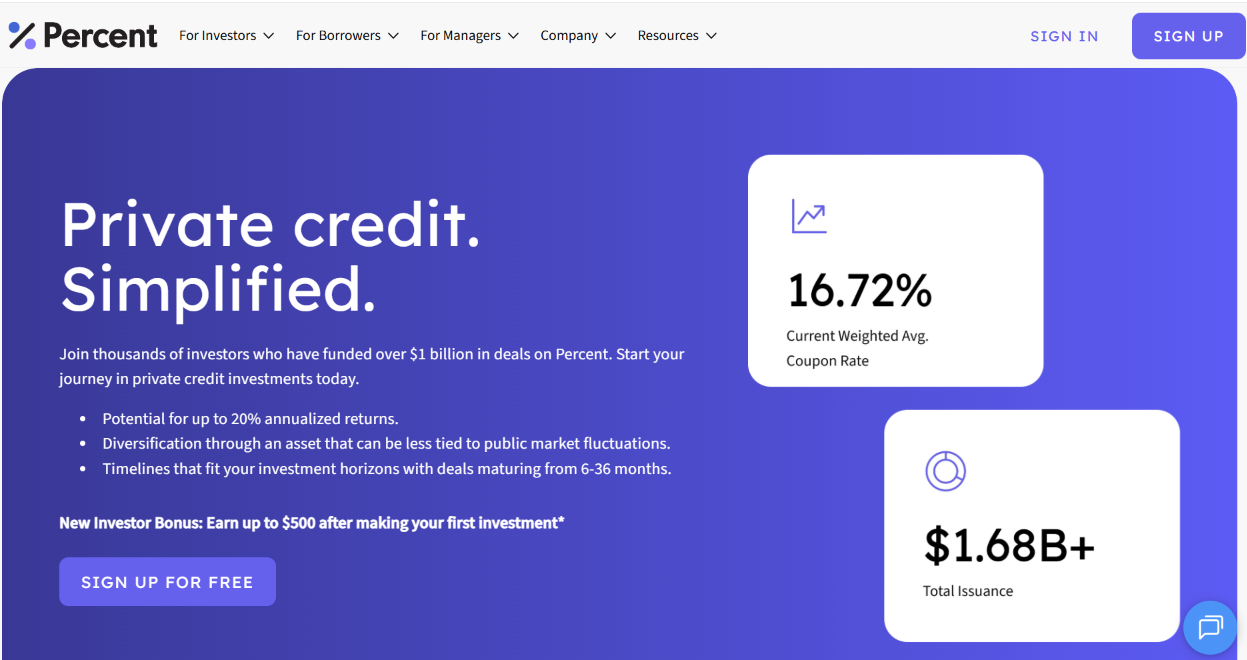

FINRA-registered broker-dealer connecting accredited investors with short-duration private credit deals (6-36 months, 10-20% yields) through marketplace access ($500 minimums) or managed accounts ($1M+). Platform has facilitated $2B+ across asset-based lending, consumer credit, and specialty deals since 2018.

Platform Overview

Private credit marketplace and registered broker-dealer (Percent Securities, since August 2023) connecting accredited investors with short-duration alternative lending opportunities unavailable through traditional banks. Platform sources asset-based financing (inventory/receivables-backed), consumer credit portfolios, equipment financing, and specialty lending deals from non-bank originators, conducts due diligence on borrower operations and collateral, structures investments as notes or participation interests, and facilitates investor access through direct marketplace ($500 minimum per deal, self-directed allocation) or separately managed accounts ($1M+ minimum, discretionary management). Since 2018 inception, platform facilitated $2B+ funding across 917 deals with historical 14.47% weighted average coupon, 681 repaid deals returning $1.33B principal plus $95.95M interest, 9-month average deal duration, and 3% default rate / 2.22% charge-off rate. Broker-dealer registration (2023) enables enhanced investor protections, regulatory oversight, and streamlined transaction execution vs. unregistered peer-to-peer lending platforms.

Platform funded $2B+ across 917 deals since 2018, with 681 repaid deals returning $1.33B principal plus $95.95M interest at 14.47% weighted average coupon. Current portfolio shows 16.72% weighted average coupon, 3% default rate, 2.22% charge-off rate. Two structures: (1) Marketplace ($500 minimum per deal, self-directed, monthly distributions), (2) SMAs ($1M+ minimum, 1% fee, professional management). Broker-dealer status provides FINRA oversight and investor protections unavailable through unregistered peer-to-peer platforms.

Investment Structures

Marketplace ($500/deal) | SMA ($1M+, 1% fee)

Platform Scale

$2B+ funded | 917 deals | 681 repaid | Thousands of investors

Target Returns

10-20% annual yields | 14.47% historical WA | 16.72% current WA coupon

Deal Duration

6-36 months typical | 9-month historical average

Credit Performance

3% default rate | 2.22% charge-off rate | $95.95M interest paid

Asset Types

Asset-based lending | Consumer credit | Specialty lending

Liquidity

Monthly distributions | Optional secondary market sales

Regulatory Status

Registered broker-dealer (FINRA) | SEC-registered investment advisor (SMAs)

🔄Private Credit Democratization Strategy

- Percent's $500 marketplace minimum lowers private credit barriers vs. $100K-$5M institutional fund minimums, enabling portfolio diversification across 10-20 deals with $5K-$10K allocation. However, low minimums create operational challenges supporting thousands of retail investors vs. institutional relationships.

- Short-duration strategy (9-month average) aligns with high-rate environment enabling quick yield realization vs. 5-7 year commitments at potentially peak rates. However, requires continuous deal sourcing to maintain deployment rates vs. passive long-term structures.

- Broker-dealer registration positions for institutional adoption (RIAs, family offices require FINRA counterparties) and future product expansion but adds $2M-$5M annual compliance costs requiring substantial volume to justify overhead.

Key Gaps & Non-Disclosures

- Originator concentration not disclosed—business continuity depends on maintaining relationships with non-bank lenders who could shift to competing platforms or direct institutional sales.

- Secondary market lacks operational transparency (volumes, execution rates, pricing discounts)—practical liquidity uncertain vs. marketed optionality.

- Granular performance data limited—aggregate 3% default rate masks deal-level variance potentially obscuring superior vs. underperforming loan categories and originator quality differences.

Investment Structures

Asset-Based Lending Deals (Inventory, Receivables, Equipment)

Short-term loans (6-24 months typical) secured by business inventory, accounts receivable, or equipment serving as collateral. Borrowers typically small-to-medium businesses requiring working capital to fund operations, purchase inventory, or bridge seasonal cash flow gaps. Lenders hold senior security interests enabling inventory liquidation, receivable collection, or equipment repossession upon default. Target yields 12-16% reflecting collateral backing and shorter duration vs. unsecured alternatives. Asset-based deals represent largest historical platform volume (Percent discloses $1.36B of $1.68B total funding categorized as 'asset-based performance'). Suitable for investors prioritizing collateral protection and moderate yields over maximum return potential, though recovery success depends on collateral quality (fresh inventory, confirmed receivables, easily marketable equipment) and liquidation execution during workout scenarios.

Consumer Credit Portfolios (Personal Loans, Auto Loans, Point-of-Sale Financing)

Diversified pools of consumer loans originated by non-bank lenders and packaged for marketplace investment. Portfolios typically contain hundreds or thousands of individual consumer loans creating diversification across borrowers, geographies, and credit profiles. Common categories include unsecured personal loans (debt consolidation, major purchases), prime and near-prime auto loans, and point-of-sale financing (retail installment loans for consumer goods). Target yields 14-18% reflecting consumer credit risk and unsecured nature of many loans, though some portfolios may include auto loans with vehicle collateral. Performance depends heavily on originator underwriting quality, borrower credit profiles, and collection/recovery capabilities—investors should evaluate originator track records, historical loss rates, and portfolio composition carefully before committing capital to consumer deals.

Specialty Lending & Opportunistic Deals (Litigation Finance, Royalty Streams, Niche Financing)

Non-traditional lending opportunities outside conventional asset-based or consumer categories, including litigation finance (funding legal proceedings in exchange for case settlement/judgment proceeds), royalty stream financing (purchasing future revenue streams from intellectual property, patents, or content), invoice factoring (purchasing outstanding invoices at discount), and other niche financing structures. Target yields often 16-20%+ reflecting complexity, illiquidity, and specialized credit assessment requirements. Deals frequently involve unique collateral types, unconventional cash flow sources, or industries requiring domain expertise to evaluate properly. Suitable for sophisticated investors comfortable with esoteric credit structures and willing to conduct extensive due diligence on deal-specific factors—not recommended for investors seeking conventional loan exposure or lacking resources to analyze complex specialty structures independently.

Separately Managed Accounts (Discretionary Professional Management)

Customized private credit portfolios managed by Percent investment team on behalf of individual client with $1M+ commitment. Percent acts as SEC-registered investment advisor allocating client capital across 20-50+ marketplace deals matching client's investment mandate (target return, risk tolerance, duration preferences, sector/collateral focus, concentration limits). Monthly or quarterly distributions with 1% annual advisory fee and potential performance-based incentives above benchmark returns. SMA structure provides institutional-grade diversification, professional credit analysis, ongoing portfolio monitoring, and operational simplicity (no deal-by-deal evaluation burden) vs. self-directed marketplace investing. Clients receive detailed reporting including position-level visibility, performance attribution, and risk metrics. Suitable for high-net-worth individuals, family offices, RIAs, or institutional investors requiring delegated private credit allocation with customization flexibility unavailable in commingled funds—particularly valuable for investors lacking internal credit expertise or time for active marketplace participation.

Risk Structure

Third-Party Originator Dependency & Information Asymmetry

Platform sources deals from non-bank originators (finance companies, specialty lenders) who originate and underwrite loans before listing on Percent—creates principal-agent problem and information asymmetry. Originators possess superior knowledge of borrower quality, collateral values, and underwriting standards, potentially retaining highest-quality loans for balance sheet while offloading marginal credits to marketplace. Percent conducts independent due diligence on originator practices but cannot fully replicate originator's borrower relationships and operational knowledge. Effectiveness of Percent's originator oversight, underwriting validation, and deal quality control critically important but difficult for investors to verify independently. Strong originator relationships and rigorous vetting separate quality marketplaces from adverse selection venues—Percent's 3% default rate and 2.22% charge-off rate suggest effective originator management though limited full-cycle track record (2018 founding, 6-36 month deal terms) prevents definitive assessment.

Credit Cycle Risk & Recession Performance Uncertainty

Platform's 2018-2025 operating history covers relatively benign economic period—strong labor markets (unemployment 3-4%), resilient consumer spending (outside brief COVID disruption), and accommodative monetary policy (2018-2021) followed by rapid rate increases creating demand for higher-yielding private credit (2022-2025). Historical 3% default rate and 2.22% charge-off rate reflect favorable conditions rather than stress-tested performance. Sustained recession, credit crisis, or industry-specific distress (retail/restaurant closures, supply chain disruptions, consumer spending collapse) could produce meaningfully higher defaults particularly in unsecured consumer loans and small business lending. Asset-based deals provide some downside protection through collateral but recovery rates depend on liquidation market conditions (distressed inventory sales, equipment values during downturn, receivable collectability from struggling customers).

Secondary Market Liquidity Effectiveness & Pricing Uncertainty

Platform markets secondary market as liquidity feature enabling note sales to other investors before maturity, but operational effectiveness uncertain without disclosed metrics (trading volumes, execution rates, bid-ask spreads, time-to-sale). Secondary market success requires critical mass of active buyers, transparent pricing discovery, and potentially platform market-making support to facilitate trades. Thin markets could force sellers to accept material discounts (15-30% haircuts typical for illiquid note trading) undermining liquidity benefit vs. hold-to-maturity approach. Investors experiencing financial distress or urgent liquidity needs may face difficult choice between holding notes to maturity despite changed circumstances or accepting steep discounts for immediate sale—marketed liquidity optionality becomes less valuable if practical execution proves challenging or expensive.

Platform Business Model Sustainability & Broker-Dealer Economics

Broker-dealer registration (2023) provides investor protections and enables institutional distribution but adds substantial costs—minimum net capital requirements ($25K-$250K depending on business activities), compliance infrastructure (CCO, legal counsel, audit, supervision systems), FINRA membership fees, regulatory examinations, and ongoing operational overhead. Small broker-dealers typically require $2M-$5M annual revenue to achieve profitability after regulatory costs. Percent must maintain sufficient deal volume, originator relationships, and investor engagement to justify broker-dealer economics vs. lighter-touch technology platforms. Platform revenue model (origination fees, servicing fees, spread capture) not transparently disclosed—without understanding economics, investors cannot assess long-term business sustainability and commitment to marketplace vs. risk of strategic pivot, consolidation, or exit if model proves challenging.

Concentration Risk Across Originator Relationships

Platform's deal flow depends on relationships with non-bank originators providing loan opportunities—if majority of volume sourced from small number of key partners (5-10 originators driving 60-80% of deals), those relationships becoming exclusive elsewhere or deteriorating could dramatically reduce marketplace inventory. Originator concentration data not disclosed, preventing investors from assessing business continuity risk and competitive positioning vs. other marketplaces (Yieldstreet, Cadre, LendingClub) competing for same originator relationships. Strong originator network with diversified relationships across 20-30+ partners provides resilience; concentrated dependency on few key partners creates fragility—investors lack transparency to distinguish platform's position on this spectrum.

Credit Cycle Deterioration & Recession Default Spike

Risk Summary

Platform's 3% default rate and 2.22% charge-off rate reflect 2018-2025 benign economic conditions (strong employment, resilient spending) but provide limited indication of performance through sustained recession, credit crisis, or industry-specific stress. Economic downturn could produce 2-5x higher default rates particularly in unsecured consumer loans and small business lending, materially reducing realized returns below historical averages.

Why It Matters

Small business borrowers accessing private credit typically lack access to traditional bank financing due to weak credit profiles, limited operating history, or asset-light business models—making them vulnerable during economic stress when revenue declines and cash flow tightens. Consumer borrowers in personal loan portfolios often carry elevated debt burdens and limited emergency savings creating default risk during job loss or income reduction. Asset-based lending provides some downside protection through collateral but recovery rates depend on liquidation conditions—distressed inventory sales (retail closeouts, equipment auctions) and receivable collections (from struggling customers) produce lower recoveries during widespread economic weakness vs. idiosyncratic borrower failures. Percent's short 6-36 month deal terms limit cumulative default exposure vs. longer-duration loans but cannot eliminate recession impact if downturn timing coincides with portfolio seasoning period.

Mitigation / Verification

Diversify across deal types and vintages—combine asset-based deals (inventory, receivables, equipment providing collateral protection) with higher-yielding unsecured consumer or specialty deals balancing risk/return. Stagger capital deployment over 6-12 months rather than concentrated entry creating vintage diversification—if recession materializes, later vintages may offer better risk-adjusted returns (wider spreads reflecting stress) vs. pre-recession vintages potentially experiencing elevated defaults. Maintain sufficient liquidity outside private credit allocation (25-50% of investable assets in liquid stocks/bonds) to avoid forced note sales on secondary market during stress periods. Monitor macro indicators (unemployment trends, consumer spending data, credit card delinquencies, small business surveys) signaling economic deterioration—consider reducing private credit exposure or shifting toward senior secured asset-based deals if recession probability increases.

Originator Quality Deterioration & Adverse Selection

Risk Summary

Platform sources deals from third-party originators who may retain highest-quality loans for balance sheet while offloading marginal credits to marketplace—creates adverse selection risk where marketplace deals systematically underperform originator's own portfolio retention. Originator underwriting standards may weaken during origination volume growth phases or when seeking to maximize marketplace distribution vs. maintaining credit discipline, producing future default spike as lower-quality vintages mature.

Why It Matters

Non-bank originators operate with lighter regulatory oversight than banks—no FDIC insurance, limited prudential supervision, variable underwriting rigor depending on management quality and credit culture. Some originators maintain institutional-grade underwriting with conservative credit boxes, thorough income/asset verification, and reasonable debt-to-income limits; others pursue aggressive growth through loosened standards, reduced documentation, or optimistic collateral valuations. Percent's due diligence on originator practices aims to distinguish quality lenders from aggressive originators, but information asymmetry favors originators who understand their borrower base and credit performance better than any third-party reviewer. If originator retains best loans (lowest LTV, highest FICO, confirmed income) while selling marginal credits to marketplace, investors experience systematically higher defaults than originator's portfolio-average performance despite paying for 'same underwriting standards' credit quality.

Mitigation / Verification

Research originator track records before committing to deals—request historical default rates, recovery rates, and vintage performance for loans similar to marketplace offerings. Compare originator's marketplace-distributed deals vs. balance-sheet-retained portfolio performance if disclosed (should show similar credit metrics if no adverse selection). Favor originators with skin-in-the-game (co-investing alongside marketplace or retaining first-loss subordinated pieces) aligning interests vs. pure pass-through distribution. Monitor deal-level performance across originators over time—if certain originators consistently produce higher defaults than peers, avoid future deals from those partners regardless of marketed yields. Diversify across multiple originators (10-20+ deals from 5-10 different lenders) reducing concentrated exposure to any single originator's underwriting quality or adverse selection practices.

Secondary Market Illiquidity & Forced Sale Discounts

Risk Summary

Platform's secondary market enables note sales to other investors but effectiveness depends on buyer demand and pricing discovery mechanisms not transparently disclosed. Thin markets, limited buyer interest, or lack of platform market-making support could force sellers to accept material discounts (15-30% below par) undermining marketed liquidity benefit—particularly during stress periods when multiple investors simultaneously seek exits creating supply/demand imbalance.

Why It Matters

Secondary market value proposition relies on adequate liquidity provision—if sellers cannot execute trades at reasonable prices within acceptable timeframes (1-2 weeks maximum), liquidity feature provides minimal benefit vs. hold-to-maturity approach. Investors experiencing changed circumstances (job loss, medical expenses, investment reallocation desires) may face difficult choice between holding notes to maturity despite urgency or accepting steep haircuts for immediate sale. Secondary market pricing typically reflects: (1) time to maturity (longer remaining terms trade at bigger discounts), (2) borrower/deal quality (performing loans trade closer to par, distressed loans at deep discounts), (3) market conditions (stress periods produce wider bid-ask spreads and lower prices), (4) platform liquidity depth (critical mass of active buyers supports tighter markets). Without operational metrics disclosure, investors cannot assess whether Percent's secondary market provides genuine liquidity or theoretical optionality with challenging practical execution.

Mitigation / Verification

Underwrite all deals as hold-to-maturity investments regardless of secondary market availability—budget liquidity expectations assuming full-term commitment vs. banking on interim exits. Maintain adequate external liquidity (emergency funds, liquid investment portfolios) preventing forced private credit sales during financial stress. Test secondary market mechanics proactively before urgency arises—attempt small note sale ($500-$1,000 position) observing time-to-execution, pricing achieved vs. par, and buyer interest levels. If test sale proves challenging (requires 10-20% discount or takes weeks to execute), adjust liquidity assumptions accordingly. Favor shorter-duration deals (6-12 months) over longer terms (24-36 months) if anticipating potential liquidity needs—shorter remaining terms trade at smaller discounts on secondary markets and reach natural maturity faster reducing holding period risk.

Platform Business Model Risk & Originator Relationship Fragility

Risk Summary

Percent's deal flow depends on relationships with non-bank originators who could shift distribution to competing marketplaces, establish direct investor relationships bypassing intermediaries, or prioritize balance-sheet retention over third-party sales if capital markets provide attractive funding alternatives. Loss of key originator relationships or reduced deal flow could decrease marketplace inventory, limit investor diversification options, and potentially threaten platform sustainability if broker-dealer economics become challenging with lower volumes.

Why It Matters

Marketplace platforms compete intensely for originator relationships—originators evaluate multiple distribution channels (Yieldstreet, Cadre, LendingClub, direct institutional sales) selecting partners offering: (1) fastest capital deployment, (2) most favorable economics (lowest fees, highest advance rates), (3) most reliable investor demand, (4) strongest operational support. Percent must continuously demonstrate value to originators maintaining relationships vs. risk of defection to competitors offering superior terms. Originator concentration (if majority of deals sourced from small number of partners) exacerbates business continuity risk—loss of 1-2 key relationships could devastate deal flow. Platform economics also uncertain—broker-dealer registration adds substantial costs ($2M-$5M+ annually for compliance, capital, examinations) requiring sufficient deal volume and revenue to justify overhead vs. lighter-touch marketplace models. Without transparency on originator diversification and platform economics, investors cannot assess long-term business sustainability.

Mitigation / Verification

Monitor marketplace deal flow consistency over time—declining available inventory, reduced deal variety, or concentration in single loan types could signal originator relationship challenges or competitive pressures. Diversify across multiple platforms (Percent, Yieldstreet, others) reducing concentrated exposure to any single marketplace's business continuity risk. Evaluate platform's competitive positioning—does Percent offer unique value (broker-dealer status, institutional distribution, technology advantages) or operate as commodity marketplace easily replicated by competitors? Assess management team experience and financial backing—venture-capital-funded platforms with experienced management teams demonstrate stronger probability of long-term sustainability vs. bootstrapped startups lacking resources for broker-dealer overhead. Consider platform's evolution and trajectory—is deal volume growing or stagnant? Are new originator partnerships announced? Does investor base appear engaged and expanding? Positive trends suggest healthy business; stagnation or contraction warrant caution.

Collateral Valuation Optimism & Recovery Shortfalls

Risk Summary

Asset-based deals (inventory financing, receivables factoring, equipment loans) rely on collateral valuations supporting loan-to-value calculations and recovery projections. Optimistic valuations (overstating inventory freshness, overestimating receivable collectability, inflating equipment secondary market prices) create illusion of security while masking true loss exposure—actual recoveries during defaults may fall dramatically short of underwriting assumptions if collateral proves less valuable than projected.

Why It Matters

Collateral valuation is art not science—inventory consists of diverse items with varying saleability (fresh merchandise vs. aged goods, in-demand products vs. slow movers, seasonal items approaching obsolescence); receivables range from confirmed purchase orders with creditworthy customers to disputed invoices with struggling buyers; equipment includes specialized machinery with limited secondary markets vs. generic tools easily resold. Conservative underwriting applies meaningful haircuts (30-50% discounts to stated values) accounting for liquidation costs, market deterioration, and adverse selection (borrowers defaulting typically have lower-quality collateral than performing loans). Aggressive underwriting uses optimistic valuations (80-90% advance rates, minimal haircuts, borrower-provided appraisals without independent verification) creating false security—when default occurs and liquidation commences, realized proceeds often disappoint dramatically. Percent's 2.22% historical charge-off rate suggests effective collateral underwriting but limited full-cycle experience prevents validating across extended stress period with many simultaneous liquidations (potentially overwhelming recovery channels and depressing proceeds).

Mitigation / Verification

Favor asset-based deals with conservative LTV ratios—inventory financing below 50% LTV, receivables factoring below 70-80% LTV, equipment loans below 60-70% LTV providing meaningful equity cushion for valuation misestimation or market deterioration. Prioritize liquid collateral types—confirmed accounts receivable from creditworthy customers (verifiable through customer confirmation), fresh inventory of in-demand merchandise (easily marketable), generic equipment with established secondary markets (construction equipment, vehicles, standard machinery) vs. illiquid alternatives (aged inventory, disputed receivables, specialized equipment with narrow buyer base). Evaluate originator's collateral management practices—do they conduct periodic collateral audits? Require updated borrowing base certificates? Maintain insurance on collateral? Strong collateral oversight reduces misappropriation risk (borrower selling inventory without remitting proceeds, accounts receivable diversion) supplementing valuation protection. Accept lower yields on conservatively underwritten deals vs. chasing highest-yield opportunities potentially reflecting aggressive collateral assumptions—sustainable risk-adjusted returns require valuation discipline more than maximum gross yield.

Clarification & Verification Items

- Review individual deal investment memoranda carefully before committing—understand borrower business model, cash flow sources, collateral type and quality, originator underwriting standards, loan terms (interest rate, maturity, payment frequency, prepayment provisions, default triggers), and recovery mechanisms. Aggregated platform statistics provide limited insight into specific deal risks—due diligence requires deal-level analysis.

- Diversify across deal types, originators, and vintages—combine asset-based deals (collateral protection) with consumer portfolios and specialty deals; spread capital across multiple originators (5-10+ lenders, 10-20+ deals minimum); stagger deployment over 6-12 months avoiding concentrated vintage exposure. Portfolio construction critically important for managing idiosyncratic risks despite platform-level performance statistics appearing stable.

- Understand fee structures embedded in deal economics—origination fees, servicing fees, and other costs typically borne by borrower but reflected in investor yields. Higher gross yields may reflect elevated credit risk more than generous terms—compare risk-adjusted returns (yield minus expected losses) vs. gross coupon when evaluating opportunities. Request fee disclosure and all-in cost transparency for both marketplace deals and SMA management.

- Test secondary market mechanics proactively if liquidity optionality important—attempt small position sale observing execution timeframe, pricing achieved vs. par value, and buyer interest depth. Use test results to calibrate realistic liquidity expectations vs. marketing claims. If secondary market proves challenging (wide discounts, slow execution), adjust portfolio liquidity planning accordingly and maintain larger external emergency reserves.

- Monitor platform health and deal flow consistency—declining inventory, reduced deal variety, originator concentration, or announced partnership changes could signal business model challenges. Platform business continuity impacts investor interests even for performing loans (ongoing servicing quality, recovery execution during defaults, secondary market support). Evaluate platform's competitive positioning and financial sustainability beyond individual deal attractiveness.

- Assess credit cycle positioning when deploying capital—current late-cycle environment (elevated corporate leverage, tight lending standards relaxation, extended economic expansion) may precede recession producing higher defaults in near-term vintages. Consider more conservative positioning (emphasizing senior secured asset-based deals, avoiding unsecured consumer exposure, maintaining higher cash reserves) if macro indicators deteriorating vs. aggressive allocation during early cycle with improving credit fundamentals.

Regulatory & Legal Posture

Security Status

Registered Broker-Dealer (FINRA Member) + SEC-Registered Investment Advisor (for SMAs)

Percent operates under dual regulatory framework: (1) Percent Securities registered as broker-dealer with FINRA (August 2023) facilitating marketplace investment transactions, providing enhanced investor protections (suitability obligations, anti-fraud provisions, best execution requirements, dispute resolution through FINRA arbitration), and enabling institutional distribution partnerships requiring FINRA-member counterparties; (2) Percent Advisors registered with SEC as investment advisor managing separately managed accounts, subject to Investment Advisers Act fiduciary duties, compliance requirements, and examination authority. Broker-dealer status differentiates from unregistered peer-to-peer lending platforms lacking equivalent regulatory oversight and investor protections. However, underlying loan investments remain subject to credit risk, borrower default risk, and loss of principal—regulatory registration provides transaction supervision and intermediary oversight but does not eliminate fundamental investment risks or guarantee returns. Individual deals structured as notes or participation interests depending on originator relationship and transaction mechanics.

Disclosure Quality

Moderate to Good. Platform provides aggregate performance statistics ($2B+ funded, 917 deals, 3% default rate, 2.22% charge-off rate, historical weighted average coupon data) offering transparency into portfolio-level outcomes. Individual deal memoranda contain borrower information, collateral descriptions, use of proceeds, and risk factors though granularity varies by deal complexity. However, key operational metrics lack public disclosure: originator relationship concentration, secondary market trading volumes/execution rates, deal-level performance distribution (variance across loan categories, originators, vintages), platform economics, and recovery rate analytics by collateral type. Enhanced disclosure in these areas would enable more sophisticated investor evaluation and risk management vs. reliance on aggregate statistics potentially masking important underlying patterns.

Custody Model

Third-Party Custodian for Cash (FDIC-Insured) + Loan Servicing by Originators or Platform

Investor cash held in segregated FDIC-insured accounts at partner bank (prevents commingling with platform operating funds, provides deposit insurance protection up to $250K per investor). Note/participation investments serviced by originating lenders or platform depending on deal structure—servicing includes payment collection from borrowers, distribution to investors, default management, and recovery/workout execution. Broker-dealer registration requires minimum net capital maintenance ($25K-$250K depending on activities) providing cushion for operational obligations though significantly smaller than bank capital requirements. Platform bankruptcy would not affect investor loan ownership (notes represent direct obligations to investors, not platform liabilities) but could disrupt servicing continuity requiring transfer to backup servicer or investor-directed collection efforts. However, structure lacks registered investment company protections (no independent board, no NAV calculation oversight, no redemption rights) and loan investments do not carry SIPC insurance (limited to securities fraud/broker insolvency claims, not credit risk). Investors bear full credit risk of underlying borrowers with recovery depending on originator/servicer capabilities and collateral liquidation success rather than platform guarantees or insurance mechanisms.

Tax Treatment

Reporting

1099-INT (Interest Income) and 1099-OID (Original Issue Discount)

Annual 1099 forms issued by January 31 following tax year reporting interest income received from note investments and potential original issue discount if notes purchased below par value. Marketplace notes generate ordinary interest income (taxed at marginal rates up to 37% federal) vs. qualified dividend treatment (15-20% for stocks) or capital gains treatment (15-20% for bonds held to maturity). SMA structures may generate additional 1099-MISC reporting for advisory fees if separately invoiced. Investors report interest income on Form 1040 Schedule B; OID reported on Form 1040 Schedule B with potential adjustments via Form 6251 for AMT. State income tax treatment follows federal characterization (ordinary income).

Income Character

Ordinary Interest Income (up to 37% Federal + State) with No Capital Gains Treatment or Qualified Dividend Benefits

Private credit marketplace investments generate ordinary interest income from monthly distributions—taxed at investor's marginal tax rate (10-37% federal plus applicable state taxes 0-13.3%) vs. preferential treatment for stocks (qualified dividends 15-20%) or municipal bonds (tax-exempt interest). No capital gains treatment available even if notes sold on secondary market at gain—gains treated as ordinary income (similar to short-term capital gains). Original issue discount (OID) recognized annually as interest income even if not received as cash (phantom income situation if notes purchased at discount below stated principal). Tax drag particularly significant for high-income investors in high-tax states (California, New York, New Jersey)—effective tax rate 40-50% (37% federal + 13.3% California for example) reduces after-tax returns dramatically vs. gross yields. Loss harvesting opportunities limited—note defaults or charge-offs generate ordinary losses deductible against ordinary income (beneficial vs. capital loss limitation of $3,000 annual deduction against ordinary income), but losses only realized upon formal charge-off typically occurring 90-180+ days after default when recovery efforts exhausted.

Tax treatment significantly less favorable than many alternative investments—stocks offer qualified dividend treatment (15-20%) and long-term capital gains (15-20%) for holdings >1 year; municipal bonds provide tax-exempt interest (effectively 0% federal, sometimes state-exempt); real estate investments enable depreciation deductions offsetting income. Private credit's ordinary income treatment (up to 37% federal + state) creates substantial tax drag reducing after-tax returns—14% gross yield becomes ~8-9% after-tax for high-income investors in high-tax states vs. ~11-12% after-tax for equivalent qualified dividend income. No tax-deferred investment growth (unlike retirement accounts), no step-up in basis at death (unlike equity investments), no 1031 exchange eligibility (unlike real estate). Tax efficiency considerations particularly important for taxable account allocations—private credit may be more suitable for tax-deferred retirement accounts (IRAs, 401(k)s) where ordinary income taxation delayed until withdrawal, though most workplace retirement plans don't offer private credit marketplace access requiring self-directed IRA structures with custodial complexity.

Special Considerations

- State tax treatment varies—43 states plus DC impose income taxes (0-13.3% top rates) taxing interest income as ordinary income. Seven states have no income tax (Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming) providing significantly better after-tax returns—14% gross yield = 8.8% after-tax (37% federal only) in no-tax states vs. 7.4% after-tax (50.2% combined federal + California) for California residents. Geographic arbitrage through residency planning can dramatically improve private credit after-tax economics for high-income investors.

- Alternative Minimum Tax (AMT) considerations—original issue discount (OID) if material could trigger AMT preference items requiring Form 6251 calculation. However, AMT primarily impacts investors with substantial tax preference items (private activity bond interest, ISO exercise spread, accelerated depreciation) rather than ordinary interest income. Most marketplace investors unlikely to encounter AMT complications unless OID substantial (notes purchased at deep discounts >5-10% below par).

- Self-employment tax does NOT apply—interest income from passive investments exempt from self-employment tax (15.3% on first $168,600 plus 2.9% above threshold) unlike active business income. Private credit investments remain passive regardless of investor's involvement level—even active marketplace participants selecting deals receive interest income vs. earned income subject to SE tax.

- Net Investment Income Tax (3.8% NIIT) applies—interest income from private credit investments subject to 3.8% Medicare surtax for high-income investors (single $200K AGI, married $250K AGI threshold). NIIT reduces after-tax returns by additional ~4% for affected investors—14% gross yield becomes 8.0% after-tax (40.8% effective rate: 37% federal + 3.8% NIIT) for single filer with $200K+ income in no-state-tax jurisdiction, further reduced to 6.8% (51.8% effective: 37% federal + 3.8% NIIT + 13.3% California) for California resident.

- Loss recognition timing—defaults generate ordinary losses deductible against ordinary income (beneficial vs. capital loss $3,000 annual limit) but only recognized upon formal charge-off when recovery efforts exhausted (typically 90-180+ days post-default). Investors cannot claim losses during default workout period even if recovery appears unlikely—must wait for platform/servicer to formally charge off before tax deduction available. Loss timing mismatch (recognize income as accrued monthly but losses only upon charge-off) can create temporary tax disadvantage.

- Retirement account considerations—private credit's ordinary income taxation makes it relatively attractive for tax-deferred accounts (Traditional IRA, 401(k)) deferring taxation until withdrawal vs. taxable accounts suffering immediate tax drag. However, workplace retirement plans rarely offer marketplace access requiring self-directed IRA structures with specialized custodians (Equity Trust, IRA Financial, Millennium Trust) involving setup fees ($50-$500), annual maintenance ($100-$300), and transaction fees ($25-$50 per deal). Self-directed IRA complexity and costs may outweigh tax benefits unless portfolio size substantial (>$100K allocation to private credit justifying custodial overhead).

Account Suitability

Taxable

Least tax-efficient account context due to ordinary income treatment (up to 37% federal + state + 3.8% NIIT) reducing gross yields dramatically. However, taxable accounts provide flexibility (no withdrawal restrictions, no RMDs, basis step-up at death) and enable loss harvesting (ordinary losses deductible against ordinary income without capital loss limitations). Suitable if: (1) retirement accounts already maximized, (2) investor accepts tax drag for current income generation, (3) high-tax-bracket investors maintain sufficient other tax-advantaged income (municipal bonds, qualified dividends, long-term capital gains) to preserve diversification. Consider geographic arbitrage (residency in no-income-tax states) to improve after-tax returns if private credit represents substantial allocation.

Roth IRA

Suboptimal account context—Roth's tax-free growth benefit wasted on moderate-return private credit (10-20% gross yields) better applied to high-growth assets (stocks, crypto potentially 15-30%+ returns). Roth also provides tax-free withdrawals but private credit's short duration (6-36 months) means capital cycles back rapidly requiring reinvestment—missing Roth's long-term compounding advantage vs. equities held 20-40 years achieving massive tax-free appreciation. However, Roth contributions accessible penalty-free providing pseudo-liquidity if needed. Consider only if: (1) investor philosophically prefers fixed income in retirement accounts, (2) adequate equity exposure elsewhere in portfolio, (3) comfortable with self-directed IRA custodial complexity required for marketplace access.

Traditional IRA

More suitable than Roth but still complicated—private credit's ordinary income taxation deferred until withdrawal (beneficial) but Traditional IRA withdrawals taxed as ordinary income anyway (negating one key advantage of bonds generating tax-efficient capital gains in taxable accounts). Best use case if: (1) investor in peak earning years (high current marginal rate 32-37%) expecting lower retirement bracket (12-24%), maximizing tax arbitrage through deferral, (2) short-term distribution focus aligns with Traditional IRA RMD requirements (starting age 73), (3) comfortable with self-directed IRA complexity and custodial fees. Requires self-directed IRA specialist custodian (Equity Trust, IRA Financial, others) as mainstream IRA providers don't support marketplace lending platforms.

HSA

Unsuitable—Health Savings Accounts offer triple tax advantage (deductible contributions, tax-free growth, tax-free medical withdrawals) but require high-deductible health plan ($1,600 individual / $3,200 family minimum deductible), impose contribution limits ($4,150 individual / $8,300 family 2024), and restrict withdrawals to qualified medical expenses (penalties + taxes if not). HSA custodians rarely support alternative investments (limited to stocks/bonds/mutual funds), requiring self-directed structures adding complexity. Private credit's illiquidity (6-36 months) conflicts with HSA's medical expense purpose requiring liquid assets for unexpected healthcare costs. Use HSAs for liquid investments (stocks, bonds, money market funds) never alternative credit.

Investor Fit

High-Income Accredited Investors Seeking Current Income & Public Market Diversification

Ideal for accredited investors ($200K+ income / $1M+ net worth) with concentrated equity exposure seeking diversification into uncorrelated assets generating current income. Private credit's 10-20% target yields provide meaningful cash flow supplement to dividend income or employment earnings, while short-duration structure (6-36 months, 9-month average) reduces interest rate risk vs. long-term bonds and enables capital recycling as market conditions evolve. Platform's $500 minimum enables portfolio diversification across 10-20 deals with $5K-$10K entry vs. $100K-$5M minimums for traditional private credit funds. Monthly distributions facilitate regular income needs or compound reinvestment. Best for investors maintaining 60-80% traditional portfolios (stocks/bonds) seeking 10-20% alternative allocation for risk-adjusted return enhancement and volatility reduction. Requires tolerance for credit risk, illiquidity within individual deals (mitigated by short-durations and secondary market optionality), and tax inefficiency (ordinary income treatment reducing after-tax returns significantly in high-tax jurisdictions).

Institutional Investors & Family Offices Requiring Delegated Private Credit Management

Separately Managed Accounts ($1M+ minimum, 1% annual fee) provide institutional-grade private credit access suitable for family offices, endowments, foundations, and RIAs requiring delegated alternative credit allocation. SMA structure offers: (1) professional diversification across 20-50+ deals without manual selection burden, (2) customizable mandates matching risk tolerance and investment criteria, (3) operational simplicity with consolidated reporting and distributions, (4) institutional-quality due diligence and ongoing monitoring. Particularly valuable for institutions lacking internal credit analysis resources or time for active marketplace participation but seeking private credit diversification benefits (uncorrelated returns, current income, inflation protection potential). 1% annual fee competitive vs. traditional private credit fund management fees (1.5-2.5%) while providing customization unavailable in commingled structures. Requires minimum $1M commitment and comfort with Percent's investment process, though portfolio transparency and detailed reporting provide oversight mechanisms unavailable in many fund structures.

Active Investors with Credit Analysis Capabilities Seeking Deal-Level Control

Marketplace structure ($500 minimum per deal, self-directed allocation) ideal for sophisticated investors with credit analysis background (banking, private equity, credit analysis, CFA training) wanting granular deal selection vs. delegated fund allocation. Platform provides detailed investment memoranda enabling thorough due diligence on borrower financials, collateral quality, originator underwriting, and recovery mechanics—rewarding investors capable of distinguishing superior opportunities from average deals. Deal-by-deal control enables portfolio customization (emphasizing asset-based deals for collateral protection, targeting specific industries, avoiding originator categories, building vintage diversification) impossible in fund structures. Lower minimums ($500 vs. $5K-$25K typical for comparable platforms) facilitate broader diversification reducing idiosyncratic risk. Best for investors viewing private credit analysis as engaging activity vs. burden, possessing time and skills for ongoing evaluation, and wanting maximum alignment between analysis effort and portfolio outcomes.

Income-Focused Retirees Seeking Higher Yields Than Traditional Fixed Income

Neutral fit for retired accredited investors seeking income enhancement beyond traditional bonds (10-20% private credit yields vs. 4-6% Treasuries/investment-grade corporates). Monthly distributions align well with retirement income needs and short-duration focus (6-36 months) reduces interest rate risk concerning fixed-income retirees. However, meaningful considerations temper suitability: (1) Credit risk and default potential (3% historical) could disrupt income expectations during economic stress—retirees with limited capacity to absorb losses may find volatility unacceptable; (2) Tax inefficiency (ordinary income treatment up to 37% federal + state) significantly reduces after-tax yields for high-income retirees vs. municipal bonds or qualified dividend stocks; (3) Illiquidity within individual deals (even with secondary market) less suitable for retirees requiring reliable liquidity access; (4) Complexity and ongoing monitoring required (deal selection, performance tracking) may overwhelm less engaged retirees. Consider only if: investor maintains substantial other assets providing security cushion (2-3 years expenses in liquid accounts), allocates limited percentage to private credit (10-20% maximum), comfortable with credit analysis burden or willing to use SMA structure accepting 1% fee for professional management.

Tax-Deferred Account Investors (IRAs) Seeking Alternative Fixed Income Exposure

Neutral fit for investors holding IRAs wanting alternative fixed income beyond traditional bonds—private credit's ordinary income taxation delayed until IRA withdrawal (Traditional) or never taxed (Roth) improving after-tax returns vs. taxable account allocations. Short-duration structure and regular distributions align reasonably with retirement account objectives (though Roth better suited for long-term growth assets). However, significant barriers limit attractiveness: (1) Mainstream IRA custodians (Fidelity, Vanguard, Schwab) don't support marketplace lending platforms requiring specialized self-directed IRA providers (Equity Trust, IRA Financial) with setup fees ($50-$500), annual maintenance ($100-$300), and transaction fees ($25-$50 per deal) that consume returns on smaller allocations; (2) Illiquid investments within tax-advantaged accounts create compounding restrictions—capital tied up 6-36 months per deal can't be immediately redeployed vs. liquid securities enabling instant rebalancing; (3) Complexity and custodial requirements add administrative burden disproportionate to benefits for many investors. Consider only if: allocation substantial enough to justify custodial costs ($25K+ minimum), investor comfortable with self-directed IRA mechanics, and diversification within retirement accounts valued sufficiently to offset structural complexity.

Non-Accredited Retail Investors Seeking Private Credit Exposure

Platform requires accredited investor status ($200K annual income / $300K married, or $1M net worth excluding primary residence)—non-accredited investors legally prohibited from accessing Percent regardless of sophistication or interest. Regulatory restriction reflects SEC concern that private credit's complexity, illiquidity, and credit risk unsuitable for retail investors lacking resources to absorb losses or conduct thorough due diligence. Non-accredited investors seeking alternative fixed income should consider: (1) High-yield bond funds or ETFs (HYG, JNK) offering exposure to below-investment-grade corporate credit with daily liquidity and lower minimums; (2) Business development companies (BDCs) providing access to private middle-market lending through publicly traded closed-end funds; (3) Peer-to-peer consumer lending platforms accepting non-accredited investors (though increasingly rare post-Lending Club, Prosper regulatory evolution). Accreditation threshold expected to remain in place—platform unlikely to expand access given broker-dealer compliance burden and private credit risk profile.

Investors Requiring Guaranteed Liquidity or Seeking Conservative Fixed Income

Private credit marketplace unsuitable for investors requiring reliable liquidity access or conservative fixed-income characteristics (principal preservation, minimal volatility, guaranteed income). Individual deals require 6-36 month commitments with secondary market providing theoretical but uncertain exit option—practical liquidity depends on buyer demand and potentially forces 10-30% discounts during stressed periods. Credit risk (3% historical default rate, 2.22% charge-off rate) creates principal loss exposure and income interruption risk when borrowers default—incompatible with conservative fixed-income mandates prioritizing capital preservation. Short-duration focus mitigates some interest rate risk but cannot eliminate credit risk fundamental to private lending. Investors requiring liquidity or conservative characteristics better served by: (1) Money market funds offering daily liquidity, principal stability, and current yields (4-5% in high-rate environments); (2) Short-term Treasury bonds (1-2 year maturity) providing government guarantee, liquidity, and minimal credit risk; (3) High-grade corporate bond funds (investment-grade only) offering modest credit risk vs. high-yield focus of private credit marketplace. Percent suitable only for investors accepting illiquidity and credit risk in exchange for yield enhancement and diversification benefits vs. traditional fixed income.

Small Account Investors Unable to Diversify Adequately (<$5K Available)

While Percent's $500 minimum appears accessible, meaningful private credit diversification requires $5K-$10K commitment (10-20 deals minimum spanning originators, deal types, vintages) mitigating idiosyncratic risk from single borrower defaults or originator underwriting failures. Investors with <$5K available capital face difficult choice: (1) concentrated single-deal exposure accepting binary outcomes (deal performs or defaults with limited portfolio-level offsetting), or (2) waiting to accumulate larger capital before entering platform. Concentrated positions amplify downside—single $500 deal defaulting with 50% recovery produces $250 loss (50% of allocation) vs. $125 portfolio impact if diversified across 10 deals (5% default rate × 50% recovery = 2.5% portfolio loss). Small account investors should consider: (1) building capital until $5K-$10K available for proper diversification; (2) using traditional bond funds/ETFs providing instant diversification at any dollar amount; (3) SMA structure if able to accumulate $1M minimum (though likely outside scope for small account discussion). Platform best for investors committing $10K+ enabling meaningful diversification vs. token allocation insufficient to manage risks appropriately.

Key Tradeoffs

Short-Duration Deals (6-36 months) vs. Long-Term Private Credit (5-7 years)

Percent's short-term focus (9-month average maturity) enables rapid capital recycling, reduces interest rate risk during monetary policy changes, and provides flexibility to reallocate capital as opportunities evolve. However, requires continuous reinvestment effort (monitoring new deals, evaluating opportunities, deploying capital) vs. longer-term commitments offering passive set-it-and-forget-it convenience. Traditional private credit funds with 5-7 year loan terms require less frequent reallocation decisions but lock capital through complete economic cycles—investors accept illiquidity for operational simplicity. Percent suits active investors wanting flexibility; passive investors may prefer longer-duration stability.

Direct Marketplace Control ($500 minimum, self-directed) vs. SMA Professional Management ($1M+ minimum, 1% fee)

Marketplace investing provides granular deal selection, complete transparency into individual positions, and lower costs (no management fee beyond embedded origination/servicing fees)—ideal for sophisticated investors with credit analysis capabilities wanting maximum control. However, requires ongoing time commitment (deal evaluation, portfolio construction, performance monitoring) and credit expertise to distinguish superior opportunities from average deals. SMA offers institutional-grade diversification, professional management, operational simplicity, and potentially superior risk-adjusted returns if Percent's team adds alpha through deal selection—but costs 1% annually and reduces investor visibility into individual allocation decisions. Active investors choose marketplace; passive or time-constrained investors prefer SMA delegation accepting fee for convenience.

Asset-Based Collateral Protection (12-16% yields) vs. Unsecured Higher Yields (16-20%+)

Asset-based deals (inventory financing, receivables factoring, equipment loans) provide tangible collateral enhancing recovery potential during defaults and reducing loss severity—conservative investors prioritize downside protection accepting lower yields (12-16% typical). Unsecured consumer lending, subordinated debt, or specialty deals offer higher returns (16-20%+) but lack collateral creating binary outcomes upon default—entire principal at risk vs. partial recovery through liquidation. Risk tolerance and return objectives drive allocation balance—conservative portfolios emphasize 70-90% asset-based deals; aggressive portfolios accept 40-60% unsecured exposure for yield enhancement understanding elevated loss risk.

Broker-Dealer Registration Protections vs. Operational Flexibility & Cost

FINRA oversight and securities law compliance provide investor protections (suitability obligations, fair dealing, dispute resolution) and institutional credibility (RIAs, family offices prefer FINRA-member counterparties) unavailable through unregistered peer-to-peer platforms. However, regulatory compliance costs (capital requirements, audit expenses, legal fees estimated $2M-$5M annually) and operational constraints (advertising restrictions, product limitations, examination burden) potentially limit innovation and competitive positioning vs. technology-first fintech lenders operating with lighter touch. Investors value protections but should recognize compliance costs ultimately borne through deal economics or platform fee structures—broker-dealer registration provides oversight but doesn't eliminate underlying credit risks or guarantee returns.

Secondary Market Optionality vs. Hold-to-Maturity Simplicity

Ability to sell notes on secondary market provides exit flexibility for changed circumstances (job loss, medical expenses, reallocation desires) unavailable in traditional private credit funds with complete illiquidity until maturity. However, secondary market mechanics require monitoring liquidity, accepting bid-ask spreads (potentially 10-30% discounts during stress), timing trade execution, and potentially realizing losses vs. par value. Hold-to-maturity investors avoid trading complexity, preserve principal recovery potential (defaults may still recover partial value), and eliminate secondary market friction—but sacrifice exit flexibility. Choice depends on investor's liquidity needs and willingness to engage secondary market vs. passive hold-and-collect approach.

Who This Is Not For

Non-Accredited Investors

Platform exclusively serves accredited investors meeting SEC thresholds: $200K annual income ($300K married) or $1M net worth excluding primary residence. Regulatory restriction reflects private credit complexity and risk profile deemed unsuitable for retail investors lacking resources to absorb losses or conduct sophisticated due diligence. Non-accredited investors should explore high-yield bond funds, BDCs, or investment-grade corporate bonds offering alternative fixed-income exposure with better regulatory protections and lower minimums.

Conservative Fixed-Income Investors Requiring Principal Preservation

Private credit carries meaningful default risk (3% historical rate, 2.22% charge-offs) creating principal loss exposure and income interruption incompatible with conservative fixed-income mandates prioritizing capital preservation and guaranteed income. Credit risk cannot be eliminated even with asset-based collateral—recoveries often partial (50-70% typical) vs. full principal restoration. Conservative investors requiring stable income and principal safety better served by money market funds, short-term Treasuries, or investment-grade corporate bonds providing minimal credit risk vs. private lending's high-yield focus.

Investors Requiring Guaranteed Near-Term Liquidity

Individual deals require 6-36 month commitments with secondary market providing theoretical but uncertain exit optionality—practical liquidity depends on buyer demand potentially forcing 10-30% discounts and multi-week execution timeframes. Investors needing reliable capital access for emergency expenses, major purchases, or investment reallocation should maintain positions in liquid securities (stocks, bonds, money market funds) offering daily liquidity vs. private credit's structural illiquidity even with secondary market feature. Percent suitable only for capital committed for full deal term accepting interim illiquidity despite secondary market availability.

Small Account Investors Unable to Diversify (<$5K Available Capital)

While $500 minimum appears accessible, meaningful diversification requires $5K-$10K commitment across 10-20 deals mitigating single-borrower defaults, originator quality variance, and vintage concentration. Investors with <$5K available face binary outcomes from concentrated single-deal exposure (deal defaults producing 30-100% loss of allocation vs. 1-5% portfolio impact with proper diversification). Small investors should accumulate larger capital before platform entry, use traditional bond funds providing instant diversification at any dollar amount, or explore alternative income sources better aligned with capital constraints than private credit marketplace requiring substantial diversification capital.

Passive Investors Lacking Time for Ongoing Deal Evaluation

Marketplace structure requires continuous engagement—monitoring new deal availability, reading investment memoranda, evaluating borrower quality and collateral, making allocation decisions, tracking portfolio performance across multiple positions. Time commitment unsuitable for passive investors seeking set-it-and-forget-it convenience. While SMA structure ($1M+ minimum, 1% fee) provides professional management alternative, passive investors with <$1M available or unwilling to pay management fees better served by traditional private credit funds or fixed-income ETFs eliminating ongoing evaluation burden despite sacrificing deal-level control and customization.

Tax-Sensitive High-Income Investors in High-Tax States

Private credit generates ordinary interest income taxed at marginal rates (up to 37% federal + state + 3.8% NIIT)—effective tax rates reaching 50%+ for California high-income investors (37% federal + 13.3% CA + 3.8% NIIT = 54.1% maximum) dramatically reducing after-tax returns. 14% gross yield becomes 6.4% after-tax vs. 11.2% after-tax for equivalent qualified dividend income (20% rate). Tax drag particularly severe in high-tax states (California, New York, New Jersey, Oregon) and for high-income investors subject to top marginal brackets. Tax-sensitive investors should prioritize municipal bonds (tax-exempt interest), qualified dividend stocks (15-20% rates), or long-term capital gains strategies (15-20% rates) vs. private credit's tax-inefficient ordinary income treatment unless allocated within tax-deferred retirement accounts.

AltStreet Perspective

Verdict

Percent democratizes institutional private credit through registered broker-dealer platform (FINRA member since August 2023) connecting accredited investors with short-duration alternative lending opportunities (6-36 months, 9-month average) across asset-based financing, consumer credit, and specialty deals. Platform's $500 marketplace minimum dramatically lowers entry barriers vs. traditional funds ($100K-$5M minimums) while broker-dealer registration provides regulatory oversight and investor protections unavailable through unregistered peer-to-peer platforms. Strong historical performance ($2B+ funded, 681 repaid deals, 14.47% average coupon, 3% default rate, 2.22% charge-off rate) and monthly distributions create compelling value proposition for accredited investors seeking public market diversification and current income generation.

Positioning

Most compelling for accredited investors committing $10K-$100K to alternative credit allocation (enabling 10-20 deal diversification across originators, collateral types, vintages) or institutional investors/family offices utilizing SMA structure ($1M+ minimum, 1% fee) for delegated professional management. Platform's short-duration focus suits current high-rate environment (monetizing elevated yields quickly) and investors prioritizing flexibility over passive long-term commitments. Broker-dealer registration positions for institutional adoption and future product expansion though adds compliance costs potentially limiting operational agility vs. unregistered competitors. However, meaningful considerations temper universal suitability: (1) Limited track record through complete credit cycle (2018 founding, 6-36 month terms) prevents validating performance during sustained recession or credit crisis; (2) Secondary market effectiveness uncertain without disclosed operational metrics (volumes, execution rates, pricing); (3) Tax inefficiency (ordinary income treatment) significantly reduces after-tax returns for high-income investors particularly in high-tax states; (4) Originator relationship dependencies and deal sourcing concentration create business continuity risks not transparently disclosed. Platform excels in short-duration private credit access with regulatory credibility but requires investors comfortable with credit risk, tax inefficiency, and limited full-cycle validation.

"Broker-dealer-registered private credit marketplace for accredited investors—diversify across 10-20 deals, prioritize asset-based collateral, understand tax inefficiency, and maintain external liquidity despite secondary market optionality."

Next Steps

Verify accredited investor status before platform engagement—confirm $200K annual income ($300K married) or $1M net worth excluding primary residence. Platform requires accreditation documentation (tax returns, brokerage statements, CPA verification letters) during onboarding. Non-accredited investors should explore alternative fixed-income options (bond funds, BDCs) vs. pursuing Percent access.

Determine appropriate private credit allocation within overall portfolio—target 10-20% alternative credit exposure for investors with 60-80% traditional portfolios (stocks/bonds) seeking diversification and yield enhancement. Assess liquidity needs ensuring adequate reserves (6-12 months expenses) in liquid accounts before committing capital to 6-36 month illiquid deals despite secondary market theoretical optionality. Calculate after-tax return expectations accounting for ordinary income treatment (effective tax rates 40-54% for high-income/high-tax-state investors) vs. gross yield marketing.

Decide between marketplace self-direction ($500 minimum per deal, 10-20 deal diversification requires $5K-$10K entry) vs. SMA professional management ($1M+ minimum, 1% annual fee, instant diversification, operational simplicity). Active sophisticated investors with credit analysis capabilities and time commitment choose marketplace control; passive investors or those lacking expertise prefer SMA delegation. Consider starting with marketplace allocation building experience before SMA evaluation if near $1M threshold.

Research platform track record and competitive positioning—review performance disclosures ($2B+ funded, 917 deals, 3% default rate, 2.22% charge-off rate, 14.47% historical average coupon), compare with alternative private credit marketplaces (Yieldstreet, Cadre, StreetShares), understand broker-dealer registration benefits vs. unregistered peer-to-peer platforms. Evaluate management team experience, venture capital backing, and platform growth trajectory signaling business sustainability vs. risk of pivot/consolidation/exit.

Establish deal selection criteria before marketplace engagement—define preferred collateral types (asset-based vs. unsecured), target yield range (prioritize moderate yields with collateral vs. chase maximum returns accepting elevated risk), originator preferences (favor established lenders with disclosed track records), duration limits (6-12 months for higher liquidity needs vs. 24-36 months accepting extended commitment), and concentration limits (maximum allocation per deal, per originator, per deal type). Systematic criteria prevent emotional decision-making and adverse selection into highest-yielding/riskiest opportunities.

Make initial small allocation testing platform operations—commit $5K-$10K across first 5-10 deals observing deal availability and quality, evaluation process and memorandum detail, capital deployment speed, monthly distribution mechanics, investor portal functionality, and customer service responsiveness. Use test phase to calibrate comfort level and refine selection criteria before scaling to full target allocation ($10K-$100K typical for diversified portfolios).

Build diversified portfolio systematically over 3-6 months—spread capital across multiple originators (5-10+ lenders), collateral types (balance asset-based deals providing security with higher-yielding unsecured opportunities), and vintage periods (avoid concentrated deployment in single quarter creating correlated maturity schedule and reinvestment timing risk). Stagger deployment enabling observation of market conditions, deal quality trends, and originator performance patterns before committing full allocation.

Understand tax implications and account placement optimization—consult CPA familiar with private credit taxation to confirm ordinary income treatment, assess NIIT applicability (3.8% for high-income investors), and optimize account placement (taxable vs. retirement accounts weighing tax drag vs. custodial complexity). Consider geographic arbitrage if approaching retirement or location-flexible (residency in no-income-tax states dramatically improves after-tax returns).

Test secondary market mechanics proactively before urgency arises—sell small position ($500-$1,000) observing time to execution, pricing achieved vs. par value, discount required for sale completion, and buyer interest depth. Use test results calibrating realistic liquidity expectations vs. marketing claims. If secondary market proves challenging (wide discounts, slow execution), adjust portfolio planning maintaining larger external emergency reserves and prioritizing shorter-duration deals (6-12 months) reducing hold-period exposure.

Monitor portfolio performance and platform health ongoing—track individual deal payment timeliness, default/charge-off rates vs. platform averages, recovery outcomes on defaulted positions, deal flow consistency (declining inventory signals originator relationship challenges), and competitive positioning vs. emerging marketplace platforms. Rebalance if private credit allocation grows beyond target percentage (10-20% typical) through appreciation or if risk profile shifts warranting reduced alternative credit exposure.

Related Resources

Explore Asset Class

Private Credit & Alternative DebtSimilar Platform Reviews

- Yieldstreet

Alternative investment marketplace with broader asset class coverage (real estate, art, legal finance, transportation) vs. Percent's private credit focus. Similar fractional ownership model and accredited investor requirements but different regulatory structure (unregistered vs. Percent's broker-dealer status) and deal durations (potentially longer-term positions vs. Percent's short-duration emphasis).

- Cadre

Institutional-quality commercial real estate investment platform for accredited investors. Complementary asset class (real estate vs. private credit) enabling cross-platform diversification but fundamentally different structure—direct property ownership vs. debt obligations, longer hold periods (5-7 years typical) vs. Percent's short-duration deals (6-36 months), and different risk/return profile (equity appreciation + rent vs. fixed income + credit risk).

- Fundrise

Non-accredited accessible real estate platform (Regulation A+) vs. Percent's accredited-only private credit focus. Different investor requirements ($10 minimum, open to all vs. $500 minimum, accredited only), different asset class (real estate equity/debt vs. private credit marketplace), longer hold periods (5+ year eREIT structures vs. 6-36 month deals), and quarterly liquidity vs. Percent's monthly distributions plus secondary market.

🔍Review Evidence

Scrape Date

2026-01-08

Methodology

Platform analysis combining Percent scraped materials (67 pages including homepage, performance tracking, product pages, FAQ) + broker-dealer registration verification (FINRA BrokerCheck) + SEC investment advisor registration (Form ADV) + private credit market research + comparative evaluation vs. marketplace platforms

Scope

Public website materials + performance disclosures ($2B+ funded, 917 deals, default rates, charge-off rates, historical coupons) + broker-dealer/RIA registration documentation + product structures (marketplace vs. SMA) + investor requirements + regulatory framework analysis

Key Findings

- •Broker-dealer registration (Percent Securities, August 2023) provides FINRA oversight and securities law compliance differentiating from unregistered peer-to-peer platforms—registration enables institutional distribution partnerships and enhanced investor protections (suitability obligations, dispute resolution) though adds substantial compliance costs ($2M-$5M annually estimated for small broker-dealer infrastructure).

- •Strong historical performance metrics: $2B+ facilitated since 2018, 917 funded deals, 681 repaid deals returning $1.33B principal + $95.95M interest, 14.47% weighted average coupon (repaid deals), 16.72% coupon (outstanding), 3% default rate, 2.22% charge-off rate through September 2025. Performance validates business model though limited full-cycle observation given 2018 founding and 6-36 month typical deal terms.

- •Short-duration focus (9-month historical average maturity, 16.6-month outstanding average) differentiates from traditional private credit funds holding 5-7 year loans—enables rapid capital recycling, reduces interest rate risk, provides allocation flexibility. However, requires continuous deal sourcing and reinvestment effort vs. passive longer-term commitments.

- •Monthly distribution frequency (vs. quarterly for most funds) accelerates income realization and compounding but creates administrative overhead for platform and investors. Asset-based lending emphasis ($1.36B of $1.68B total funding) provides collateral protection though recovery effectiveness depends on liquidation execution during defaults.

- •Secondary market feature enables note sales to other platform investors providing theoretical exit optionality, but operational effectiveness uncertain without disclosed metrics (trading volumes, execution rates, bid-ask spreads, time-to-sale). Marketed liquidity benefit requires validation through user testimonials and independent research.

- •Platform serves thousands of investors (exact count not disclosed) with $500 minimum per deal enabling portfolio diversification at accessible entry points ($5K-$10K for 10-20 deal diversification) vs. $100K-$5M minimums for traditional private credit funds. SMA structure ($1M+ minimum, 1% fee) bridges gap between marketplace and institutional funds.

- •Tax treatment significantly less favorable than many alternatives—ordinary interest income (up to 37% federal + state + 3.8% NIIT) vs. qualified dividends (15-20%), municipal bond tax exemption, or real estate depreciation benefits. Effective tax rates 40-54% for high-income/high-tax-state investors dramatically reduce after-tax returns (14% gross → 6-9% after-tax depending on jurisdiction).

Primary Source Pages

- percent.com (homepage)

- percent.com/our-track-record-of-performance

- percent.com/what-is-private-credit

- percent.com/separately-managed-accounts

- percent.com/faq

- percent.com/terms-and-conditions

- FINRA BrokerCheck - Percent Securities

- SEC Investment Adviser Public Disclosure - Percent Advisors

- Private credit market research (Bloomberg, T. Rowe Price, Coalition Greenwich)

Comparable Platforms

- Yieldstreet

Broader alternative investment marketplace covering multiple asset classes (real estate, art, legal finance, transportation) vs. Percent's private credit focus. Similar fractional ownership and accredited investor model but different regulatory status (unregistered vs. Percent's broker-dealer registration) and potentially longer deal durations vs. Percent's short-term emphasis.

- StreetShares

Veteran-focused small business lending marketplace with similar short-duration deals and asset-based lending emphasis. Comparable structure but different origination focus (veteran-owned businesses) and potentially different default experience given specialized borrower population. Both serve accredited investors through marketplace models.

- LendingClub

Consumer lending marketplace pioneer (founded 2007) now operating as full bank post-2020 acquisition. Historical peer-to-peer model similar to Percent's marketplace but evolution to bank charter provides depositor funding and FDIC insurance vs. Percent's investor-funded model. Consumer lending focus vs. Percent's asset-based and specialty lending diversification.

Frequently Asked Questions

What is Percent and how does it differ from traditional private credit funds?

Percent operates as registered broker-dealer (FINRA member since August 2023) providing accredited investors access to short-duration private credit deals (6-36 months typical, 9-month average) through two structures: (1) Direct marketplace ($500 minimum per deal, self-directed allocation across asset-based financing, consumer credit, specialty lending), (2) Separately Managed Accounts ($1M+ minimum, 1% annual fee, discretionary professional management). Key differences from traditional funds: dramatically lower minimums ($500 vs. $100K-$5M), shorter deal durations (6-36 months vs. 5-7 years), monthly distributions (vs. quarterly), granular deal selection vs. commingled pooling, and broker-dealer regulatory oversight (FINRA supervision, securities law compliance, investor protections) unavailable through unregistered peer-to-peer platforms. Since 2018, platform facilitated $2B+ across 917 deals with 14.47% historical weighted average coupon, 3% default rate, and 2.22% charge-off rate.

What are the key risks of investing through Percent?